HST & GST New Housing Rebate: Eligibility & Key Details

Purchasing a new home in Ontario comes with substantial costs, but savvy homeowners know there’s a silver lining: the HST rebate and Ontario GST new housing rebate programmes can put thousands of dollars back in your pocket.

Combined with federal GST rebates, eligible buyers can recover up to $30,300 in sales taxes paid on qualifying properties.

Key Takeaways

- Combined Savings: Ontario homeowners can recover up to $30,300 through federal and provincial rebates on qualifying new home purchases

- Strict Deadline: Applications must be submitted within two years of closing or renovation completion; late filings are typically not accepted

- Primary Residence Rule: Properties must serve as your primary residence or that of an immediate relative for at least one year

- Substantial Renovation Threshold: The 90% rule requires removing or replacing at least 90% of interior components to qualify

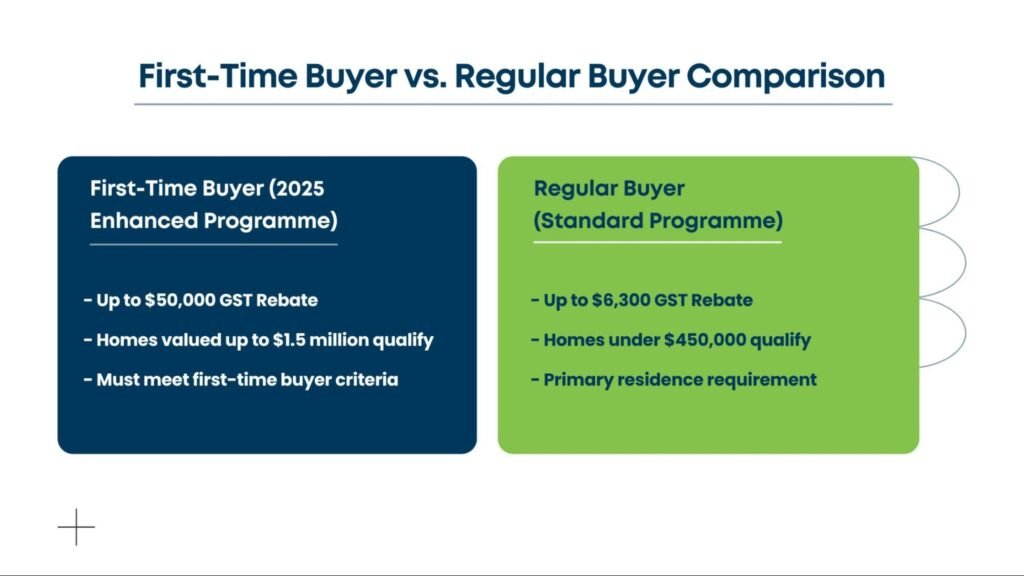

- Enhanced First-Time Buyer Benefit: New federal programme offers up to $50,000 in GST relief for eligible first-time buyers on homes up to $1.5 million

Understanding HST Rebate Ontario and GST New Housing Rebate

Ontario’s 13% Harmonised Sales Tax comprises a 5% federal GST component and an 8% provincial component. On a $500,000 new home purchase, you’re paying $65,000 in HST, a substantial sum that significantly impacts affordability.

The GST housing rebate programmes help recover a meaningful portion of these taxes, easing the burden for homeowners and stimulating housing market activity.

Ontario’s provincial component offers substantially more generous benefits. The province rebates 75% of the provincial HST (8%) on the first $400,000 of your home’s purchase price, delivering a maximum provincial rebate of $24,000.

Recent federal initiatives have introduced an enhanced First-Time Home Buyers’ GST Rebate, offering 100% GST relief on qualifying new homes valued up to $1 million. This programme provides up to $50,000 in federal rebates for eligible first-time buyers, with graduated benefits for homes priced between $1 million and $1.5 million.

Who Qualifies for the GST New Housing Rebate

Eligibility for the HST rebate for new houses in Ontario hinges on several critical requirements that applicants must understand before claiming these valuable tax benefits.

Primary Residence Requirement

The cornerstone of rebate eligibility is the primary residence requirement. You must purchase or build the property for use as your primary place of residence, not a vacation home, investment property, or secondary residence.

The Canada Revenue Agency defines your primary residence as the home where you live permanently, considering factors including the length of time you inhabit the premises, whether you consider it your main residence, and the designation of that address on personal and public records such as driver’s licences, income tax returns, and voter registration.

Property Types That Qualify

Several property categories qualify for the GST rebate in Ontario, each with specific criteria:

Newly Constructed Homes: Properties purchased directly from builders qualify, provided you’re the first occupant after substantial completion. The home must be newly built; you cannot claim the rebate on resale homes, even if they’re only a few years old.

Owner-Built Homes: If you’re building your own home or hiring contractors to construct on land you already own, you can claim the rebate using Form GST191. This category includes individuals who act as their own general contractor, coordinating trades and managing construction directly.

Substantially Renovated Properties: Renovations meeting the CRA’s “90% rule” qualify as substantial renovations. At least 90% of the property’s interior must be removed or replaced. Simply updating kitchens and bathrooms or refinishing floors doesn’t meet this threshold – substantial renovations typically involve gutting the property to the studs and rebuilding.

Major Additions: If you’re building an addition that at least doubles your home’s living space, such as adding a full second storey to a bungalow, and making physical changes to at least 50% of existing rooms, the resulting property may qualify as newly constructed.

Enhanced First-Time Buyer Programme

The enhanced First-Time Home Buyers’ GST Rebate introduced in May 2025 offers unprecedented savings for qualifying purchasers. To qualify, you must be a Canadian citizen or permanent resident aged at least 18 years who hasn’t owned a home in the current calendar year or the preceding four calendar years.

Your purchase agreement must be signed between May 27, 2025, and December 31, 2030, with construction substantially completed before 2036.

This enhanced rebate provides 100% GST relief on homes up to $1 million and graduated benefits for homes between $1 million and $1.5 million – for example, a 50% rebate on a $1.25 million home saves $25,000.

Navigating the Application Process

Successfully claiming your new housing rebate in Ontario requires meticulous preparation, accurate documentation, and adherence to strict timelines.

Essential Documentation

Before submitting your application, gather comprehensive supporting materials: your Agreement of Purchase and Sale showing the purchase from a builder, Statement of Adjustments provided by your lawyer at closing, and proof of occupancy such as recent utility bills or government-issued identification.

Consistency across all documents is critical. Even minor discrepancies in names, addresses, or dates can trigger CRA requests for additional information, significantly delaying processing.

Selecting the Correct Forms

Your property type and situation determine which forms you’ll complete:

Form GST190 applies when purchasing a newly constructed or substantially renovated home directly from a builder. This is the most common form for buyers purchasing pre-construction condominiums or newly built single-family homes.

Form GST191 is required for owner-built houses, including situations where you built your own home or hired contractors to construct on land you already owned. You’ll also complete Form GST191-WS (Construction Summary Worksheet) detailing all construction costs and GST/HST paid.

Form RC7191-ON (GST191 Ontario Rebate Schedule) must accompany your federal application to claim the provincial portion of the HST rebate in Ontario.

Meeting Critical Deadlines

The CRA maintains an inflexible two-year filing deadline. For purchased homes, this period begins from your closing date. For substantial renovations or owner-built homes, the two-year countdown starts when construction is 90% complete.

Late-filed applications receive no consideration except in extraordinary circumstances such as natural disasters, postal disruptions, serious illness, or documented CRA errors contributing to the delay.

Once submitted, expect processing times of two to six months. Applications filed through the CRA’s My Business Account online portal typically process faster than paper submissions. If selected for audit, processing may extend to six months.

Maximising Your HST Rebate for New Houses in Ontario

Strategic planning optimises your rebate benefits and avoids common pitfalls that jeopardise applications.

Strategic Timing Considerations

For first-time buyers, ensure your purchase agreement is dated after May 26, 2025, to qualify for the enhanced federal rebate offering up to $50,000 in savings. Agreements signed before this date, even if subsequently varied or assigned, don’t qualify for the enhanced programme.

If you’re undertaking a substantial renovation, carefully track which components you’re removing or replacing to ensure you meet the 90% threshold.

Common Mistakes That Delay or Deny Rebates

Missing the deadline is the most costly mistake. Set calendar reminders well before your two-year deadline and begin gathering documentation at least three months before submission.

Incorrect rebate calculations result in CRA adjustments that can delay your refund by months. Double-check all calculations or work with qualified tax professionals to ensure accuracy before submission.

The Value of Professional Tax Guidance

The complexity of GST housing rebate programmes – combined with the substantial financial outsourcing stakes – makes professional guidance invaluable for many Ontario homeowners.

For Canadian CPAs and accountants managing multiple client rebate applications, outsourced accounting professionals provide valuable capacity during peak filing periods. This approach ensures accurate calculations, timely submissions, and comprehensive documentation while maintaining high standards of client service.

Offshore bookkeeping are particularly valuable for owner-built homes and substantial renovations, where maintaining clean, organised records of construction costs, receipts, and GST/HST payments from the beginning significantly reduces processing times and minimises audit risk.

Securing Your Maximum HST Rebate in Ontario

The HST rebate and Ontario and GST new housing rebate programmes represent substantial savings opportunities – up to $30,300 for most homeowners and up to $50,000 for eligible first-time buyers under the enhanced federal programme.

For professional guidance tailored to your specific situation, consider connecting with accounting outsourcing who specialise in Canadian housing rebates.

For comprehensive support navigating the complexities of Ontario’s housing rebate programmes, Contact us who can guide you through every step of the application process, ensuring you secure every dollar you’re entitled to receive.