Complete Guide to Outsourcing E-Commerce Accounting

The Canadian e-commerce landscape has transformed dramatically, with market value reaching US$89.4 billion in 2024 and projected to grow at a 7.38% CAGR through 2028.

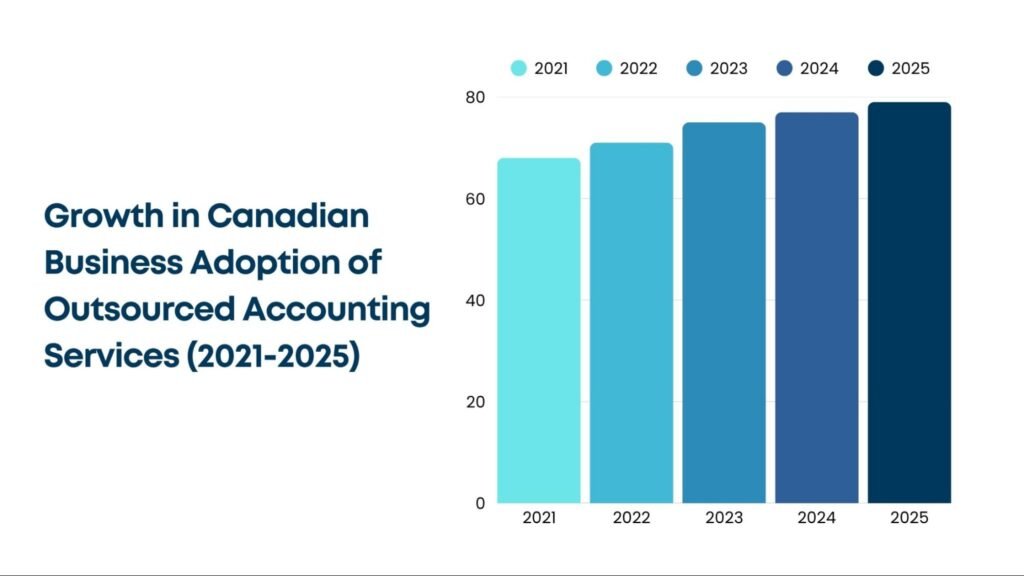

As 54% of Canadian SMBs now outsource e-commerce accounting, traditional in-house approaches struggle to meet the demands of multi-platform financial management.

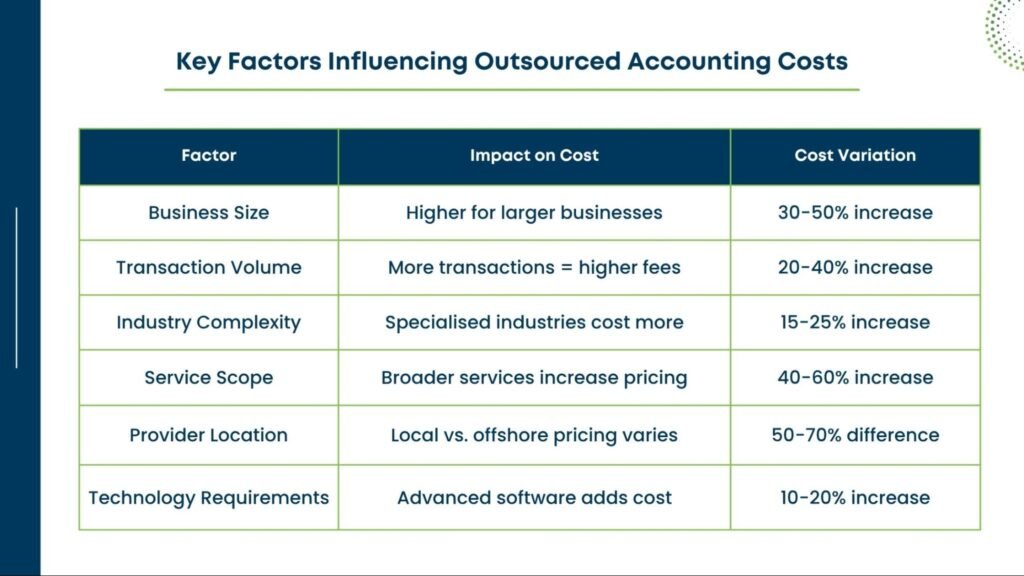

Outsource e-commerce accounting has evolved from a cost-saving tactic into a strategic necessity. The convergence of complex GST/HST regulations, multi-channel reconciliation, and real-time reporting demands specialised expertise.

This guide examines how Canadian CPAs and accountants can leverage outsourced solutions to navigate modern e-commerce financial management while maintaining compliance and delivering superior client value.

Key Takeaways

- 79% of Canadian businesses will adopt outsourced accounting by 2025, driven by complex compliance requirements and technological demands

- E-commerce bookkeeping requires specialised handling of platform fees, inventory valuation, and multi-jurisdictional sales tax across Shopify, Amazon, and direct channels

- Offshore e-commerce accountants provide cost efficiencies of 40-50% compared to in-house teams while delivering CPA-level expertise in Canadian regulations

- Xero and Amazon integration automation reduces reconciliation time by 85% and eliminates manual data entry errors

- Tax accounting in e-commerce demands proactive GST/HST registration at the $30,000 CAD threshold and meticulous tracking of marketplace facilitator obligations

The Strategic Shift Toward Outsourced E-Commerce Accounting

Canadian accounting practices face mounting pressure as e-commerce clients expand across multiple platforms. The traditional model of employing full-time outsourcing bookkeepers for transaction processing has become financially unsustainable and operationally limiting.

Research indicates that 36.5% of Canadian businesses outsourced professional services, including accounting, in Q1 2025, with adoption rates climbing from 55% to 75% between 2018 and 2023.

Why Canadian CPAs Are Embracing Outsourcing

Cost Efficiency Without Compromise

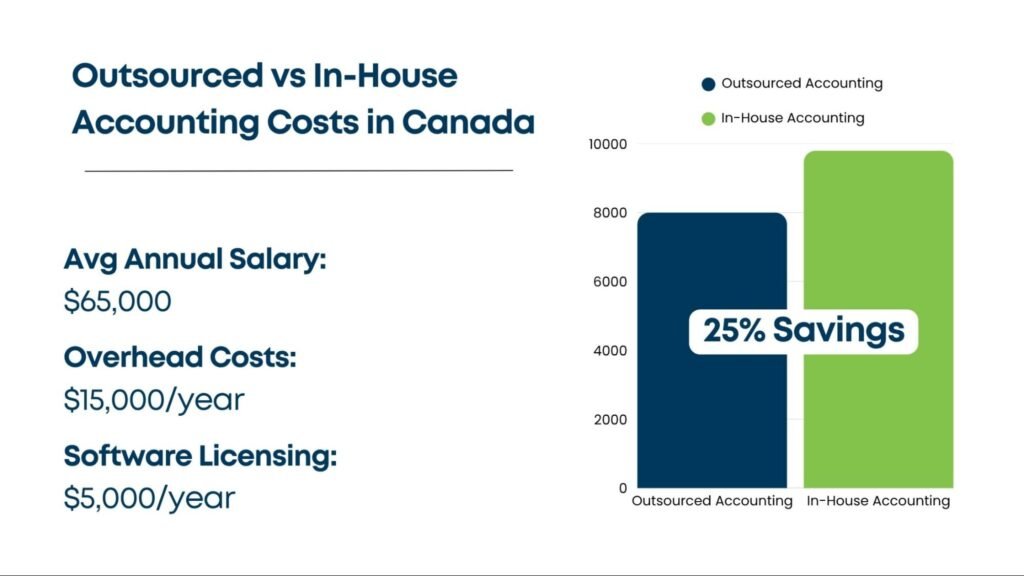

Maintaining specialised e-commerce accounting expertise in-house requires significant investment. Salaries for professionals with multi-platform experience exceed $65,000 annually, plus benefits, training, and software licensing.

When you outsource e-commerce accounting, solutions reduce these operational costs by 40-50% while providing access to teams already proficient in Shopify bookkeeping, Amazon accountant for an e-commerce business functions, and cross-border compliance.

Access to Specialised Platform Expertise

E-commerce accounting extends beyond traditional bookkeeping. Each platform presents unique challenges:

| Platform | Accounting Complexity | Key Challenges |

|---|---|---|

| Shopify | Moderate-High | Multi-currency, payment gateway fees, and sales tax by province |

| Amazon | High | FBA fees, storage costs, referral charges, and marketplace tax collection |

| Multi-channel | Very High | Inventory sync, fee reconciliation, unified reporting |

Scalability During Peak Periods

E-commerce transactional volume fluctuates dramatically during holiday seasons, product launches, and promotional events. Outsourced teams scale resources within 48-72 hours without HR complications, ensuring continuous service delivery during critical reporting periods.

Understanding E-commerce Bookkeeping Fundamentals

E-commerce bookkeeping differs fundamentally from traditional retail accounting. The digital nature of transactions creates data complexity that demands systematic automation and specialised knowledge.

Core Challenges in E-Commerce Financial Management

Platform Fee Reconciliation

Amazon charges 15% referral fees plus FBA storage and fulfilment costs that vary by product dimensions and seasonality. Shopify merchants face 2% transaction fees on external payments plus subscription tiers from $39 to $399 monthly. Accurate bookkeeping requires mapping these fees to correct expense categories while maintaining gross margin integrity.

Inventory Valuation Complexities

Unlike traditional retail, e-commerce inventory exists across multiple locations: FBA warehouses, third-party logistics providers, and direct merchant facilities. The cost of goods sold must account for inbound shipping, customs duties, storage fees, and returns processing. Misclassifying inventory as immediate expenses remains the third most common accounting error among Canadian e-commerce sellers.

Multi-Jurisdictional Sales Tax Compliance

The 2018 South Dakota v. Wayfair decision triggered economic nexus laws across Canadian provinces, requiring sellers to register for GST/HST once taxable revenues exceed $30,000 CAD in any rolling 12-month period. Four provinces operate under HST (13-15%), while others maintain separate PST systems, creating a compliance matrix that changes based on customer location.

Essential Bookkeeping Practices

| Practice | Implementation | Impact |

|---|---|---|

| Separate Business Banking | Dedicated accounts per sales channel | Reduces reconciliation errors by 60% |

| Automated Transaction Sync | Real-time integration via A2X or Link My Books | Saves 15–20 hours monthly |

| Monthly Account Reconciliation | Match platform payouts to bank deposits | Identifies discrepancies within 24 hours |

| Inventory Tracking by SKU | Perpetual system with COGS analysis | Improves gross margin accuracy by 35% |

Platform-Specific Accounting Requirements

Shopify Bookkeeping Essentials

Canadian Shopify merchants must navigate provincial tax variations while managing payment gateway diversity. Shopify bookkeeping requires:

- Transaction-level accounting to identify profit centres by product, channel, and marketing campaign

- GST/HST collection based on the customer’s province, not the merchant’s location

- Payment processor reconciliation for PayPal, Stripe, and Shop Pay transactions

- Refund and chargeback tracking to maintain accurate revenue recognition

Common Shopify Accounting Mistakes:

- Recording gross deposits as revenue without fee deduction

- Failing to separate shipping income from product sales

- Ignoring gift card liability accounting

- Misclassifying marketing apps as operating expenses rather than COGS

Amazon Accountant for E-commerce Business Operations

An Amazon accountant for an e-commerce business functions demands specialised knowledge of marketplace mechanics. The platform’s complexity creates unique compliance risks:

Key Amazon Accounting Challenges:

- FBA fee structures include variable closing fees, storage costs, and long-term storage penalties that change quarterly

- Marketplace Facilitator Tax collection began in 2021, but sellers remain responsible for non-marketplace sales and wholesale orders

- Multi-country inventory triggers customs valuation and transfer pricing considerations

- Advertising cost of sales (ACoS) must be allocated across SKUs for accurate profitability analysis

Critical Compliance Requirement: Amazon’s data retention policies provide only 24 months of transaction history. Professional accounting services must implement automated backup systems to preserve records for CRA’s six-year audit requirement.

Tax Accounting in E-commerce: GST/HST Compliance

Tax accounting in e-commerce represents the most complex aspect of Canadian online retail financial management. The CRA has intensified enforcement, with enhanced data-sharing arrangements with payment processors and marketplaces to identify non-compliant sellers.

GST/HST Registration and Filing Obligations

Mandatory Registration Threshold: $30,000 CAD in taxable revenues within any 12-month period triggers GST/HST registration requirement. This includes:

- Direct website sales

- Marketplace transactions (even if tax is collected by the platform)

- Digital product revenues

- Service commissions

Filing Frequency Based on Revenue:

- Annual filing: Under $1.5 million CAD

- Quarterly filing: $1.5 million to $6 million CAD

- Monthly filing: Over $6 million CAD

Electronic Filing Mandate:

Since 2024, electronic filing is mandatory for all businesses with limited exceptions, eliminating paper-based submissions.

Provincial Tax Variations

| Province | Tax Type | Rate | Filing Requirement |

|---|---|---|---|

| Ontario | HST | 13% | Combined federal/provincial return |

| British Columbia | GST + PST | 5% + 7% | Separate PST filing required |

| Alberta | GST | 5% | Federal only |

| Quebec | GST + QST | 5% + 9.975% | Separate QST registration |

| Atlantic Provinces | HST | 15% | Combined return |

Marketplace Facilitator Rules

Since July 2021, major platforms have been collecting and remitting GST/HST on behalf of unregistered sellers. However, this does not relieve sellers of all obligations:

- Sellers must still register once thresholds are exceeded

- Direct sales through non-marketplace channels require seller collection

- Input Tax Credits can only be claimed by registered businesses

- Wholesale orders remain the seller’s tax responsibility

CRA Enforcement Priority: The 2025 audit focus targets unregistered sellers exceeding thresholds and foreign suppliers using simplified registration schemes improperly.

Offshore E-commerce Accountants: Strategic Considerations

Offshore accountants provide Canadian firms with 24/7 operational capability and specialised expertise at competitive rates. The Canadian BPO market generated USD 28.9 billion in 2024, with projections reaching USD 46.7 billion by 2030.

Advantages of Offshore Support

Cost Optimization

Professional offshore teams deliver CPA-qualified expertise at 40-60% lower cost than domestic hiring, enabling firms to offer competitive pricing while maintaining margins.

Specialised Skill Sets

Leading offshore providers employ professionals trained in:

- Canadian ASPE and IFRS standards

- CRA audit procedures and electronic filing requirements

- Platform-specific outsourced accounting for Shopify, Amazon, Walmart

- Cross-border tax compliance for US-Canada operations

Technology Enablement

Offshore teams operate on cloud-based platforms with:

- Secure client portals with PIPEDA compliance

- Real-time collaboration tools

- AI-powered reconciliation and anomaly detection

- Automated backup and disaster recovery

Conclusion: Strategic Transformation Through Outsourcing

The trajectory is clear: 79% of Canadian businesses will adopt outsourced accounting by 2025. When firms outsource e-commerce accounting, they redirect internal resources toward high-value advisory services while ensuring expert-level compliance and financial outsourcing reporting.

The Canadian e-commerce market is expected to approach $118.8 billion by 2028—the question is not whether to outsource, but how quickly to implement strategic partnerships.

Expert outsourcing partners with proven Canadian market experience offer the fastest path to scalability. By selecting providers demonstrating mastery of Shopify bookkeeping, Amazon accountant for an e-commerce business functions, and CRA compliance, firms position themselves as indispensable advisors in Canada’s digital economy.

Contact us to explore how specialised outsourcing can transform your practice’s e-commerce service delivery and achieve sustained growth.