Cost of Outsourcing Accounting Services in Canada

Managing financial operations efficiently is crucial for business success, yet many Canadian enterprises struggle with the mounting costs and complexities of maintaining in-house accounting departments.

As we approach 2026, understanding the cost of outsourcing accounting services has become essential for CPAs, accountants, and business owners seeking to optimise their financial management strategies while controlling expenses.

Recent industry data reveals that 36.5% of Canadian businesses have already outsourced professional services such as accounting and bookkeeping, with adoption rates climbing from 55% in 2018 to 75% in 2023.

This dramatic shift reflects how outsourcing has evolved from a cost-cutting measure into a strategic business advantage that delivers expertise, scalability, and competitive edge.

Key Takeaways

- Monthly outsourced accounting services cost ranges from $500 to $10,000, depending on business size and service complexity

- Canadian businesses save 40-60% by outsourcing compared to maintaining in-house accounting teams

- Pricing models include hourly rates, fixed monthly fees, per-transaction, and tiered packages, offering flexibility

- The Canadian BPO sector is projected to grow from CAD 28.9 billion (2024) to CAD 46.7 billion by 2030

- Over 54% of Canadian SMBs have outsourced core accounting functions, with efficiency improvements reported by 72% of firms

Understanding Outsourced Accounting Service Costs in Canada

What Determines the Cost of Outsourcing Accounting Services?

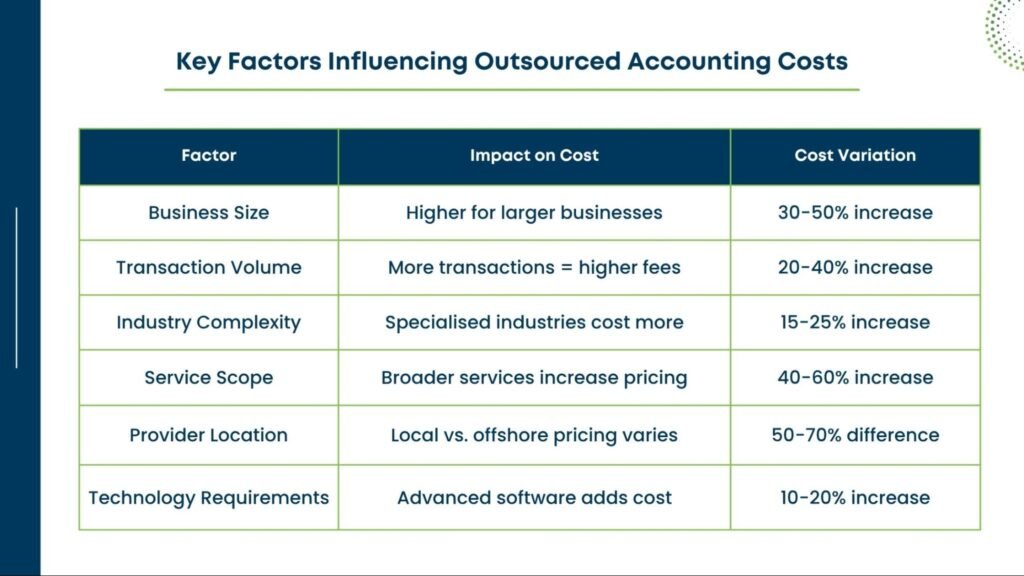

The cost of outsourcing accounting services varies significantly based on several critical factors that Canadian businesses must consider:

Business Size and Complexity

Larger organisations with multiple entities, complex transactions, and extensive reporting requirements naturally incur higher costs. Small businesses with straightforward bookkeeping needs can expect to pay substantially less than mid-market enterprises requiring comprehensive financial management.

Transaction Volume

The number of monthly transactions directly impacts pricing. Businesses processing hundreds of invoices, payments, and reconciliations require more extensive service hours, increasing outsourced bookkeeping rates accordingly.

Industry-Specific Requirements

Specialised industries such as healthcare, cannabis, real estate, and e-commerce often require industry-specific expertise and compliance knowledge, which commands premium outsourced accounting pricing.

Service Scope and Frequency

Basic bookkeeping services cost considerably less than comprehensive packages that include payroll processing, tax preparation, financial analysis, and CFO-level strategic guidance.

Provider Location and Expertise

Outsourcing to local Canadian providers versus offshore destinations can result in 50-70% pricing differences. However, local providers offer advantages, including time zone alignment, regulatory familiarity, and cultural compatibility.

Technology and Software Requirements

Advanced accounting platforms, automated workflows, and real-time reporting capabilities may increase costs by 10-20%, though these investments typically deliver substantial efficiency gains.

How Much Does Outsourced Accounting Cost? Pricing Breakdown

| Service Level | Monthly Cost Range (CAD) | Typical Services Included |

|---|---|---|

| Basic Bookkeeping | $500 – $1,000 | Transaction recording, bank reconciliation, basic reports |

| Standard Accounting Package | $1,000 – $2,000 | Monthly bookkeeping, sales tax filing, financial statements |

| Comprehensive Services | $2,000 – $3,000 | Full bookkeeping, payroll, tax preparation, financial analysis |

| Full-Service with CFO Support | $3,000 – $5,000 | All above + CFO guidance, budgeting, cash flow forecasting |

| Enterprise-Level Services | $5,000 – $10,000+ | Multi-entity reporting, advanced analytics, compliance |

These figures align with Statistics Canada data showing that professional service outsourcing has become mainstream across 36.5% of Canadian businesses.

Understanding Different Pricing Models

Hourly Rate Pricing

Canadian outsourced accounting pricing for hourly services ranges from $25 to $150 per hour, with experienced CPAs commanding rates at the higher end. This model suits businesses requiring occasional consulting or project-based assistance rather than ongoing support.

Fixed Monthly Fee

The most popular model among Canadian businesses, fixed monthly fees provide cost predictability and typically range from $500 to $5,000 depending on service scope. This approach works exceptionally well for businesses with consistent transaction volumes and regular reporting needs.

Per-Transaction Pricing

Ideal for seasonal businesses or companies with fluctuating activity levels, per-transaction pricing typically costs $1 to $5 per transaction. This model ensures businesses only pay for actual work performed.

Tiered Package Pricing

Many Canadian providers, including a trusted outsourcing company, offer tiered packages allowing businesses to select appropriate service levels and scale as they grow. Entry-level packages start around $500 monthly, with premium tiers reaching $10,000 or more.

Value-Based Pricing

Strategic financial planning and CFO-level advisory services often use value-based pricing, where costs align with the business impact delivered rather than hours worked. This model suits growing businesses seeking transformational financial guidance.

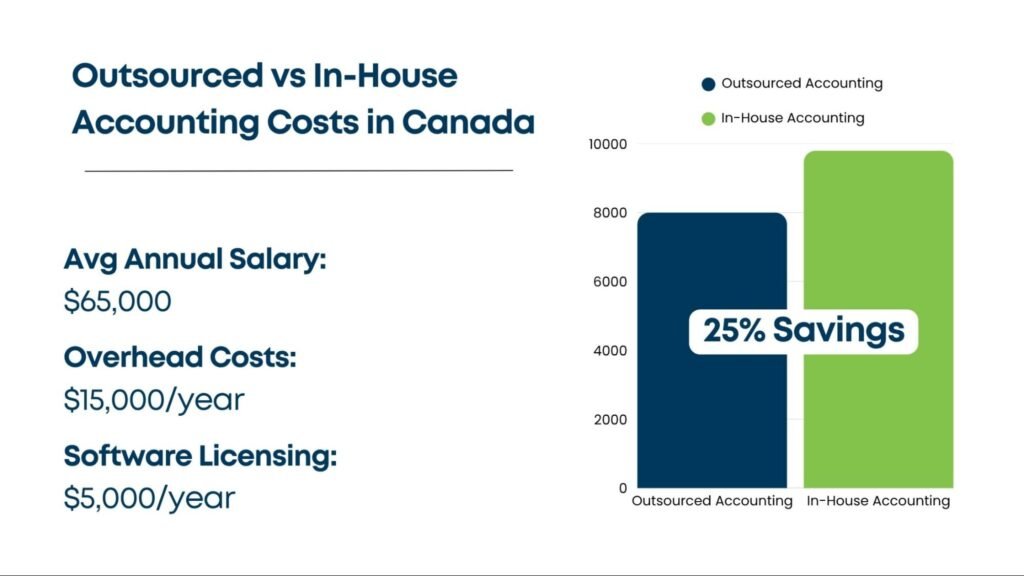

| Aspect | In-House Accounting (CAD) | Outsourced Accounting (CAD) | Savings Potential |

|---|---|---|---|

| Monthly Cost | $5,400 – $7,500/month | $500 – $5,000/month | 40–60% |

| Annual Cost | $65,000 – $90,000/year | $6,000 – $60,000/year | 30–70% |

| Expertise Access | Limited to staff skills | Team of specialists | Multiple expert access |

| Scalability | Difficult and expensive | Flexible and instant | Unlimited flexibility |

| Technology Investment | Required ($3,000–$5,000) | Included in service | 100% savings |

| Training & Benefits | Required (35–40% overhead) | Not required | 100% savings |

Industry statistics reveal that Canadian businesses can reduce accounting costs by 40-50% through outsourcing compared to maintaining in-house teams. According to Deloitte research, 54% of Canadian small businesses outsource accounting primarily to manage compliance complexity while reducing operational expenses.

What Canadian Businesses Should Expect When Outsourcing

Services Typically Included in Outsourced Accounting Packages

Core Bookkeeping Services

- Daily transaction recording and categorisation

- Bank and credit card reconciliation

- Accounts payable and receivable management

- General ledger maintenance

- Month-end and year-end closing procedures

Tax Compliance and Preparation

- GST/HST return preparation and filing

- Corporate tax return preparation (T2)

- Individual tax returns (T1)

- Payroll tax compliance (T4, T4A)

- Tax planning and optimisation strategies

Financial Reporting and Analysis

- Monthly financial statements (P&L, balance sheet, cash flow)

- Budget preparation and variance analysis

- Key performance indicator (KPI) tracking

- Custom reporting dashboards

- Management reporting packages

Strategic Services

Outsourced CFO services, including cash flow forecasting, financial modelling, strategic planning, and business advisory support, are increasingly popular among Canadian mid-market businesses.

Technology and Software Integration

Modern Accounting outsourcing providers leverage cloud-based platforms, including QuickBooks Online, Xero, Sage Intacct, and NetSuite, to deliver real-time financial visibility. According to industry data, 86% of Canadian accountants currently use cloud accounting software, with 84% planning to adopt AI solutions soon.

Hidden Costs and Considerations

While evaluating how much outsourced accounting costs, Canadian businesses should consider several additional factors beyond base pricing:

Setup and Onboarding Fees

Initial setup typically ranges from $500 to $2,500, covering data migration, system configuration, and process documentation. Reputable providers like professional accounting firms often waive or reduce these fees for long-term contracts.

Software and Licensing Costs

Some providers include software costs in their monthly fees, while others charge separately. Clarify whether QuickBooks, Xero, or other platform licenses are included in the quoted outsourced accounting services cost.

Seasonal Fluctuations

Tax season and year-end closing periods may incur temporary cost increases of 15-30% due to increased workload demands.

The Future of Accounting Outsourcing Costs in Canada

As we approach 2026, several trends are reshaping outsourced accounting pricing:

AI and Automation Impact

Artificial intelligence and machine learning are reducing costs for routine tasks while increasing value for strategic advisory services. The Canadian BPO market is projected to reach US$9.82 billion by 2030, growing at 3.47% annually.

Increased Adoption Rates

With 79% of Canadian businesses expected to outsource accounting by 2025, market competition is driving improved service quality and competitive pricing.

Regulatory Complexity

Evolving compliance requirements, including ESG reporting frameworks and international financial standards, are increasing demand for specialised expertise available through financial outsourcing.

Making the Right Choice for Your Business

Selecting the appropriate outsourcing partner requires evaluating multiple factors beyond price alone:

Provider Credentials and Experience

Verify that providers employ qualified professionals with relevant certifications (CPA, CGA, CMA) and Canadian tax return outsourcing.

Technology Capabilities

Ensure compatibility with your existing systems and access to modern cloud-based platforms offering real-time reporting.

Data Security and Compliance

Confirm providers maintain ISO 27001 certification and robust cybersecurity measures protecting sensitive financial information.

Scalability and Flexibility

Choose partners capable of scaling services as your business grows without significant cost increases or service disruptions.

References and Track Record

Request client testimonials and case studies demonstrating successful partnerships with businesses similar to yours.

The cost of outsourcing accounting services in Canada represents a strategic investment rather than merely an expense. With monthly costs ranging from $500 for basic bookkeeping to $10,000+ for comprehensive enterprise solutions, Canadian businesses can achieve 40-60% cost savings compared to in-house teams while accessing superior expertise and technology.

Conclusion

As the Canadian BPO market continues expanding toward CAD 46.7 billion by 2030, businesses embracing outsourced accounting position themselves for enhanced financial clarity, regulatory compliance, and sustainable growth.

Whether you’re a small business seeking basic bookkeeping support or a mid-market enterprise requiring comprehensive financial management, understanding pricing structures and cost drivers enables informed decisions that drive long-term success.

Pricing accounting services, understanding how much outsourced accounting costs is essential for choosing the right level of support and ensuring alignment with your budget and operational needs.

By partnering with offshore accountants, Canadian CPAs and accountants can focus on high-value client advisory services while delegating routine tasks to specialised teams, ultimately improving profitability, client satisfaction, and competitive positioning in an increasingly complex financial landscape.