How to Survive a CRA Audit: Steps and Best Practices

Facing a CRA audit can feel intimidating, especially when you’re unsure of what to expect. However, being selected for an audit doesn’t always mean something is wrong, it’s often part of routine checks to ensure compliance. What truly matters is how prepared you are. Facing a Canada Revenue Agency audit can be manageable with the right preparation and understanding.

In this guide, we’ll break down the CRA audit process, outline what triggers an audit, and share practical strategies to help you respond effectively. With the right knowledge and a clear action plan, navigating a CRA audit can be far less stressful than anticipated.

The Reasons Behind CRA Audits

CRA audits can occur for several reasons, including:

- Routine Checks: Part of regular compliance monitoring.

- Discrepancies: Differences between your tax return and third-party data.

- Large Changes: Significant fluctuations in income or expenses.

- High-Risk Industries: Cash-based businesses or other high-risk sectors.

- Frequent Errors: Regular mistakes or late filings.

- Tips: Informants reporting potential issues.

- Random Selection: Some audits are chosen at random.

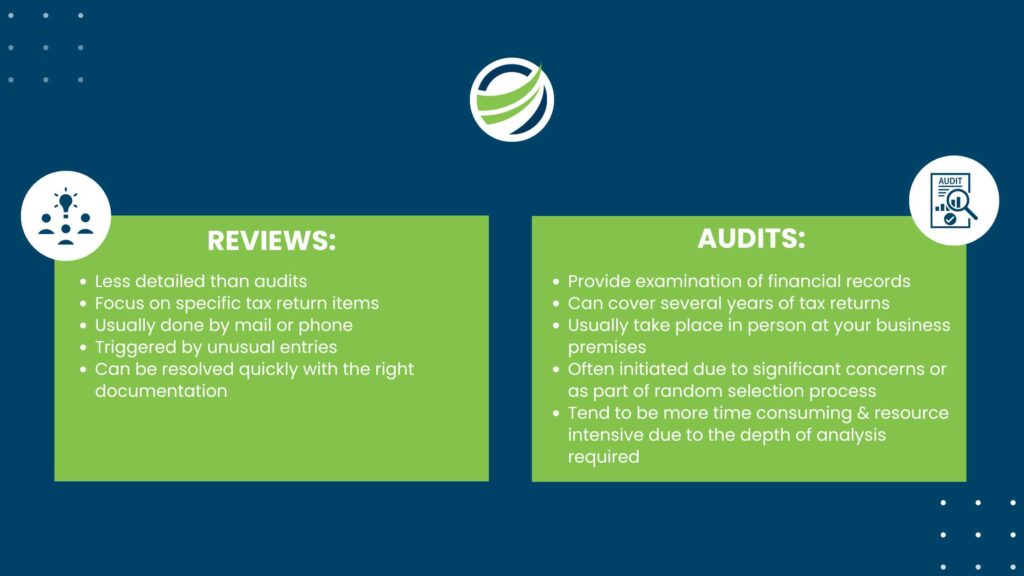

CRA Reviews vs CRA Audits: know the difference

Both CRA reviews and CRA audits require detailed examinations of your financial records, but they vary in terms of scope and depth. While both processes require you to provide access to your financial documents, maintaining well-organised and accurate records can contribute to a smoother and more efficient outcome. The better prepared you are, the more efficient the process will be.

Reviews:

- Less detailed than audits

- Focus on specific tax return items

- Usually done by mail or phone

- Triggered by unusual entries

- Can be resolved quickly with the right documentation

Audits:

- Provide detailed examination of financial records

- Can cover several years of tax returns

- Usually take place in person at your business premises

- Often initiated due to significant concerns or as part of random selection process

- Tend to be more time consuming and resource intensive due to the depth of analysis required.

Common CRA review and Audit trigger

The CRA may review or audit your return for several reasons, including these:

- Large changes in income or expenses every year

- Discrepancies between your return and third party data such as GST filings

- High risk industry, like cash based businesses

- Frequent errors or late filings

- Tips from informants

- Random selection for compliance check

Top 6 CRA Audit Triggers to Avoid

So, what are the most common CRA audit triggers? While some audits are random, many are avoidable if you know what to watch for.

Here are the top 6 CRA audit triggers to avoid:

- Significant changes in income or expenses from year to year

- Discrepancies between your return and third-party data (like T-slips or GST returns)

- Operating in high-risk industries, such as cash-heavy businesses (restaurants, salons)

- Frequent filing errors or late returns

- Tips or complaints from informants (yes, this happens)

- Random selection for compliance reviews

Being aware of these can help you identify red flags before the CRA does.

How Far Back Can CRA Audit?

One common question is: how far back can CRA audit? Typically, the CRA can go back three years from the date of your last Notice of Assessment. However, if there’s suspicion of fraud, misrepresentation, or neglect, the agency can audit as far back as it deems necessary, sometimes up to seven years or more.

The CRA audit process: step by step

Here’s a simplified breakdown of what the CRA audit process looks like:

Step 1: Audit Notification

- The process begins with a formal letter from CRA informing you that your tax return has been selected for audit. The letter outlines which tax years are under review and specifies documents initial requirements.

Step 2: Initial Contact

- A CRA auditor will call to schedule a time to review your records and confirm which documents are needed.

Step 3: Information Gathering

Prepare your:

- Financial statements

- Bank and credit card statements

- Contracts and receipts

- Ledgers, journals and payroll reports

- Minute books and corporate records

Step 4: The Audit

The audit may occur at your business, your accountant’s office, or a CRA office. Expect questions regarding business operations, income, and expenses.

Step 5: Preliminary Findings

You’ll receive a summary of findings. You’ll be given a chance to respond or clarify any issues.

Step 6: Final Report

The auditor will provide a final report with their findings, which may include adjustments or reassessments to your tax filings.

Step 7: Resolution

If you accept the auditor’s findings you’ll sign an agreement and settle any additional penalties or taxes. If you do not you can file an appeal or objection.

Providing Information to the CRA

When providing information to the CRA, make sure to:

- Arrange documents by category and in chronological order

- Explain clearly any discrepancies and unusual items

- Use professional presentation formats such as binders, digital files

- Be ready to describe your bookkeeping system and financial practices

Specifically when dealing with a Scientific Research & Experimental Development (SR&ED) audit:

- When answering questions about your claim

Answer as directly as possible and provide only the necessary information. While this may seem obvious the auditor will be following a standard procedure to assess SR&ED tax credit eligibility. Offering extra details could be misinterpreted by the CRA and potentially lead to your claim being denied or amended. - When defending an SR&ED claim

Focus on the technology throughout the audit. While project details and financial impact may seem relevant, the auditor is mainly concerned with whether your claim meets the SR&ED criteria, including technological advancement, technical challenges overcome and a systematic process.

Best Practices During a CRA Audit

Being prepared goes a long way. Follow these best practices to make the process smoother:

- Organise documents by category and date

- Be honest, clear, and concise in your responses

- Provide only what’s asked for avoid oversharing

- Keep a record of all communications with CRA

- Have your accountant or tax advisor present during meetings

- Ask questions if anything is unclear

Taxpayer rights During an Audit

Taxpayers have specific rights during the audit process, Here are the key ones you should know:

- To be treated with professionalism, fairness, and respect

- To receive clear information about the audit and your responsibilities

- To have representation (yourself, accountant, or legal counsel)

- To appeal CRA decisions or file service complaints

Why Bookkeeping Matters More Than You Think

Good bookkeeping is your best audit defense. Here’s why:

- Makes audits faster and less stressful

- Shows your intent to comply with tax laws

- Reduces errors that may trigger a CRA audit

- Keeps you prepared for potential reviews or assessments

How Bookkeepers Help During an Audit

Professional bookkeeping services can be invaluable during an audit:

- Organise financial records in a CRA-compliant format

- Explain accounting practices to auditors

- Flag discrepancies before they become issues

- While outsourced payroll services in Canada help ensure all employee-related data is accurate and audit-ready.

- Assist legal teams in high-risk cases

- Offer year-round audit-readiness support

When You May Need Legal Representation

Legal counsel may be necessary in serious cases, such as:

- Suspected fraud

- Major reassessments

- Complex tax disputes

While bookkeepers can’t provide legal advice, they can collaborate closely with legal professionals to clarify financial details and ensure accuracy.

How bookkeepers can assist in Serious Non-Compliance Cases

In cases of serious non-compliance:

- Reconstruct financial records when original documentation is missing or incomplete

- Coordinate with legal teams to provide accurate and organised financial documents

- Establish stronger bookkeeping systems to prevent future compliance risks

While bookkeepers can’t offer legal advice, they can play a critical support role:

- Collaborating with legal counsel to explain or clarify financial data

- Translating complex financial information into clear, actionable summaries

- Preparing essential financial documentation for legal proceedings

With their expertise, bookkeepers bridge the gap between your financial records and your legal strategy ensuring your case is presented accurately and professionally.

Challenges You May Face During an Audit

Audits can bring several hurdles:

- Time-consuming and divert focus from business operations

- Emotionally stressful, especially if you’re unprepared

- Financial strain, if reassessments result in tax owing

- Complex tax law, requiring expert interpretation

The key is to not let these challenges paralyse you. Instead, lean on your support system bookkeepers, accountants, and legal advisors to guide you through.

Post-Audit: what’s next?

Once the audit wraps up, your work isn’t done. Take these proactive steps:

- Review audit findings carefully

- Implement recommendations

- Improve recordkeeping systems

- Train your internal accounting team

- Consider outsourcing to a professional bookkeeper

Conclusion

A CRA audit doesn’t have to be overwhelming. With well-organised financial records, consistent compliance, and the right support system in place, it becomes a manageable process rather than a stressful event.

Understanding CRA audit triggers, the CRA audit process, and how far back the CRA can audit is half the battle. The other half? Staying organised, proactive, and informed. Whether you’re handling things in-house or relying on a trusted external accounting partner, staying proactive and informed can make all the difference.