The world is now a global village, quite literally. It is very easy now to process any transaction on

online platforms. But here’s the twist – it is now very simple for fraudsters to execute perfect thefts online.

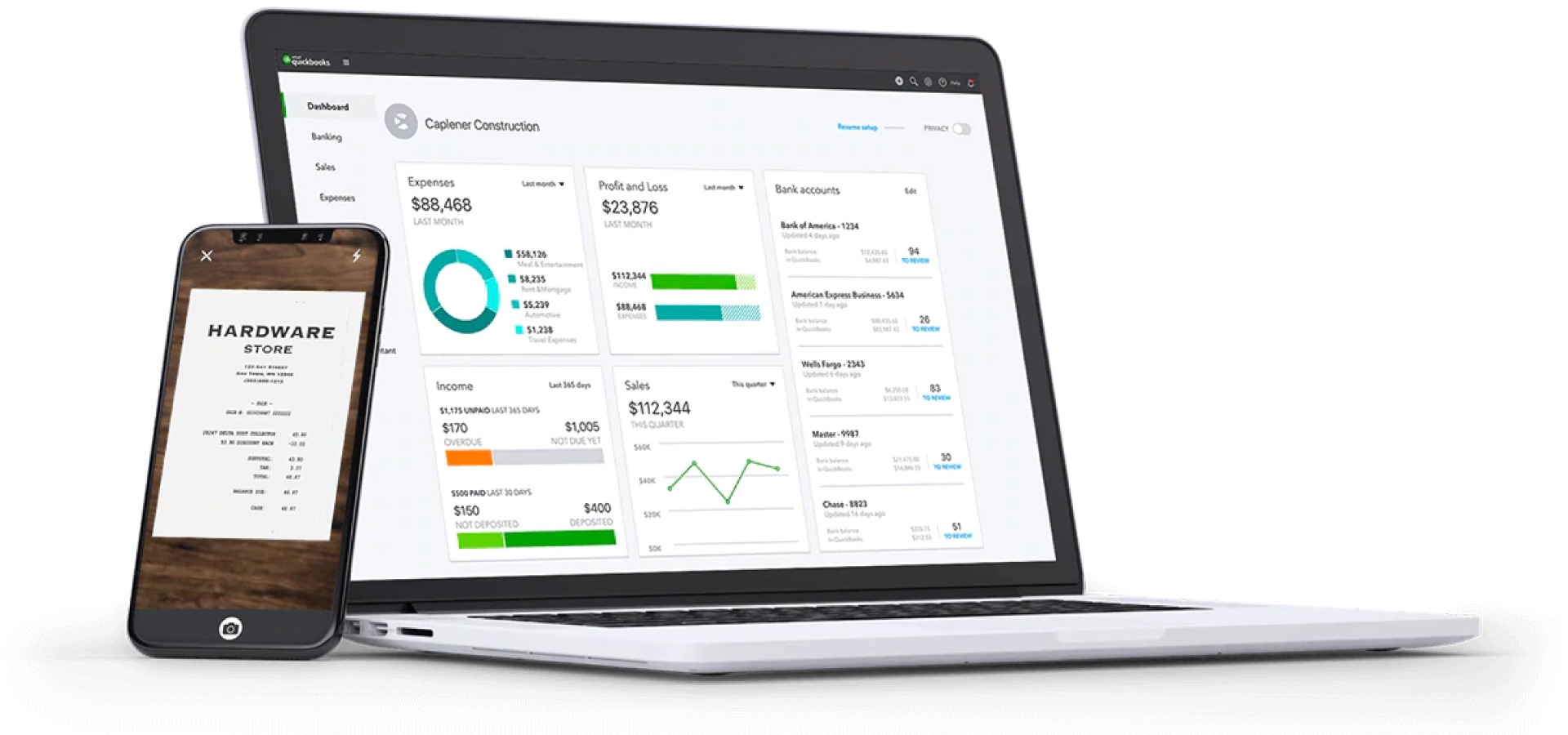

8 Hacks/Features of QuickBooks Every Accountant Must Know

QuickBooks Online enables us to manage the books of clients in a very accurate & systematic manner. Dive into these unexplored hacks that could possibly change your game & boast in front of your clients!

Continue readingTips for Canadian CPAs to be more productive

NCS Canada provides outsourcing services to Canadian CPAs and Corporates at extremely low and affordable rates. At this time of world crisis,

Continue readingWhy NCS Canada can be a savior for Canadian CPAs and Corporates in this time of Global Lockdown?

NCS Canada provides outsourcing services to Canadian CPAs and Corporates at extremely low and affordable rates. At this time of world crisis,

Continue readingTax planning for small business owners

While running a small business, we cannot refuse to accept that every single penny counts for it to grow. When entrepreneurs are surviving on razor-thin margins and brawling for market share, it can be extremely important to know where you can save your money.

Continue readingBenefits of incorporation

NCS makes sure to re-assess your family business’s organizational structure and give you the ideas/outputs best suited for you and your business.

Continue readingEverything you need to know about T2 Corporate Tax Return

All the resident corporations cited in the Canadian Proficiency have to file a corporation income tax known as T2. To be frank, business owners need to file a T2 tax return along with the T1 personal tax return.

Continue readingComplete Information on T1 Personal Tax Return

You need to file the return whether you are employed (Salary or commission income) or self-employed. Are you filing your first income tax return as a business in Canada? If yes, let me tell you if your business is a sole proprietorship or partnership or incorporation, then you have to file T1, which is better known as General Income Tax Form or Income Tax and Benefit Return.

Continue readingFind out if you have to register for a GST/HST account

You generally cannot register for a GST/HST account if you provide only exempt supplies.

Use the following sections to determine if you are a small supplier to find out if you have to register.

What are the duties of a bookkeeper?

Payroll processing is a time-consuming one and it requires a high concentration in order to avoid human error. In addition, handling payroll processing requires a strong and solid system with the right team. So, that business owner can deliver paycheck on right time and avoid frustration among employees.

Continue reading