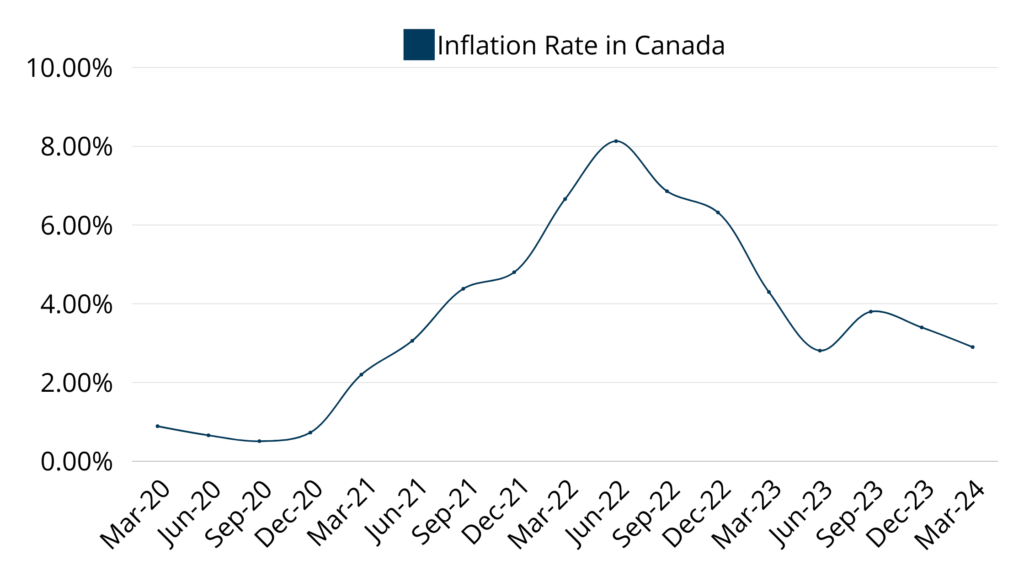

As Canadians brace themselves for economic turbulence, recent data reveals a roller-coaster ride of interest rate hikes and fluctuating prices across sectors. According to a recent Forbes article, the Bank of Canada’s monetary policy maneuvers have left an indelible mark on the nation’s financial landscape. From soaring food prices to fluctuating gas costs, Canadians are grappling with the impact of inflation on their wallets.

Impact on CPA Firms

Cost of Operations

Inflation is leading to higher operating costs for CPA firms, including rent, utilities, and employee wages. As expenses rise, firms need to adjust their pricing strategies to maintain profitability.

Client Fees

As inflation erodes the purchasing power of money, clients are less willing or able to pay higher fees for accounting services. CPA firms are facing pressure to keep their fees competitive while still covering their rising costs.

Small Businesses Shutting Down

As a result of inflation, some small businesses are being forced to shut down operations, leading to a decline in demand for accounting services from this segment of the market.

Talent Retention Challenges

Inflationary pressures are leading to higher employee turnover as professionals are seeking higher salaries to cope with rising living expenses.

How to thrive in this environment?

This tough current situation demands changes in the techniques we use to expand and operate the business. This means we need to acquire knowledge of the new age marketing tools and also focus on the operational cost reduction.

Non-Traditional Strategies to Expand Your Business

Google My Business (GMB)

I agree that you might have a GMB profile already set up. But is it well optimized? When a potential client searches for a local business, only the top 3 listings are visible. Is your business amongst the top 3? This is a must-do for all CPAs to attract local clients.

Search Engine Optimization (SEO)

When clients search for “CPA near me”, does your website appear in the first page of Google Search Engine Results Page? If yes, then congratulations! But if not, then you’re losing out on a lot of potential ready-to-convert clients.

Google Ads

Reiterating the previous point, when clients search for “CPA near me”, does your business appear at the top of the page in Google’s sponsored search results? Using Google Ads to get attention along with Search Engine Optimization (SEO) to build trust is a perfect strategy to never run out of clients.

Social Media Optimization

As a CPA, you might not directly receive a lot of leads from Social Media, however, it’s essential to optimize your social media.

When a potential client is searching for your services, he might not be ready to trust you from the get-go. It takes 7-32 times of appearing in front of the clients in order to make a conversion.

When making a decision, the client is very likely to check out your social media profiles, and if they are well-optimized, you increase the trust factor.

Most people don’t pay much attention to their social media presence so this can be a shrouded goldmine for your business.

Influencer Marketing

This is a shortcut for building trust in a yet unaware audience.

This is where you find a content creator with a lot of ‘real’ followers (a.k.a. Influencer) whose audience is similar to your target audience. In a paid partnership, they promote your services in front of their audience.

This gets you visibility to a large audience who are potentially your target audience, and it also bridges the trust gap because an influencer they follow recommended your services.

Strategies for Operational Cost Reduction

Operational efficiency improvements

Streamlining internal processes and workflows by automating repetitive tasks, implementing efficient software solutions, and optimizing staff allocation to maximize productivity can help reduce wastage of resources.

Remote work arrangements

By allowing employees to work from home or remotely, CPA firms can reduce their expenses associated with office space, utilities, and maintenance and potentially increase employee satisfaction and retention.

Outsourcing non-core functions

Outsourcing non-core activities such as IT support, administrative tasks, bookkeeping and payroll processing to external expertise not only reduces costs but also reduces the burden of managing the operations and a team in-house, empowering you to focus on business expansion.

Technology investments

Embracing technology solutions such as cloud-based software, data analytics tools, and cybersecurity measures can improve operational efficiency and reduce reliance on manual processes. While initial investments may be required, technology adoption can lead to long-term cost savings and competitive advantages.

Training and development programs

Investing in employee training and development programs can enhance the talent within the firm, leading to higher productivity and efficiency. Well-trained staff can deliver higher-quality services in less time, reducing the overall cost per client engagement.

Conclusion

Most CPAs are running business the traditional way. If you can utilize the above information to change the way your business operates, you’ll get far ahead of your competitors.

In order to provide you a practical step-by-step guide on implementing the above strategies for your business, we’re conducting a live webinar on 2nd May’24 at 4:00 PM EST. If that sounds of interest to you, use this link to register for the webinar.