Save on Taxes with Income Splitting Canada in 2025

Your household finances can be greatly impacted by taxes, but there are effective ways to lower your overall tax burden, such as income splitting. This guide explains how to use income splitting to your benefit, whether you’re running a family business, saving for retirement, or just trying to maximise your income.

To help you start saving in the Canada 2025 tax brackets, we’ll go over useful tactics like pension income splitting, spousal Registered Retirement Savings Plans, and important regulations like Form T1206, TOSI rules, etc.

What is Income Splitting and Why Should You Use It?

Income splitting is a tax strategy that allows higher-earning individuals to allocate income to lower-earning family members to reduce the family’s overall taxes. Canada’s progressive tax system means the more you earn, the higher your marginal tax rate. By redistributing income, families can take advantage of lower tax brackets and reduce their overall tax liability. If you’re looking for more ways to optimise your finances, consider exploring comprehensive tax solutions that could further help reduce your tax burden.

Quick Example:

Imagine you earn $100,000 annually, and your spouse earns $25,000. Without income splitting, you’ll likely pay a higher tax rate on your income. But by transferring part of your income to your spouse, more of your household income falls into lower tax brackets, resulting in significant savings.

How to Implement Income Splitting in Canada:

The first step in putting income splitting into practice is determining which tactics are best for your family:

- Assess the Income of Your Family:

Learn who makes what and which sources of income can be divided. - Select the Proper Approach:

Prescribed rate loans, family business income sharing, spousal Registered Retirement Savings Plans, and pension income splitting are among the available options. - Observe the CRA’s guidelines:

To guarantee compliance, become familiar with Form T1206, TOSI regulations, and CRA attribution rules. - Seek Expert Advice:

To properly structure your plan and prevent penalties, consult a tax professional.

Learn more about structuring taxes in the T1 Personal Tax Return.

Is Income Splitting Allowed in Canada in 2025?

Yes, income splitting is allowed in Canada in 2025, but it is subject to specific rules and restrictions set by the CRA.

- Allowed: Pension income splitting, spousal RRSP contributions, prescribed rate loans, and reasonable salaries paid within a family business.

- Restricted: Unless the recipient is actively involved in the business, income splitting for dividends or capital gains from private corporations is restricted by the TOSI rules.

To avoid fines or having income returned to the higher earner, it is crucial to make sure that all income-splitting plans adhere to CRA regulations.

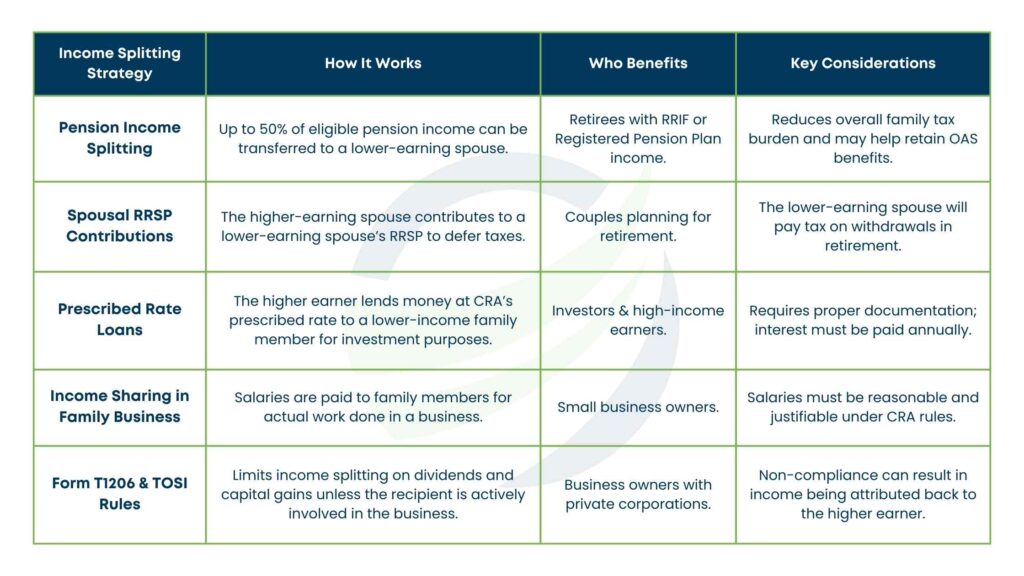

Income Splitting Strategies You Should Know

Here are the most effective income splitting strategies for families and retirees in Canada:

1. Pension Income Splitting

Dividing pension income

One of the easiest ways for retirees to reduce their taxes is to split their pension income.

Eligibility:

Up to 50% of eligible pension income, such as withdrawals from an RRIF or income from a Registered Pension Plan, may be transferred by Canadians to a spouse or common-law partner who earns less.

How It Helps:

Families can balance taxable income between spouses by shifting pension income, which can result in significant savings if one spouse is in a lower tax bracket.

In recent years, more than 2 million Canadians have benefited from pension income splitting, saving billions of dollars in taxes overall, according to the CRA.

2. Spousal Registered Retirement Savings Plan (Spousal RRSP)

Another effective strategy for long-term tax savings is a spouse’s Registered Retirement Savings Plan.

How It Works:

By making contributions to the lower-earning spouse’s RRSP, the higher-earning spouse receives an instant tax deduction. When the money is taken out in retirement, it is then taxed at the rate of the spouse with the lower income.

Key Benefit:

This guarantees even larger retirement savings in addition to lowering your household’s taxes today.

3. Prescribed Rate Loans

Prescribed rate loans are an option if you wish to transfer investment income to a spouse or child who earns less.

How It Works:

At the prescribed interest rate set by the CRA (currently 5% in 2025), the higher-earning spouse lends money to a lower-earning family member. Any income from investments is subject to taxation by the borrower rather than the lender.

Why It’s Effective:

This method legally shifts investment income, reducing the household’s taxable income.

4. Income Sharing in Family Businesses

For small business owners, paying salaries to spouses or children for legitimate work done in the business is another way to benefit from income sharing. To keep records compliant with CRA rules, many entrepreneurs rely on an outsourced bookkeeper to track payroll and ensure proper documentation.

Be Careful:

Salaries must reflect the actual work performed to comply with CRA rules. Otherwise, the income could be attributed back to the higher earner.

What Are the Income Splitting Rules in Canada?

While income splitting in Canada offers fantastic opportunities to save on taxes, there are strict income splitting rules enforced to prevent abuse. The Tax on Split Income (TOSI regulations) stops higher earners from sharing income with family members in specific situations.

Who Is Impacted?

Family members earning income from private companies or family enterprises could be subject to TOSI regulations if they aren’t actively involved in the business.

How to Maintain Compliance:

Make sure family members are actively engaged in the business or explore different options such as prescribed rate loans.

Form T1206:

If you’re claiming capital gains exemptions or allocating split income, you may need to file Form T1206 with your tax return to report specific details.

Canada 2025 Tax Brackets and How They Impact Income Splitting

To make income splitting work effectively, it’s important to understand the Canada 2025 tax brackets:

- 15% on income up to $53,359

- 20.5% on income between $53,360 and $106,717

- 26% on income between $106,718 and $165,430

- 29% on income between $165,431 and $235,675

- 33% on income over $235,675

By redistributing income from higher brackets (29–33%) to lower ones (15–20.5%), households can see significant tax savings.

Benefits and Drawbacks of Income Splitting in Canada:

Benefits

- Lower Taxes:

Transferring income to a family member who is in a lower tax bracket can help lessen your household’s total tax obligations. - Increased Eligibility for Benefits:

Lowering taxable income may increase eligibility for benefits such as the Canada Child Benefit (CCB) or Old Age Security (OAS). - Retirement Planning:

Strategies such as splitting pension income and using spousal RRSPs can reduce taxes now and in retirement.

Drawbacks

- Complex Rules:

Approaches such as prescribed rate loans or dividing rental income need proper documentation and strict adherence to the CRA regulations. - Limited Applicability:

Certain strategies, such as pension income splitting, are exclusively accessible only to retirees. - Potential Audits:

Non-compliance with TOSI rules or misreporting can lead to reassessments.

Why Income Splitting in Retirement Canada is a Must!

Splitting your retirement income is an important part of your tax plan if you are retired. Pension income splitting and RRSP withdrawals are two ways that seniors can reduce their taxes. Reducing taxable income can also make one more eligible for benefits like the Guaranteed Income Supplement (GIS) or Old Age Security (OAS).

Start Saving with Income Splitting:

Income splitting in Canada is a powerful strategy to lower household taxes in 2025. Whether you’re planning for retirement, managing investments, or running a business, tools like pension income splitting, spousal Registered Retirement Savings Plans, and prescribed rate loans can significantly reduce your tax burden.

Professional tax solutions can help you navigate these strategies effectively, ensuring you maximise tax-saving opportunities while staying compliant. By understanding income splitting rules and staying compliant with CRA requirements like Form T1206, you can maximise your family’s financial health while staying within the law.Take control of your taxes and start planning today. because every dollar saved is a dollar earned!