The accounting industry is changing rapidly, with digital transformation, client expectations, and succession planning all influencing the future of firms. Whether you’re planning to exit your practice or looking to expand, buying an accountancy practice or selling one is a major move, financially and strategically.

This blog outlines what you need to know before stepping into a transaction. From valuation and due diligence to staff retention and compliance, here’s your go-to guide to making smart, informed decisions.

Why Buy or Sell an Accountancy Practice?

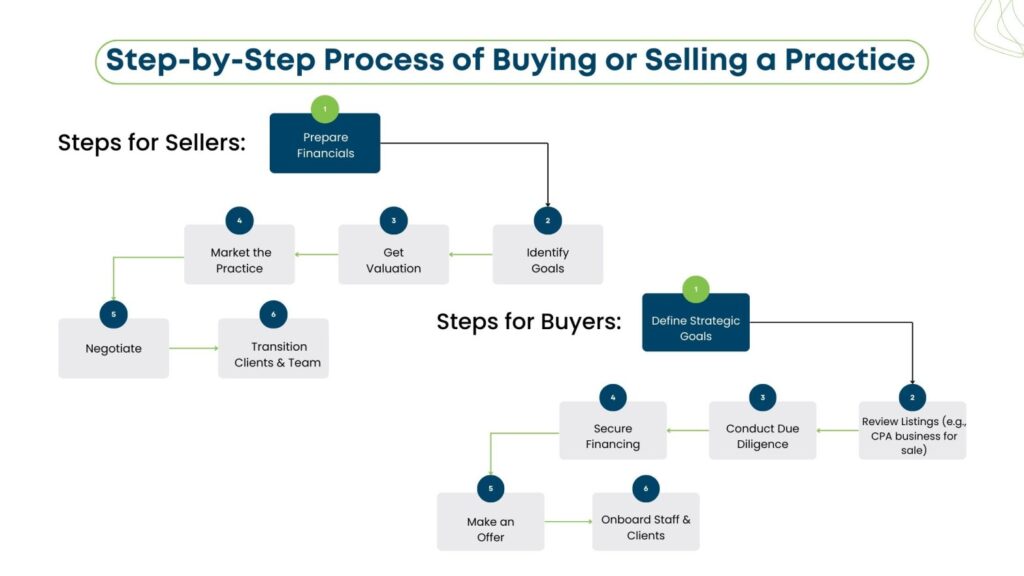

There are many reasons professionals explore the idea of buying or selling an accountancy practice. For sellers, retirement is a common driver, but lifestyle shifts, relocation, or the desire to pursue a different business model also play a role. On the buyer’s side, acquiring an existing client base can accelerate growth, increase market share, and reduce the cost and time of organic client acquisition.

According to a report by Benchmark International, the global accounting services sector grew from $652.32 billion in 2023 to $676.73 billion in 2024, marking a compound annual growth rate (CAGR) of 3.7%. It’s projected to reach $804.27 billion by 2028, reflecting sustained demand and steady expansion across the profession. This industry-wide growth underscores why now is a strategic time to consider either acquiring a firm or preparing your practice for sale.

In recent years, more professionals have also turned their attention to the digital space. A virtual accounting practice for sale may appeal to firms aiming to expand beyond geographic boundaries or tap into tech-savvy clientele without opening new offices.

Valuation: Knowing What the Practice is Worth

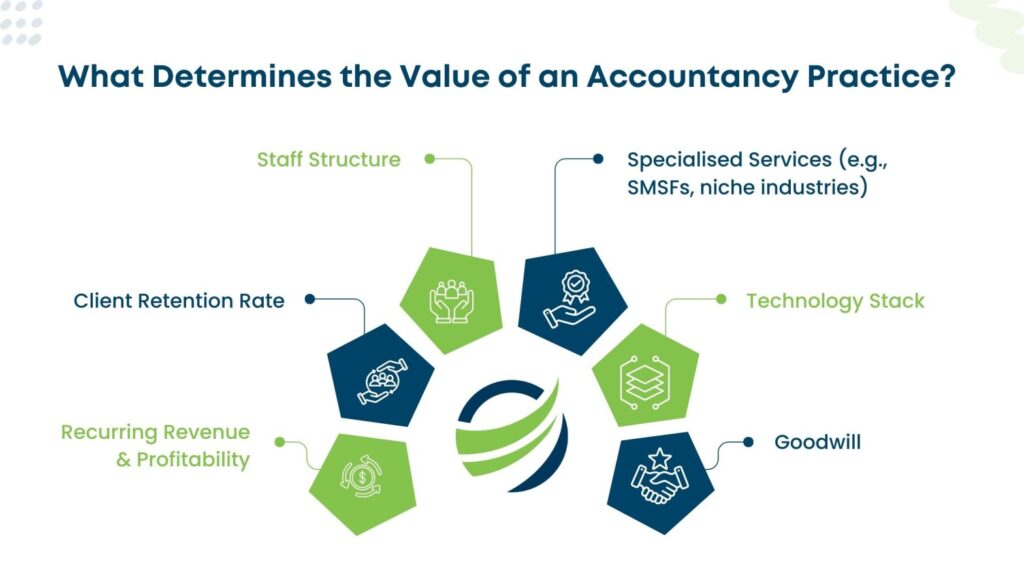

One of the first and most crucial steps in buying or selling a firm is understanding its true market value. Sellers often overvalue goodwill, while buyers may underestimate the importance of existing client relationships.

Here are the main factors that influence valuation:

- Annual recurring revenue (ARR) and profitability

- Stability and tenure of the client base

- Specialised services or niche markets (e.g., SMSFs, hospitality)

- Technology stack and systems efficiency

- Staff retention and leadership structure

Many practices, especially those listed as CPA business for sale, also factor in branding strength, compliance history, and existing referral partnerships. It’s highly advisable for both parties to engage a professional valuer with experience in the accounting industry to arrive at a realistic price point.

Furthermore, according to data shared by industry analysts on LinkedIn, private equity-backed accounting firms often attract higher valuations, with exit multiples ranging from 8x to 12x EBITDA. In contrast, traditional firms typically see valuations between 4x and 6x EBITDA. This reflects how scale, digital maturity, and growth positioning significantly influence market value.

Due Diligence Is Essential

For buyers, due diligence isn’t just a box-ticking exercise, it’s where you uncover the story behind the numbers. For sellers, preparation during this phase makes or breaks buyer confidence.

Here’s what due diligence should cover:

- Profit and loss statements, balance sheets, and tax returns for the past 3–5 years

- Client mix and retention rate (e.g., how many clients generate 80% of revenue)

- Staff roles, tenure, and employment contracts

- Internal processes, software used, and automation capabilities Also consider whether the firm leverages external accounting for functions like payroll or BAS lodgements, as this may impact both cost structure and internal capacity.

- Compliance history and any legal liabilities

Buyers should also look at intangible elements, such as the culture of the firm and client communication style. If you’re targeting accounting businesses for sale, pay attention to whether they’ve invested in scalable systems or are overly reliant on manual work or one key person.

Planning for Client and Staff Transition

One of the biggest concerns during a sale is continuity. Clients want reassurance that their financial affairs won’t be disrupted, while staff seek job security and clarity.

For Sellers:

- Notify key staff early and transparently.

- Consider offering retention bonuses or phased exits.

- Be involved in the handover, especially if you’re personally managing high-value clients.

For Buyers:

- Prioritise relationship-building with team members.

- Maintain familiar service delivery in the early stages.

- Introduce gradual improvements rather than sweeping changes.

In some cases, especially with virtual accounting practices for sale, the transition can be smoother due to already standardised processes and remote work arrangements.

Legal, Regulatory, and Compliance Considerations

There’s more to the deal than just a price tag. Every agreement should be underpinned by clear legal documentation and compliance planning.

Key legal documents may include:

- Sale agreement with asset or share purchase details

- Confidentiality and non-compete clauses

- Staff and client transfer agreements

- Earn-out terms, if applicable

Buyers should also confirm if there are any obligations with regulatory bodies, especially when dealing with a CPA business for sale, including:

- ASIC registration transfers

- ATO portal access

- BAS or tax agent registrations

- Public practice certificates

- Professional Indemnity Insurance

Financing the Deal

If you’re buying an accountancy practice, you’ll need to explore financing options early. Common choices include:

- Bank loans (secured against assets or expected revenue)

- Vendor financing (staged payments to the seller)

- Private equity or internal capital

An upfront payment combined with an earn-out (a portion of the price paid based on future performance) is common. This gives buyers protection and gives sellers an incentive to ensure smooth continuity during handover.

Also, consider tax implications—both for the buyer (capitalising on deductible acquisition costs) and the seller (capital gains tax or small business CGT concessions).

Pitfalls to Avoid

Some common missteps can derail what should be a smooth process.

Sellers:

- Overestimating the value of goodwill.

- Withholding key information during due diligence.

- Rushing the deal without preparing financials and systems.

Buyers:

- Failing to understand the practice’s culture and client expectations.

- Underestimating the need for a structured onboarding process.

- Neglecting compliance reviews or legal risks.

Even when scanning listings for accounting businesses for sale, it’s important to avoid falling in love with the potential. Stick to data, process, and performance when making your decisions.

Should You Use a Broker or Advisor?

The accounting practice sales market has matured significantly. Whether you’re a seller wanting maximum value or a buyer looking for a solid deal, working with a broker or M&A advisor can be a smart move.

Benefits of using a broker:

- Access to a wider network of potential buyers or sellers

- Assistance with valuation and negotiations

- Management of confidentiality and legal documents

- Smoother handling of transition planning

Ensure that any advisor you work with has specific experience in the accounting industry. They should understand the nuances of client billing, compliance demands, and the value of recurring income.

What’s Next: Strategic Moves for Both Sides

Whether you’re stepping away from your firm or stepping into a new venture, the success of the transaction lies in preparation, transparency, and vision.

If you’re a seller, consider:

- Cleaning up financials, documenting internal systems, and defining your ideal buyer profile.

- Preparing emotionally and practically for your exit.

If you’re a buyer:

- Clarify your growth goals, do you want to expand into a new region, enter a niche, or modernise your portfolio?

- Evaluate whether a virtual accounting practice for sale might align better with your operational model than a traditional one.

Final Thoughts

The decision to sell or buy an accountancy practice is not just transactional, it’s transformational. The right acquisition can fast-track your growth, while a well-planned exit can secure your legacy and retirement. Whether you’re scanning through CPA businesses for sale or listing your firm among accounting businesses for sale, success lies in the details.

For both buyers and sellers, embracing modern solutions, like leveraging external accounting services or digital platforms, can enhance efficiency and make your practice more appealing in today’s evolving market.

Plan early, communicate openly, and don’t hesitate to seek professional guidance. In today’s competitive environment, informed decisions make all the difference.