Investment Accounting Methods: Recording & Reporting Income

Investment accounting is one of the most critical financial reporting domains in modern business, particularly as Canadian enterprises navigate increasingly complex investment portfolios and evolving regulatory requirements.

As we advance through 2025, the significance of accurate investment accounting methods has reached unprecedented levels, with the global accounting services market projected to reach $735.94 billion and accounting firms experiencing heightened demand for specialised investment services.

For Canadian CPAs and accountants, mastering investment accounting methods isn’t merely about compliance; it’s about providing strategic value to clients while ensuring adherence to evolving GAAP standards.

This comprehensive guide explores the fundamental investment accounting methods, their practical applications, and the reporting requirements that shape modern financial statements.

Key Takeaways

- Three primary methods govern investment accounting: the cost method, the fair value method, and the equity method, each applicable based on ownership percentage and influence level

- GAAP compliance requires specific journal entries for investment accounting and reporting structures that vary significantly between methods

- Recent regulatory changes in 2025 demand enhanced disclosure requirements and fair value measurements for certain crypto assets

- Professional competency in investment accounting has become crucial, with 83% of firms now offering advisory services as core offerings

Understanding Investment Accounting Methods

Investment accounting encompasses the systematic recording, measurement, and reporting of a company’s investment activities. The method selected depends primarily on the investor’s level of ownership and degree of influence over the investee company.

The Three Primary Methods

Cost Method: Applied when ownership is less than 20% and the investor exercises minimal influence over the investee. Under this method, investments are recorded at historical cost, with dividend income recognised when received. This approach provides simplicity but may not reflect the true economic substance of the investment relationship.

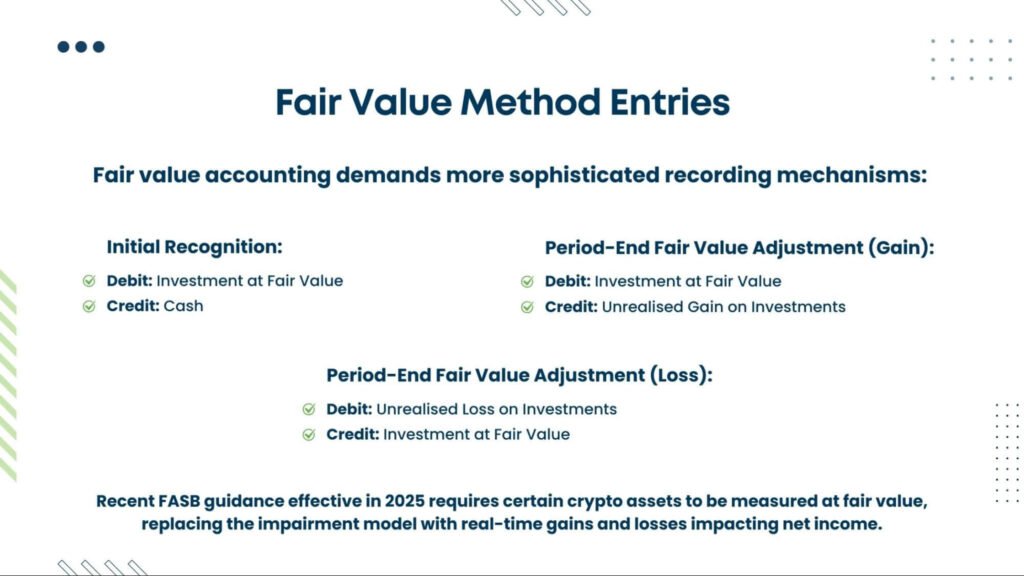

Fair Value Method: Utilised for investments in marketable securities where fair value can be reliably determined. This method requires periodic revaluation to current market prices, with unrealized gains and losses flowing through either net income or other comprehensive income, depending on classification.

Equity Method: Implemented when ownership ranges between 20 and 50%, creating significant influence without control. This method recognises the investor’s proportionate share of the investee’s earnings, adjusting the investment carrying amount accordingly.

Recording Investment Accounting Journal Entries

Proper documentation through journal entries forms the foundation of reliable investment accounting. Each method requires distinct recording approaches that Accounting Professionals must master to ensure accuracy and compliance.

Cost Method Journal Entries

When employing the cost method, initial investment recording appears straightforward:

Initial Purchase Entry:

- Debit: Investment in Securities

- Credit: Cash

Dividend Receipt Entry:

- Debit: Cash

- Credit: Dividend Income

However, Canadian practitioners must carefully monitor for impairment indicators, requiring potential write-downs that affect both the balance sheet investment value and income statement results.

Equity Method Investment Journal Entry Examples

The equity method requires the most complex journal entries, reflecting the investor’s economic interest in the investee:

Initial Investment:

- Debit: Investment in Associate

- Credit: Cash

Recording Share of Earnings:

- Debit: Investment in Associate

- Credit: Investment Income

Dividend Receipt (reduces investment carrying value):

- Debit: Cash

- Credit: Investment in Associate

Investment Income on Income Statement Presentation

Investment income on the income statement presentation varies significantly based on the accounting method employed and the nature of the underlying investments.

Fair Value Method Reporting

Under fair value accounting, investment income encompasses multiple components that require separate presentation. Dividend and interest income appear as separate line items, whilst realised and unrealised gains and losses may be presented together or separately, depending on the entity’s accounting policies.

For investment companies subject to ASC 946, specific presentation requirements mandate gross presentation of income components. Interest income earned on debt securities must be presented separately from other changes in fair value, providing investors with clearer insight into income sources.

Equity Method Income Recognition

Accounting for equity method investments generates investment income equal to the investor’s proportionate share of the investee’s reported earnings. This income appears as a single line item on the income statement, typically labelled “Income from Equity Investments” or a similar designation.

The carrying amount of equity method investments on the balance sheet increases for the investor’s share of earnings and decreases for dividends received and the investor’s share of losses.

Accounting for Equity Method Investments

The equity method requires a sophisticated understanding of both initial recognition and subsequent measurement principles. Recent developments in 2025 have introduced additional complexity through updated guidance on joint ventures and tax credit investments.

Initial Recognition and Measurement

Equity method investments are initially recorded at cost, including transaction costs directly attributable to the acquisition. However, when the purchase price exceeds the investor’s share of the investee’s book value, the excess may represent goodwill or other intangible assets requiring separate analysis.

Fair Value Method of Accounting for Investments

Fair value accounting has gained prominence as markets have become more sophisticated and transparent. The International Accounting Standards Board and FASB continue refining fair value guidance, with significant updates implemented throughout 2025.

Fair Value Hierarchy and Measurement

Fair value measurement follows a three-level hierarchy established in ASC 820:

Level 1: Quoted prices in active markets for identical assets

Level 2: Observable inputs other than Level 1 prices

Level 3: Unobservable inputs requiring significant judgment

Canadian entities must provide extensive disclosures about fair value measurements, particularly for Level 3 investments where valuation uncertainty is highest.

Implementation Challenges

Despite its theoretical appeal, fair value accounting presents practical challenges that Financial Reporting Experts regularly encounter. Market volatility can create significant income statement fluctuations, whilst determining appropriate discount rates for Level 3 measurements requires substantial professional judgment.

The accounting profession has responded with enhanced guidance on valuation techniques, with 71% of organisations now using AI to some degree in their financial operations to improve valuation consistency and accuracy.

Current Industry Trends and Statistics

The investment accounting landscape continues evolving rapidly, driven by technological advancement and regulatory change. Recent industry data reveals that 61% of accountants view AI as an opportunity to enhance their work, with the AI accounting market projected to grow from $6.68 billion in 2025 to $37.6 billion by 2030.

Regulatory Environment

Canadian securities rules continue to require Canadian-based reporting issuers to use Canadian GAAP in all financial statement filings. However, ongoing harmonisation efforts with international standards create opportunities for enhanced comparability whilst maintaining Canadian-specific requirements.

The global accounting services market is expected to reach $735.94 billion by 2025, reflecting increasing complexity in financial reporting requirements. This growth directly correlates with expanding investment portfolios and sophisticated financial instruments requiring specialised accounting expertise.

Technology Integration

Modern investment accounting increasingly relies on sophisticated software solutions and Automated Reconciliation Processes. The integration of blockchain technology and artificial intelligence promises to revolutionise traditional recording and reporting mechanisms, with significant implications for Canadian practitioners.

Investment management firms report particular benefits from technology adoption, with automated fair value calculations and real-time portfolio monitoring becoming standard practice. These developments require Continuous Professional Development to maintain competency in evolving technological environments.

Best Practices for Canadian CPAs

Successful investment accounting implementation requires adherence to established best practices that ensure accuracy, compliance, and professional competence.

Documentation and Internal Controls

Comprehensive documentation remains fundamental to reliable investment accounting. Canadian practitioners must maintain detailed records of investment decisions, valuation methodologies, and supporting calculations that withstand regulatory scrutiny and professional review.

Internal Control Systems should encompass investment authorisation procedures, independent valuation verification, and regular reconciliation between accounting records and external statements. These controls become particularly critical when dealing with complex instruments requiring fair value measurement.

Professional Judgment and Estimates

Investment accounting demands significant professional judgment, particularly in fair value measurements and impairment assessments. Canadian CPAs must document their reasoning and maintain consistency in methodological approaches whilst remaining responsive to changing circumstances.

The profession’s emphasis on ethical behavior and professional competence becomes particularly relevant in investment accounting, where estimation uncertainty and judgment calls directly impact financial statement users’ decision-making processes.

Future Outlook and Emerging Considerations

As we progress through 2025, several trends will continue shaping investment accounting practice. Enhanced ESG reporting requirements will demand new measurement and disclosure approaches, whilst cryptocurrency and digital assets require ongoing methodological development.

The integration of artificial intelligence and machine learning into investment accounting processes presents both opportunities and challenges. Whilst technology can enhance accuracy and efficiency, it also requires professional oversight and continuous competency development to ensure appropriate application.

Canadian practitioners must remain vigilant regarding international developments, particularly as global accounting standards continue to converge.

The ongoing evolution of fair value measurement guidance and equity method refinements will require continuous professional development and adaptation.

Conclusion

Investment accounting methods represent a critical competency area for Canadian CPAs and accounting professionals. As investment portfolios become increasingly complex and regulatory requirements continue evolving, mastery of the cost method, fair value method of accounting for investments, and equity method accounting becomes essential for providing value-added services to clients.

For Canadian accounting professionals seeking to enhance their investment accounting capabilities, partnering with specialised service providers can provide valuable support while developing internal expertise. The combination of technical knowledge, practical experience, and ongoing professional development creates the foundation for excellence in this critical practice area.