A Complete Guide on Real Estate Accounting for 2025

The Canadian real estate industry continues its remarkable growth trajectory, with the market reaching $183.8 billion in 2024 and projected to expand at a compound annual growth rate (CAGR) of 2.6% through 2033.

As this sector evolves, the complexity of financial management intensifies exponentially, making real estate accounting and bookkeeping more critical than ever for Canadian professionals.

This comprehensive guide explores essential accounting practices, regulatory requirements, and emerging trends that will define success in 2025.

Key Takeaways

- Track real estate finances: sales, rentals, expenses, valuations.

- New trust reporting rules (2023) reshape compliance.

- Property management software market → $7.1B by 2033 (8.5% CAGR).

- AI cuts 30% manual tasks, saving 40+ hours yearly per client.

- Separate finances + monthly reviews = accurate, compliant records.

Understanding Real Estate Accounting Fundamentals

Real estate accounting and bookkeeping represents a specialised financial framework designed to address the unique complexities inherent in property-based businesses. Unlike conventional accounting practices, it must accommodate fluctuating asset values, diverse income streams, and intricate tax regulations that standard bookkeeping systems cannot adequately manage.

For Canadian real estate professionals, this expertise becomes increasingly vital given the market’s substantial expansion. The property management sector alone is expected to grow from $26.49 billion in 2024 to $42.78 billion by 2030, creating significant opportunities for those equipped with robust financial management systems.

Core Components of Real Estate Accounting

Income Management: This involves systematically tracking all revenue sources, including rental payments, commission income, lease fees, and ancillary revenue streams.

Expense Tracking: Real estate businesses face diverse costs beyond initial property acquisition, encompassing maintenance, utilities, insurance, Professional accounting services, and property management fees.

Asset Valuation: Properties represent substantial assets requiring ongoing valuation assessments that reflect market conditions, improvement investments, depreciation schedules, and fluctuations that impact overall financial position.

Liability Management: This encompasses mortgages, property taxes, maintenance contracts, insurance obligations, and other financial commitments that significantly affect cash flow patterns and strategic planning decisions across property portfolios.

Canadian Regulatory Landscape and Enhanced Compliance Requirements

The regulatory environment for real estate trust accounting has undergone transformative changes, particularly with Canada’s enhanced trust reporting requirements effective for tax years ending after December 30, 2023.

Provincial Compliance Standards and Requirements

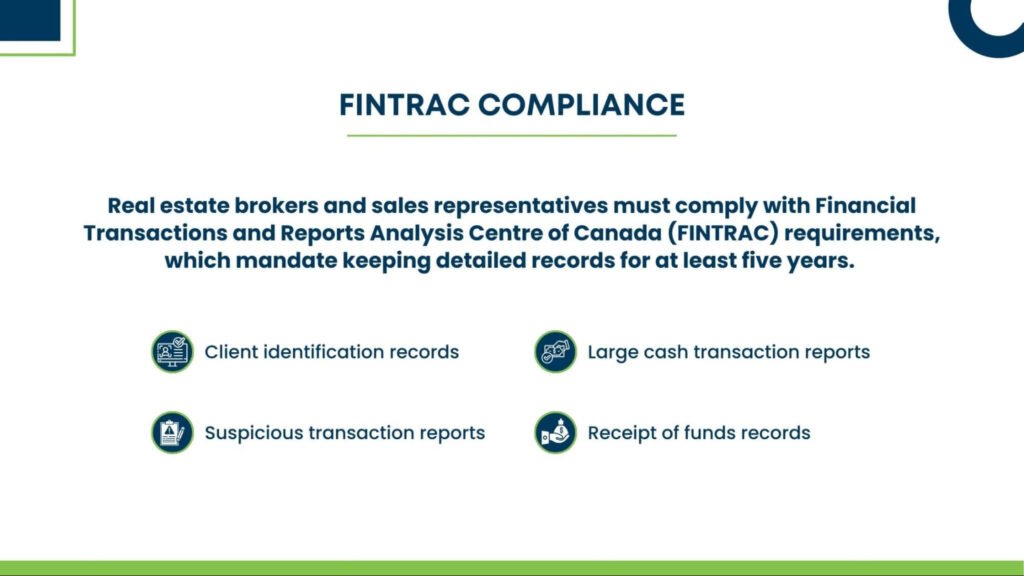

Canadian provinces maintain specific requirements for real estate professionals that vary by jurisdiction. In Ontario, real estate brokers must maintain detailed trust account records and comply with stringent financial reporting standards, making accounting for real estate agents a critical part of meeting regulatory obligations.

Essential Accounting Practices for Real Estate Professionals

Real Estate Bookkeeping Best Practices and Implementation

Effective real estate bookkeeping forms the cornerstone of successful financial management, requiring systematic approaches to record daily transactions while maintaining accuracy and regulatory compliance.

Separate Business and Personal Finances: Establishing dedicated business banking relationships prevents commingling of personal and professional funds, significantly simplifying record-keeping and ensuring accurate financial reporting.

Implement Comprehensive Reporting Procedures: Utilising reliable accounting systems enables real estate professionals to generate essential reports, including profit and loss statements, cash flow analyses, balance sheets, and specialised tax documents.

Conduct Regular Financial Reviews: Monthly financial assessments help identify emerging trends, detect discrepancies early, and support informed strategic decision-making.

Advanced Property Management Accounting Strategies

For professionals managing rental property accounting operations, specific strategies enhance financial control and maximise profitability across property portfolios:

Automated Rent Collection Systems: Implementing sophisticated online rent collection platforms with integrated tracking capabilities helps maintain consistent cash flow while reducing administrative burden.

Strategic Maintenance and Expense Management: Proper categorisation of maintenance expenses proves crucial for maximising available tax deductions.

Professional Security Deposit Administration: Proper handling of security deposits requires separate accounting treatment and strict compliance with provincial regulations regarding interest calculations, return procedures, and tenant rights protection.

Commercial Real Estate Accounting: Specialised Considerations

Commercial properties present unique accounting challenges requiring specialised expertise and sophisticated approaches:

Complex Lease Accounting Compliance: Commercial leases frequently involve intricate terms including percentage rents, tenant improvement allowances, escalation clauses, and shared expense arrangements that demand careful tracking and transparent reporting.

Comprehensive Operating Expense Reconciliation: Commercial properties typically involve detailed expense-sharing arrangements with tenants necessitating precise reconciliation processes, transparent reporting methodologies, and clear communication protocols.

Strategic Capital Expenditure Management: Distinguishing between operating expenses and capital improvements remains crucial for proper tax treatment, accurate financial reporting, and strategic investment planning across commercial portfolios.

Technology Revolution and Innovation in Real Estate Accounting

The property management accounting software market demonstrates an exceptional growth trajectory, with projections indicating dramatic expansion from $3.5 billion in 2024 to $7.1 billion by 2033.

Artificial Intelligence and Automation Integration

The integration of artificial intelligence represents a paradigm shift in real estate financial management.

Key AI-driven improvements include:

Automated Transaction Processing: AI systems can analyse bank and credit card transactions, automatically categorising them to correct properties and appropriate expense categories.

Predictive Analytics and Forecasting: Machine learning algorithms analyse historical data, market trends, and seasonal patterns to forecast cash flows, predict maintenance requirements, and optimise pricing strategies.

Enhanced Accuracy and Error Reduction: AI-powered systems significantly reduce errors common in manual bookkeeping processes while providing real-time financial intelligence for superior decision-making capabilities.

Strategic Financial Planning and Performance Analysis

Advanced Cash Flow Management Techniques

Effective cash flow management represents the cornerstone of real estate business success, involving sophisticated forecasting methodologies, seasonal variation management, and strategic reserve planning for unexpected costs and opportunities.

Predictive Forecasting Models: Utilising historical data, market analysis, and AI-powered algorithms to project future cash flows enables real estate professionals to make informed investment decisions, avoid potential shortfalls, and capitalise on emerging opportunities.

Strategic Reserve Management: Maintaining appropriate reserves for maintenance, vacancy periods, capital improvements, and market downturns ensures business continuity and supports long-term asset preservation strategies.

Essential Performance Metrics and KPI Analysis

Comprehensive key performance indicators (KPIs) specific to real estate operations provide invaluable insights for strategic decision-making and portfolio optimisation:

Occupancy Rate Optimisation: Tracking occupancy percentages across properties identifies high-performing assets and areas requiring strategic attention. Industry benchmarks typically range from 85-95%, with top-tier properties achieving rates above 95%.

Net Operating Income (NOI) Analysis: This fundamental metric measures property profitability after operating expenses but before debt service and taxes.

Operating Expense Ratio Management: This critical ratio compares operational costs to rental income, with industry best practices targeting ratios below 80% for optimal profitability.

Capitalisation Rate Assessment: This metric evaluates potential returns by dividing Net Operating Income by current market value, enabling comparison of different investment opportunities.

Tenant Retention Rate Monitoring: High retention rates indicate effective management and reduce costly turnover expenses while maintaining stable income streams.

Tax Optimisation and Strategic Planning

Understanding available deductions and strategic timing significantly impacts profitability and long-term wealth building:

Depreciation Strategy Implementation: Properly calculating and claiming depreciation on properties and equipment maximises tax advantages while ensuring compliance with Canada Revenue Agency requirements and regulations.

Business Expense Maximisation: Leveraging deductions for legitimate business expenses, including travel, marketing, continuing education, and PROFESSIONAL DEVELOPMENT services, reduces overall tax liability and supports business growth.

Strategic Income and Expense Timing: Coordinating income recognition and expense timing optimises tax positions across multiple tax years while maintaining compliance with accounting principles.

Conclusion: Positioning for 2025 Success

Real estate accounting in 2025 demands sophisticated approaches that address complex regulatory requirements, leverage advanced technology solutions, and support strategic business objectives through comprehensive financial management.

Success requires unwavering commitment to best practices, continuous education, and professional support systems.

By implementing robust accounting frameworks and partnering with experienced real estate Accounting and Bookkeeping providers.