In 2025, with compliance requirements growing more complex, errors risking hefty penalties, and employee satisfaction increasingly tied to payroll accuracy, choosing the best payroll service for small businesses is more critical than ever. The right solution should combine technology, expertise, and scalability.

Whether you opt for an in-house online payroll service or partner with payroll outsourcing companies, understanding your unique needs and evaluating key features will ensure you make an investment that supports growth, simplifies HR workflows, and protects your practice from unnecessary risk.

Key Takeaways

- Prioritise compliance features and automated tax updates to avoid penalties

- Compare pricing models: per-employee vs flat-fee to match your budget

- Assess integration with accounting and HR software for streamlined workflows

- Evaluate in-house online payroll services versus full payroll outsourcing companies

- Look for scalable solutions that grow with your small company’s payroll services needs

The Ultimate Guide to Choosing the Best Payroll Service for Small Businesses

1. Why Choosing the Right Payroll Service Matters

Selecting the best payroll service for a small business impacts accuracy, compliance, and cost efficiency. Mistakes in payroll calculations or tax filings can incur significant fines from CRA, while manual processes consume valuable staff hours.

A well-chosen payroll platform not only automates gross-to-net calculations, statutory remittances, and T4A filings but also integrates seamlessly with your general ledger and HR and payroll management software, reducing data entry errors and freeing up your team to focus on advisory services.

According to Forbes Advisor, businesses that adopt cloud-based payroll solutions report a 33% reduction in payroll processing time. ADP’s small-business payroll service claims 99.9% tax-filing accuracy and automatic CRA updates, boosting compliance confidence.

2. Key Features to Look For

When evaluating payroll services for business, consider these critical capabilities:

- Automated Tax Calculations and Filings

Ensure regular updates for provincial and federal rates. - Direct Deposit and Employee Self-Service

Employee portals reduce HR inquiries and manual distribution. - Custom Reporting and Analytics

Access payroll cost insights to support budgeting and forecasting. - Integrations with Accounting and HR Systems

Bi-directional data flow streamlines workflows and eliminates duplicate entry. - Scalability and Support

A provider must accommodate growth from 5 to 100+ employees without juggling multiple platforms.

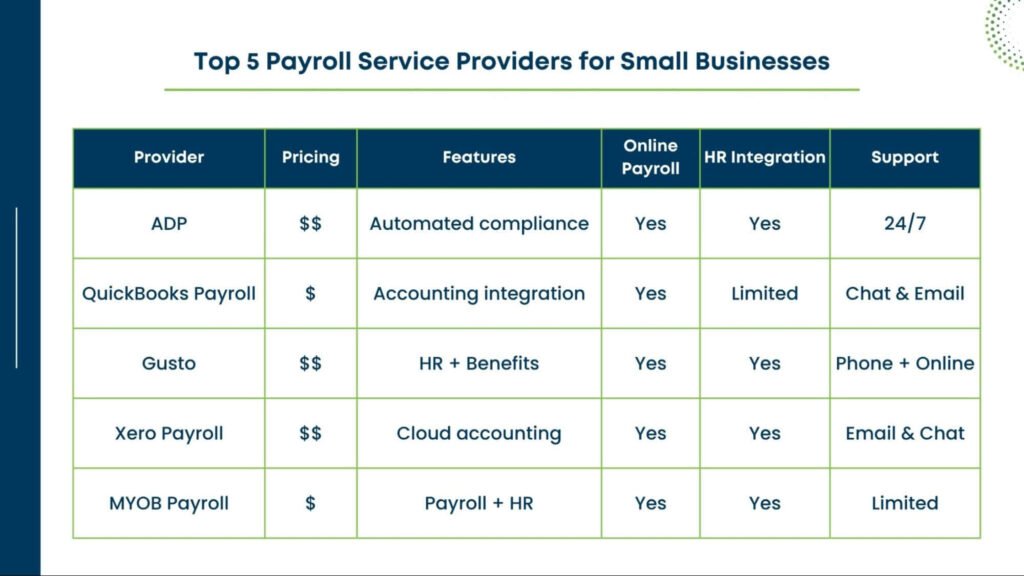

3. Comparing Online Payroll Services

Online payroll services blend affordability with control. Leading solutions include:

- Wave Payroll (flat fee plus per-employee rate)

- QuickBooks Online Payroll (tiered monthly subscriptions with W-2 and T4 support)

- Rise Payroll (Canadian-focused platform with automated remittances)

Wave Payroll customers save up to 40% on monthly fees compared to traditional providers, making it ideal for businesses with under 20 employees.

QuickBooks integration ensures seamless posting to your books, while Rise’s focus on Canadian compliance and bilingual support adds regional advantages.

4. HR and Payroll Management Software Suites

All-in-one platforms combine payroll with HR functions such as time-tracking, benefits administration, and performance management. Examples include:

- BambooHR with integrated payroll

- JazzHR with payroll connectors

- Sage Business Cloud People

These suites deliver unified employee records, reduce administrative overhead, and support strategic HR initiatives. However, they often come at a premium, so small businesses must weigh comprehensive functionality against budget constraints.

5. When to Consider Payroll Outsourcing Companies

Outsourcing your payroll to dedicated payroll service providers shifts responsibility for filings, remittances, and compliance to experts. This option suits firms that:

- Lacks internal payroll expertise

- Seek to free up time for advisory services

- Handle complex payroll scenarios (multi-jurisdictional, commissions, garnishments)

Studies indicate that firms outsourcing payroll reduce compliance errors by 60% and save an average of 15 hours per month on payroll administration. Leading outsourcing companies often bundle benefits like year-end reporting, audit support, and dedicated account management.

6. Cost Models and Budget Planning

Small company payroll services pricing typically falls into these categories:

- Flat monthly fee + per-employee charge

- Tiered subscriptions by feature set

- Fully bespoke outsourcing packages

A flat fee plus per-employee model suits firms with variable headcounts, while tiered subscriptions offer predictable costs up to a certain employee cap.

Outsourcing packages may include additional fees for year-end services or multi-jurisdictional filings. Always request a detailed quote and compare the total cost of ownership over 12 months, factoring in potential CRA penalties for late filings.

7. Navigating Payroll System Migration and Implementation Challenges

Migrating from an existing payroll system to a new payroll service provider presents significant operational challenges that Canadian businesses must carefully navigate. Data migration ranks as the most critical hurdle, with 70% of payroll migration failures stemming from incomplete or inaccurate data transfer.

Organisations must establish parallel processing protocols, running both old and new systems simultaneously for at least two pay cycles to validate calculations and identify discrepancies before full implementation.

The 2025 implementation of CPP2 contributions with dual earning thresholds at $71,300 and $81,200 adds another layer of complexity for migration planning.

Successful migrations require dedicated project teams comprising HR specialists, IT personnel, and accounting professionals working closely with the new provider’s implementation specialists.

8. Implementation and Change Management

Transitioning payroll systems requires careful planning:

- Data Migration: Gather historical payroll data, employee records, and tax information.

- Testing and Parallel Runs: Validate calculations by running payrolls concurrently on old and new systems.

- Staff Training: Ensure your team understands the new workflows and portal features.

- Cutover Planning: Schedule go-live to minimise disruption, ideally at the start of a pay period.

Partnering with a knowledgeable provider or outsourcing company can streamline these steps and reduce implementation risk.

9. Ensuring Security and Compliance

Payroll data is highly sensitive. Verify that your provider offers:

- Data encryption at rest and in transit

- Role-based access controls and audit logs

- ISO 27001 or SOC 2 compliance certifications

- Automatic backups and disaster recovery protocols

Strong security measures safeguard against breaches and ensure you remain compliant with PIPEDA and provincial privacy laws.

10. Customising for Your Practice

As a Canadian CPA or accounting firm, you may require specialised integrations, such as linking payroll data to your tax workflow or time-billing system.

Look for providers offering open APIs or pre-built connectors for platforms like QuickBooks Online, Xero, or NetSuite. Custom reports can tie payroll costs directly to client billing or internal profit centre analytics.

11. Leveraging Expert Support

Beyond software features, evaluate the level of support:

- Dedicated account manager

- On-demand compliance advisory

- 24/7 technical helpdesk

Outsourcing companies often include expert guidance on complex cases, such as CRA audits or administrative tasks.

12. Measuring ROI and Cost Benefits of Payroll Solutions

- ROI calculation methods for payroll software investment

- Time savings metrics (average 260+ hours annually saved)

- Cost reduction analysis (reduced compliance errors by 60%)

- Productivity improvements and error reduction benefits

- Break-even analysis for different business sizes

13. 2025 Payroll Technology Trends and Future-Proofing

- AI and machine learning integration in payroll processing

- Real-time payroll analytics and predictive insights

- Enhanced cybersecurity measures and data protection

- Employee self-service portal evolution

- Cloud-based system benefits and scalability features

- Integration with emerging HR technologies

- Automated compliance and regulatory reporting to ensure accuracy and alignment with changing laws

Conclusion

Selecting the best payroll service for small businesses in 2025 demands careful assessment of features, cost models, compliance safeguards, and scalability.

Whether you choose an online payroll service, a comprehensive HR and payroll management software suite, or full payroll outsourcing companies, aligning the solution with your practice’s growth trajectory and client services approach is paramount.

By prioritising automated tax updates, robust security, seamless integrations, and expert support, you’ll free your team to focus on strategic advisory work, driving both client satisfaction and firm profitability.