The Best Accounting Firm Structure by Revenue Explained

The right accounting firm structure can make the difference between a thriving practice and one that struggles to scale. As Canadian CPAs and accounting professionals navigate an increasingly competitive landscape, understanding how to organise their firm based on revenue levels becomes crucial for sustainable growth.

With the global accounting services market projected to reach $735.94 billion by 2025, structuring your practice effectively isn’t just about organisation; it’s about positioning for success.

Key Takeaways

- Revenue-based structures range from simple 3-role setups for firms under $250K to complex hierarchies for practices over $1 million

- Modern accounting firm organisational structures outperform traditional partnership models by 40-60% in growth metrics

- Practice manager accounting firm roles become critical at the $500K revenue threshold for operational efficiency

- Staff compensation ratios should represent 56-66% of total operating expenses for optimal accounting firm management

- Canadian CPA firms report a median of 6.7% revenue growth with proper organisational alignment

Understanding Accounting Firm Organisational Structure

An effective accounting firm organisational structure serves as the blueprint for how responsibilities, workflows, and decision-making processes are distributed throughout your practice.

Unlike traditional partnership models, where partners handle everything from sales to quality control, modern structures delegate specific functions to specialised roles, creating scalable systems that support growth.

The fundamental difference lies in operational philosophy. Traditional structures often create bottlenecks where partners must review all work, limiting scalability as client loads increase. Modern structures, conversely, implement departmental leadership and clear financial reporting lines that allow firms to grow without overwhelming key personnel.

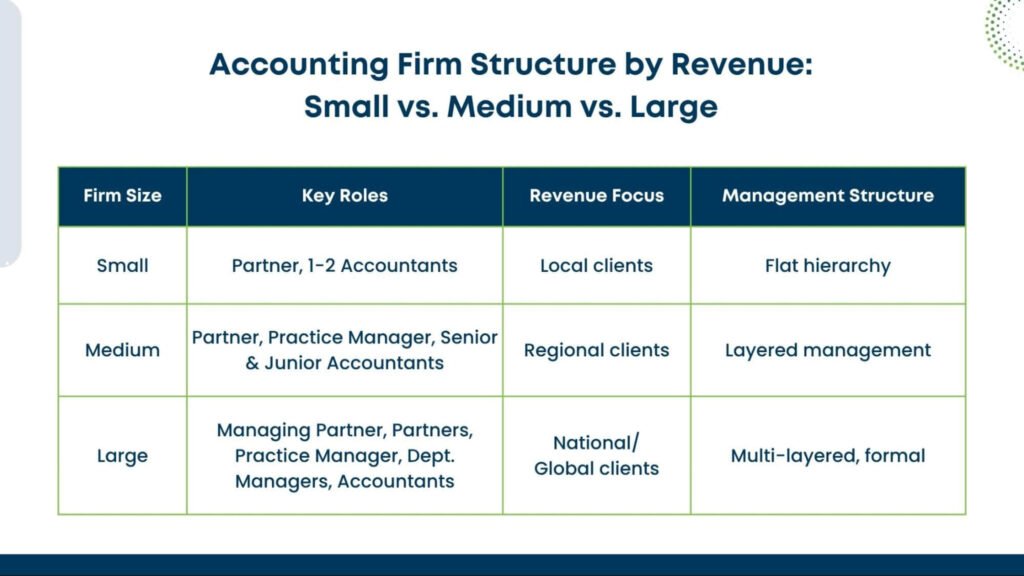

Revenue-Based Structure Models

Firms Up to $250,000 Revenue

At this foundational level, your accounting firm staff structure should focus on three core positions: CEO/Owner, Manager, and Accountant/Bookkeeper. The key insight for this stage is hiring experienced team members early rather than multiple junior staff members.

This approach may initially impact margins, but the autonomy provided by senior team members allows complete task delegation, freeing owners to focus on client acquisition and strategic growth. Solo firms in this category average $62,327 in revenue, while 2-5 employee firms reach $292,292.

Firms Up to $500,000 Revenue

As practices reach the half-million mark, introducing a COO or Operations Manager becomes essential. This practice manager accounting firm role shields owners from day-to-day operations while overseeing staff performance and client service delivery.

The structure expands to include additional Accountants/Bookkeepers under the COO, maintaining the CEO’s focus on strategic direction rather than operational management. Firms in the 6-10 employee range typically generate $741,166 in average revenue.

Firms Up to $1 Million Revenue

Million-dollar practices require multiple management layers, as single managers can only effectively oversee a limited team members. This stage introduces specialised roles such as Head of Tax and Head of Technology, all reporting to the COO rather than the CEO.

The organisational complexity increases to support larger client bases while maintaining service quality. Firms with 11-20 employees average $1,093,330 in revenue, reflecting the revenue potential of proper structural alignment.

Firms Beyond $1 Million Revenue

Seven-figure practices demand sophisticated audit firm organisational structure models with Senior Managers overseeing Managers who direct Accountants, Bookkeepers, and specialised staff. Department heads manage specific business functions—tax, technology, client services, and onboarding—all coordinated through the COO.

Large firms with 20+ employees generate average revenues of $2,871,429, demonstrating the scalability potential of properly structured organisations. These practices often mirror corporate structures with clear hierarchies and specialised departments.

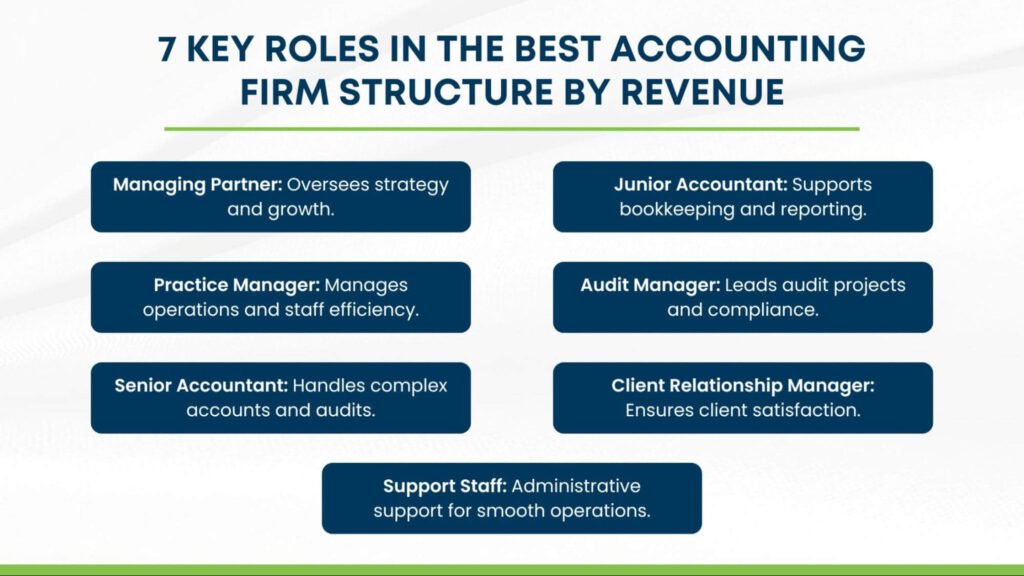

Critical Roles in Modern Accounting Structures

Modern accounting firm growth strategy depends heavily on key positions that traditional partnership models often overlook. The CEO maintains strategic oversight, while the Director of Sales & Marketing removes client acquisition burdens from technical staff.

The Head of People manages talent acquisition and workplace culture, particularly crucial given that 75% of CPAs plan to retire within the next decade. Technology leadership becomes essential as 61% of accountants view AI as an opportunity to enhance their work.

Client Services leadership ensures service quality while allowing technical staff to focus on delivery rather than relationship management. These specialised roles create the foundation for sustainable growth and operational efficiency.

Growth Strategy Implementation

Successful accounting firm management requires aligning structure with growth objectives. Firms implementing modern structures report up to 20% revenue increases within two years compared to traditional models. The key lies in systematic delegation and departmental specialisation.

Advisory services represent the fastest-growing revenue segment, with firms offering Client Advisory Services reporting 17% median revenue growth and projections of 99% growth over three years. Structuring your practice to support advisory capabilities requires dedicated roles for financial analysis, strategic planning, and client consultation.

Technology integration becomes paramount as cloud-enabled firms grow 15% faster than desktop-first practices. Proper structure ensures technology adoption aligns with growth objectives while supporting scalability initiatives.

Canadian Market Considerations

The Canadian accounting services industry generates $12.5 billion in annual operating revenue, with Ontario firms capturing 41.6% of the market share. Canadian CPA firms report strong performance metrics, with a median 6.7% revenue growth and 11.9% increases in net remaining per partner.

Outsourced Accounting Services have become increasingly important as Canadian firms seek to optimise operations while maintaining service quality. The industry’s emphasis on compliance and advisory services creates opportunities for structured practices to capture market share through specialised service delivery.

Compensation structures in Canadian practices show salaries and benefits representing 56% of operating expenses, with total labour costs reaching 66% when all personnel expenses are included. This data informs structural decisions about staffing ratios and role allocation within revenue-based models.

Technology and Automation Integration

Modern accounting practices leverage technology platforms including QuickBooks, Xero, NetSuite, and specialised workflow management systems. The integration of AI and automation tools supports structural efficiency by handling routine tasks while freeing skilled personnel for higher-value activities.

Cloud-based systems enable distributed team management and real-time collaboration, essential for firms implementing modern organisational structures. VIRTUAL CFO SERVICES and remote team coordination become feasible through proper technology integration aligned with structural design.

Practices investing in technology automation report significant capacity increases and improved client service delivery. The key is ensuring technology adoption supports rather than replaces human judgment and professional expertise.

Performance Metrics and Benchmarking

Effective accounting firm structure implementation requires consistent performance measurement. Key metrics include revenue per employee, client retention rates, average engagement values, and service delivery timelines.

Firms achieving optimal structure report client retention rates exceeding 90%, with recurring revenue streams providing predictable cash flow for growth investment. Professional development and talent retention become critical success factors as labour markets tighten.

Benchmarking against industry standards helps identify structural adjustments needed for competitive positioning. Canadian CPA Practice can leverage provincial CPA associations and industry surveys to establish performance targets aligned with structural capabilities.

The accounting profession’s evolution toward advisory services and strategic consulting requires organisational agility supported by proper structure. Firms preparing for this transition must balance compliance capabilities with advisory service delivery, often requiring structural modifications to support both service lines effectively.