In the world of small business finance, few documents are as underappreciated yet as essential as a bookkeeping engagement letter template. Whether you’re an experienced bookkeeper or just starting to build your client base, having a clear, professional agreement in place sets the tone for the entire working relationship.

It’s not just about paperwork. It’s about protecting your business, managing expectations, and building trust, something that matters now more than ever in 2025, where cloud accounting, remote work, and evolving tax standards are the norm.

In this blog, we’ll walk through what a bookkeeping engagement letter template is, why you need one, and what it should include. We’ll also share a downloadable version to help you get started, saving you time while ensuring you tick the right compliance boxes.

What Is a Bookkeeping Engagement Letter?

A bookkeeping engagement letter is a formal agreement between a bookkeeper and their client outlining the scope of work, responsibilities, fee structure, and terms of engagement. It’s not just a nice-to-have, it’s a must-have if you want to avoid misunderstandings and keep things professional.

Many confuse an accounting engagement letter with a simple quote or invoice. But while quotes and invoices describe a transaction, an engagement letter provides a framework for the entire working relationship.

Think of it as a handshake in writing: it clearly sets out what you’re expected to do (and what you’re not expected to do). This matters even more if you’re in a region like Canada where engagement letters are often a regulatory expectation, including compliance with GST/HST reporting. In fact, an engagement letter bookkeeping Canada style will typically include clear language about compliance with CRA guidelines, GST/HST support, and data handling protocols.

Why It Still Matters in 2025

Some bookkeepers may wonder if engagement letters are outdated or unnecessary, especially when working with small, casual clients or friends.

But the truth is, having a bookkeeping engagement letter template protects both parties, even if you’re doing the books for a neighbour’s bakery. And it’s more relevant than ever.

According to CPA Canada’s Business Report, over 58% of small businesses in Canada now outsource at least part of their financial functions, with bookkeeping ranking among the top three most commonly outsourced services. Many of these businesses also explore accounting outsourcing services to efficiently manage more complex financial processes such as tax preparation, payroll, and compliance reporting.

As more entrepreneurs turn to bookkeeping help instead of hiring full-time staff, formalising that support through a written engagement becomes critical.

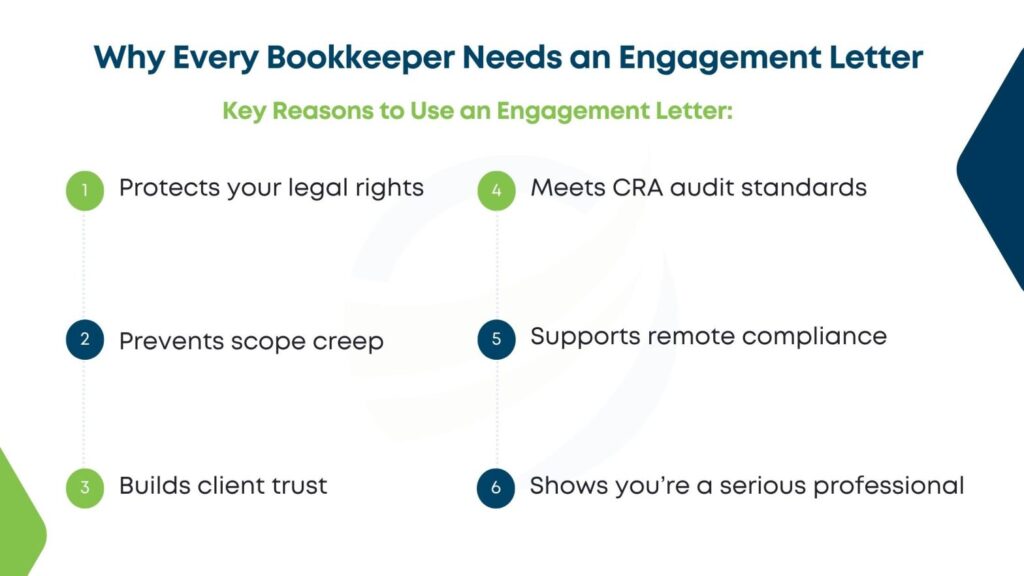

Here’s why this document is still critical in 2025:

- Clarity in deliverables: Clients know exactly what services they’re getting, no scope creep.

- Legal protection: If a dispute arises, you have written evidence of what was agreed.

- Professionalism: It instantly positions you as a serious professional, not a casual freelancer.

- Remote Compliance: With more bookkeeping done online, it helps set expectations around file sharing, communication, and deadlines.

- CRA Alignment: For Canada, an engagement letter helps meet compliance norms.

A CRA report revealed that 22% of audits uncovered issues tied to unclear financial records or undefined responsibilities of third-party providers. A signed bookkeeping engagement letter doesn’t just protect you, it may also help your client if they’re ever audited by offering clear documentation of who was responsible for what.

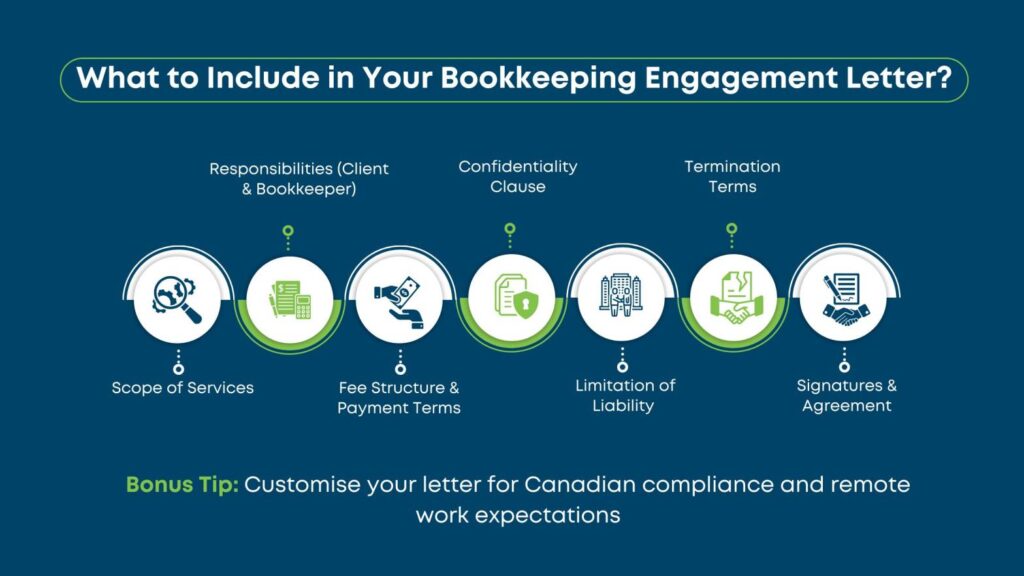

What Should a Bookkeeping Engagement Letter Include?

While every client engagement is different, a solid bookkeeping engagement letter template generally includes these core sections:

1. Scope of Services

Outline exactly what you’re offering. This might include:

- Transaction recording and categorisation

- Bank and credit card reconciliations

- Accounts payable/receivable tracking

- Outsourced payroll support

- Monthly financial reporting

This section can make or break your relationship with the client. Be specific enough to protect yourself but flexible enough to evolve.

2. Client and Bookkeeper Responsibilities

Define who does what. For example:

- The client agrees to provide timely, accurate data.

- The bookkeeper agrees to deliver monthly reports by a certain date.

3. Fee Structure and Payment Terms

Set expectations around how and when you’ll be paid. Will you charge a flat monthly fee or an hourly rate? Are late fees applicable?

4. Confidentiality Clause

You’re handling sensitive data—this clause assures the client you’ll keep their financials private.

5. Limitation of Liability

This protects you from being held liable for mistakes based on inaccurate client data.

6. Termination Terms

Outline how either party can end the engagement usually with written notice.

7. Signatures and Agreement

This final section confirms mutual agreement. Signatures from both parties are key for legal validity.

If you’re also drafting your own accounting engagement letter template, the structure is quite similar but typically covers a broader scope of services such as tax returns, financial statements, and advisory work.

What’s Different in 2025?

The fundamentals of an engagement letter haven’t changed much. But a few factors are increasingly relevant this year:

- Increased use of cloud platforms like Xero, QuickBooks Online, and MYOB mean more digital clauses are being included especially about data sharing and cybersecurity.

- AI-powered tools in bookkeeping may require new disclaimers or transparency on the use of automated tools.

- Regulatory updates in countries like Canada, the UK, and Australia may require engagement letters to reference updated compliance frameworks.

- Remote working norms have reshaped communication timelines, expectations, and service boundaries, something the modern bookkeeping engagement letter template must reflect.

If you’re a job-seeking professional hoping to land your first few freelance clients, you might also consider including a polished accounting bookkeeper cover letter as part of your onboarding documents. It can set a tone of professionalism before you even sign the engagement letter.

When Should You Use One?

The answer is simple: Always.

Even for one-off clients or those you know personally, using a bookkeeping engagement letter template helps draw a line between friendly help and professional responsibility.Even if you’re hiring an outsourced bookkeeper for short-term cleanup or ongoing monthly tasks, an engagement letter makes roles and responsibilities crystal clear. It helps distinguish informal favors from actual professional service agreements, especially when you’re relying on remote bookkeeping help

You should use an engagement letter:

- At the start of every new client relationship

- When the scope of work changes

- When you raise fees or shift service models

- If working with clients across different regions or industries

Benefits of Using a Free Template

Creating an engagement letter from scratch can be intimidating, especially if you’re not familiar with legal writing. That’s where a downloadable bookkeeping engagement letter template comes in handy.

Here’s what a good template should offer:

- Pre-drafted legal language that covers all major clauses

- A professional layout you can personalise

- Flexibility for fixed fee or hourly billing

- Country-specific compliance support (like for engagement letter bookkeeping Canada users)

- Editable format (Word or Google Docs)

Templates help you save time, reduce errors, and maintain consistency across all your client relationships.

Final Thoughts

If you’re serious about growing your bookkeeping business in 2025, or positioning yourself as a reliable finance professional, don’t overlook the power of a strong engagement letter. It creates a foundation for trust, ensures legal clarity, and shows you take your clients and your work seriously.

Whether you’re a seasoned professional or just starting your journey with a few clients through outsource bookkeeping services, having the right systems in place will elevate how you’re perceived. Think of the engagement letter as a natural extension of your professionalism, right up there with clean reports and clear communication.