Important Canada Tax Changes 2025 You Must Know!

Introduction

Tax laws evolve every year, impacting individuals, businesses, and investors across Canada. With canada tax changes 2025 bringing key adjustments to federal tax brackets, pension contributions, savings programs, and trade tariffs, staying informed is essential. Whether you are an employee, investor, or retiree, understanding these tax changes for 2025 can help you plan your finances better and avoid surprises when filing your return.

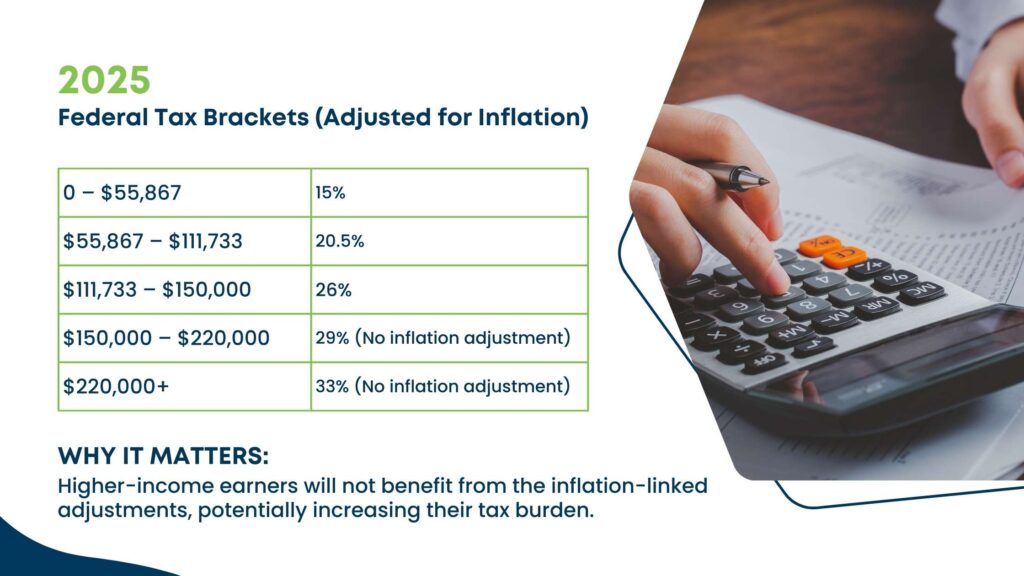

Federal Tax Bracket Adjustments

To account for inflation, Canada has adjusted its federal tax brackets by 2.7% in 2025. However, the $150,000 and $220,000 tax brackets remain unchanged as they are not indexed for inflation. This means that while some taxpayers will see minor tax relief, high-income earners will not benefit from these adjustments.

These income tax changes 2025 Canada impact taxpayers differently based on their income levels. Those earning below $150,000 may see small tax savings due to inflation adjustments. Since high-income earners won’t benefit from inflation-adjusted brackets, consulting outsourced accounting services can help in restructuring income strategies for better tax efficiency.

Canada Pension Plan (CPP) Contribution Changes

The maximum pensionable earnings under the CPP have increased to $71,300 in 2025, up from $68,500 in 2024. As a result:

- Employees must contribute up to $4,034.10, up from $3,867.50 in 2024.

- Self-employed individuals face a higher maximum contribution of $8,068.20, up from $7,735 in 2024.

These changes reflect an effort to provide better retirement security, but they also mean increased payroll deductions for workers and employers. Partnering with an experienced outsourced bookkeeper ensures accurate payroll tracking and compliance with updated CPP contribution rules.

TFSA Contribution Limits

For 2025, the Tax-Free Savings Account (TFSA) annual contribution limit remains at $7,000, unchanged from 2024. This brings the cumulative TFSA contribution room to $102,000 for individuals who have been eligible since the program’s inception and have never contributed. This stability allows Canadians to continue tax-free investing without changes to their annual limits.

Home Buyers’ Plan Expansion

In a move to support first-time homebuyers, the withdrawal limit under the Home Buyers’ Plan (HBP) has increased from $35,000 to $60,000. Additionally, the repayment period for withdrawals made between January 1, 2022, and December 31, 2025, has been extended to start five years after the initial withdrawal. This change aims to ease financial burdens on homebuyers while improving access to homeownership.

Canada Capital Gains Tax Changes

One of the most significant updates from the Financial Post in canada tax changes 2025 is the upcoming modification in the capital gains tax rules. Originally planned for 2024, the proposed increase in the capital gains inclusion rate, from 50% to 66.67%, has been deferred to January 1, 2026.

Key Points:

- Investors and business owners now have additional time to restructure their assets before the new rate takes effect.

- The higher inclusion rate will mean that more of a taxpayer’s capital gains will be subject to taxation.

- This deferral provides an opportunity for individuals planning to sell investments, real estate, or business assets to do so under the lower 50% inclusion rate before 2026.

With the deferral of the capital gains inclusion rate increase, seeking tax advisory services can help investors determine the optimal timing for realising gains.

Mineral Exploration Tax Credit Extension

To promote investment in Canada’s mining sector, the government has extended the mineral exploration tax credit for two additional years. Investors in flow-through shares of smaller mining companies will continue to receive a 15% tax credit, ensuring ongoing support for resource development.

Temporary GST/HST Waiver on Essentials

A proposed temporary suspension of Goods and Services Tax (GST) and Harmonized Sales Tax (HST) on select essential goods aims to provide financial relief amid rising living costs. For details on government disbursements and important gst payment dates, Canadians should monitor official updates closely. For details on government disbursements and important gst payment dates, Canadians should monitor official updates closely. If approved, this exemption will apply between December 14, 2024, and February 15, 2025, covering items such as prepared meals, children’s essentials, and reading materials.

Canada’s Retaliatory Tariffs on U.S. Goods

In response to new U.S. trade measures, Canada will impose 25% tariffs on approximately CAD 155 billion worth of U.S. imports starting March 4, 2025. The first phase targets CAD 30 billion worth of goods immediately, with additional tariffs on CAD 125 billion following in 21 days. These tariffs could lead to higher prices for imported goods and potential trade tensions.

Old Age Security (OAS) Eligibility

The eligibility age for Old Age Security (OAS) remains at 65, ensuring continued financial support for retirees. OAS payouts depend on the number of years an individual has lived in Canada after turning 18, with full benefits available to those who have resided in the country for at least 40 years.

For those who qualify, the maximum monthly OAS payment in 2025 is set at $713.34 for individuals aged 65 to 74 and $784.67 for those 75 and older. OAS benefits are subject to clawbacks if annual income exceeds $90,997, with full repayment required when income surpasses $148,270.

Conclusion

The tax bracket changes 2025 Canada bring adjustments across income brackets, pension contributions, and savings opportunities, while also introducing new trade tariffs and incentives for homebuyers and investors. Staying informed about these updates can help individuals and businesses make proactive financial decisions. To ensure compliance with the latest regulations and maximise tax benefits, many businesses and individuals consider outsourcing tax services to professionals who stay updated with evolving tax laws.