Capital Gains Tax on Inherited Property in Canada: How to Avoid It and Who Pays

Inheriting property in Canada brings both emotional significance and important tax considerations. Whilst Canada doesn’t impose a direct inheritance tax, the capital gains tax on inherited property in Canada can significantly impact your financial planning.

For Canadian CPAs and accountants advising clients on estate planning, staying informed about the latest tax regulations and exemptions is crucial.

Key Takeaways

- Canada has no inheritance tax, but capital gains tax applies to inherited property through deemed disposition rules at fair market value.

- The estate pays capital gains tax first; beneficiaries may owe tax only when selling the property later.

- The capital gains inclusion rate remains at 50% for 2025 after the government cancelled the proposed increase to 66.67%.

- Principal residence exemption, spousal rollovers, and strategic planning can help avoid or defer capital gains tax on inherited property.

- Seeking PROFESSIONAL GUIDANCE from qualified accounting professionals ensures compliance and optimal tax strategies.

Understanding Capital Gains Tax on Inherited Property in Canada

When someone passes away in Canada, the Canada Revenue Agency (CRA) treats all their capital property as if it were sold immediately before death at fair market value. This is called a deemed disposition.

According to the Income Tax Act Section 70(5), this deemed disposition can trigger substantial capital gains taxes, particularly on appreciated assets such as real estate, investment properties, and securities.

Provincial probate fees also apply, varying significantly across Canada. Ontario charges 1.5% on estates exceeding $50,000, whilst British Columbia levies 1.4% on amounts over $50,000. Alberta maintains one of the lowest rates, with a flat fee of $525 for estates exceeding $250,000.

Who Pays Capital Gains on Inherited Property?

Understanding who pays capital gains on inherited property is essential for effective estate planning. The responsibility falls into two distinct phases.

Firstly, the deceased person’s estate must settle all outstanding tax obligations, including capital gains tax triggered by the deemed disposition. The estate executor files a final tax return reporting these capital gains, and the estate pays the tax before distributing assets to beneficiaries.

According to statistics from the CRA, proper estate planning can reduce tax burdens significantly, making professional guidance from financial outsourcing essential for maximising after-tax inheritance.

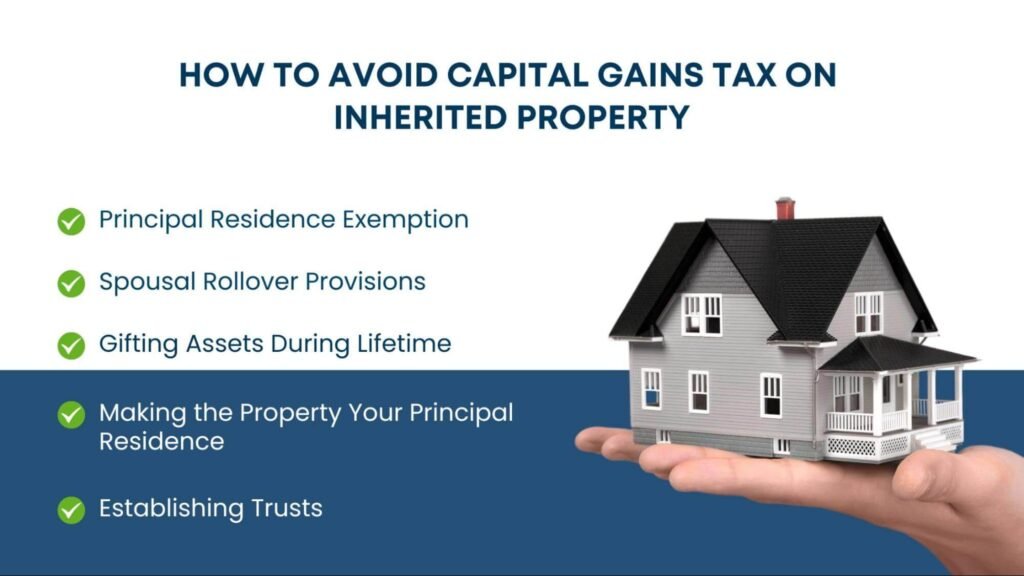

How to Avoid Capital Gains Tax on Inherited Property

Several legitimate strategies exist for minimising or avoiding how to avoid capital gains tax on inherited property. Understanding these options helps preserve family wealth across generations.

Principal Residence Exemption

The principal residence exemption represents the most powerful tool for eliminating capital gains tax. The estate claims this exemption on the deceased’s final tax return by completing Schedule 3 and Form T2091(IND).

Properties qualifying include houses, apartments, cottages, mobile homes, and even houseboats, provided they were ordinarily inhabited by the taxpayer, spouse, or child during the year.

Spousal Rollover Provisions

Transferring property to a surviving spouse or common-law partner who is resident in Canada allows for tax-deferred treatment under Section 70(6) of the Income Tax Act.

This automatic rollover can be elected out of if circumstances warrant triggering an immediate capital gain, such as when the deceased has unused capital losses to offset the taxable gains. Estate planning specialists can help determine the optimal approach based on individual circumstances.

Gifting Assets During Lifetime

Canada has no gift tax, allowing property transfers during one’s lifetime. However, deemed disposition rules still apply, triggering capital gains at the time of transfer based on fair market value. Strategic gifting, combined with the principal residence exemption or when capital losses are available, can minimise tax impact.

Making the Property Your Principal Residence

If you inherit a property and designate it as your principal residence for at least two years before selling, you may qualify for a partial or full exemption from capital gains tax. This strategy works particularly well for beneficiaries who can relocate to the inherited property.

Establishing Trusts

Testamentary trusts and family trusts offer sophisticated planning opportunities for high-net-worth estates. Trusts can multiply access to the Lifetime Capital Gains Exemption (LCGE), which increased to $1.25 million effective June 25, 2024, for qualified small business corporation shares and farming and fishing property.

Inheritance Tax Canada: What You Need to Know

Whilst Canada doesn’t impose an inheritance tax in the traditional sense, the deemed disposition rules create similar tax consequences. Unlike countries with direct inheritance or estate taxes, Canadian beneficiaries receive inheritances tax-free, but the estate must settle all tax obligations first.

This system distinguishes Canada from the United States, where estate taxes can reach 40% on estates exceeding $13.99 million USD. The Canadian approach focuses taxation at death through deemed disposition rather than taxing the transfer to heirs.

According to recent data, proper planning with qualified accounting outsourcing firms can reduce estate tax burdens by 30-50% through strategic use of exemptions, rollovers, and timing considerations. Corporate tax outsourcing and Individual tax services are essential for navigating these complex rules.

Capital Gain Tax Canada: Current Rates and Rules 2025

The capital gain tax Canadian landscape experienced significant changes and reversals in 2025. Originally, the 2024 federal budget proposed increasing the capital gains inclusion rate from 50% to 66.67% for individuals on gains exceeding $250,000 annually, effective June 25, 2024.

However, on January 31, 2025, the government deferred this increase to January 1, 2026. Subsequently, on March 21, 2025, Prime Minister Mark Carney announced the cancellation of the proposed increase entirely.

The maximum combined federal and provincial capital gains tax rates vary by province, ranging from approximately 23.5% in the Northwest Territories to 27.4% in Newfoundland and Labrador. These rates apply to the taxable portion (50%) of capital gains.

The government maintained the increased Lifetime Capital Gains Exemption of $1.25 million for qualifying small business shares and farming and fishing property, effective June 25, 2024. This exemption provides significant tax relief for entrepreneurs and farmers passing businesses to the next generation.

Conclusion

Understanding capital gains tax on inherited property in Canada requires careful attention to deemed disposition rules, exemptions, and strategic planning opportunities. Whilst Canada doesn’t impose a direct inheritance tax, the tax consequences at death can substantially reduce estate value without proper planning.

The complexity of capital gain tax Canada rules, combined with provincial variations in probate fees and tax rates, underscores the value of professional accounting services.

Whether you’re inheriting property, planning your estate, or advising clients, partnering with experienced professionals who understand both federal and provincial requirements is essential. Contact us to develop a comprehensive strategy customised to your specific circumstances and financial goals.