Get actionable 2025 accountancy practice management tips and proven advice for accountants looking to enhance operations, client service, and growth.

Continue readingWhy Small Businesses Outsource Accounting Services?

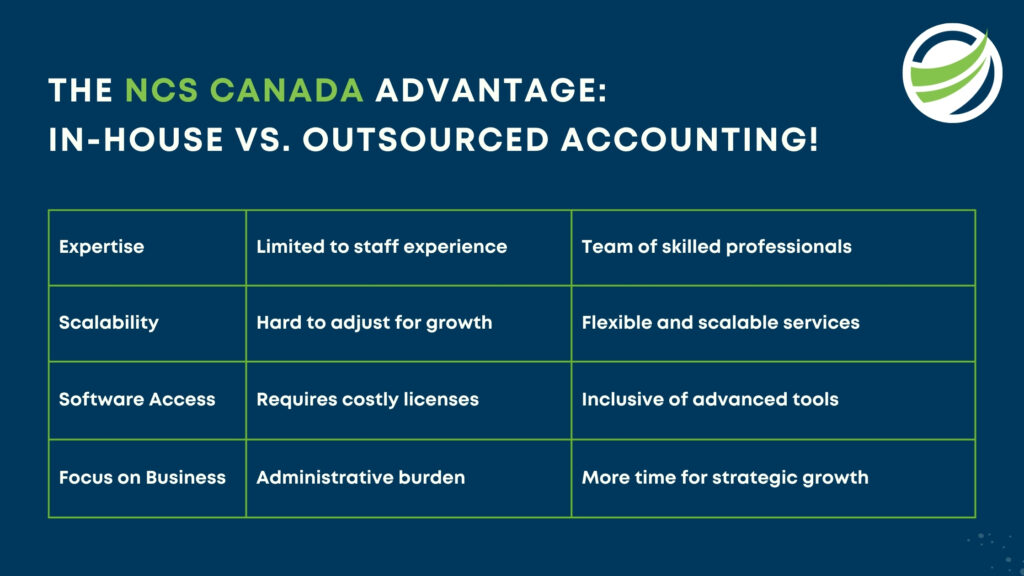

Know why more small businesses outsource accounting services in Canada in 2025. Save time, reduce costs, and focus on growth with expert support.

Continue readingGet the Bookkeeping Engagement Letter Template

Download a 2025 ready bookkeeping engagement letter template for Canada. Set clear terms, outline services, and protect your bookkeeping firm legally.

Continue readingBuying or Selling an Accountancy Practice: What to Know

With the accounting industry on a steady growth path, now is a strategic time to consider a sale or acquisition. Buyers gain instant scale and recurring revenue, while sellers can unlock value especially if the practice has strong client retention, digital systems, and stable profits. Key to success: accurate valuation, due diligence, and a smooth transition for clients and staff.

Continue readingHow to Get Bookkeeping Clients in Canada for 2025

In 2025, getting bookkeeping clients in Canada requires more than word-of-mouth or outdated referral tactics. With SMEs embracing digital tools and demanding flexible, virtual support, bookkeepers must adopt a multi-channel strategy that speaks directly to niche industries from tech startups to dental clinics. By defining your ideal client, optimizing your online presence, and leveraging targeted SEO, you can position your services where modern Canadian businesses are already looking.

Continue readingAccounting Challenges? How Outsourcing Bookkeeping Can Simplify Your Life

Revolutionizing Workflow Efficiency with Xero: NCS Global Success

NCS Global, a key player in outsourced services, identified the pressing demand to boost its workflow efficiency to maintain a competitive edge in the industry. NCS Global opted for Xero software, a top-notch solution tailored to enhance accounting and bookkeeping procedures…

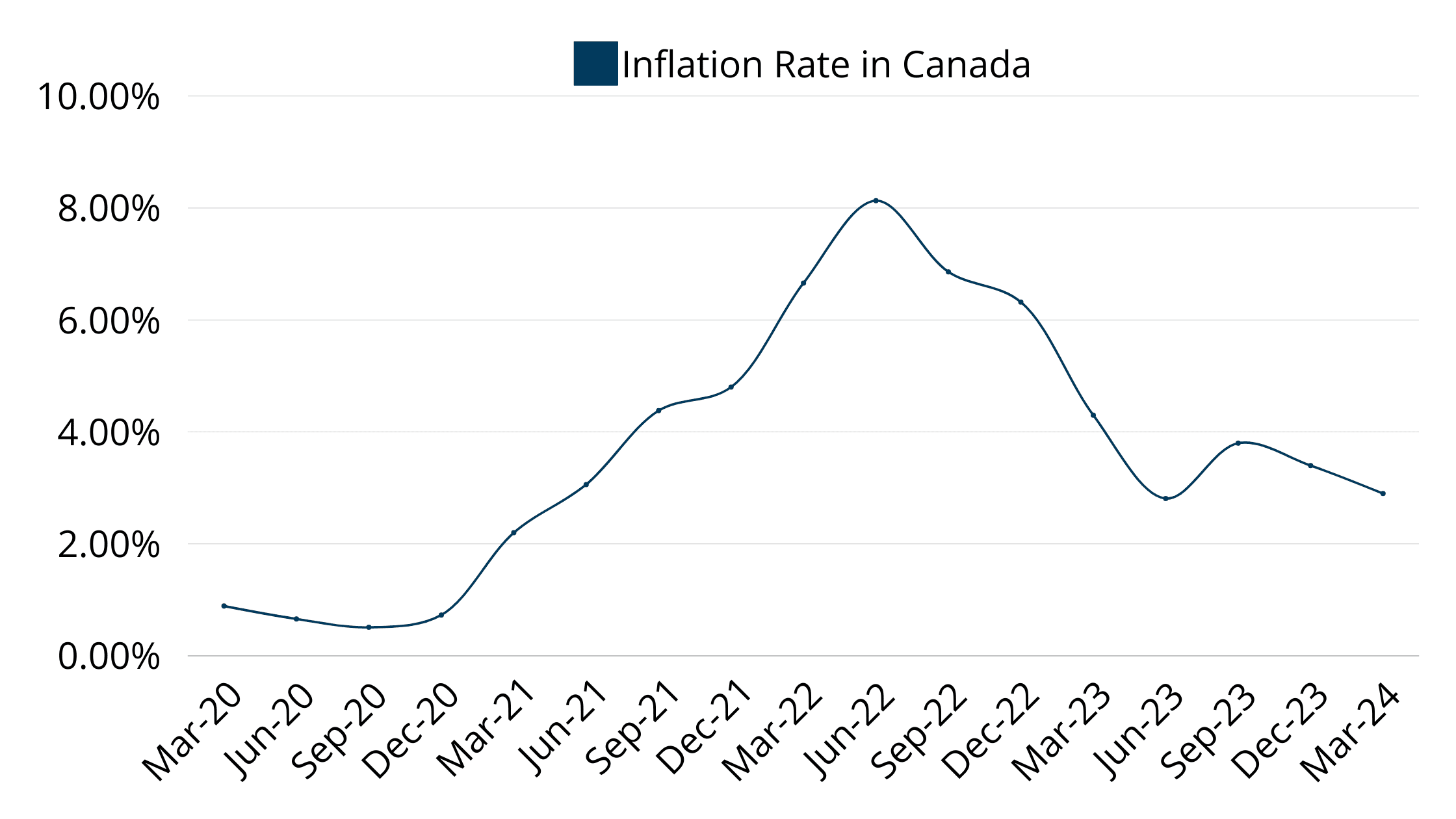

Continue readingNavigating Inflation: A Guide for Canadian CPAs

Thank you for your support and enthusiasm for the previous article on what’s new and different in the t1 income tax return. Now we’re back with another hot topic: what new changes have been made to a corporation’s tax return.

Continue readingFive Cyber Security issues that private Businesses should address now

Everybody is striving to stay up with the times in this digital age, and as we go into the new internet era, huge MNCs have their own firewalls and security measures that small and medium-sized business owners cannot afford.

Continue reading5 Ways to Keep Your Team Motivated

Maintaining the smooth and efficient operation of your finance and accounting departments, even during peak seasons, is a common challenge for businesses.

Accounting departments are often lean units in many companies, with members subjected to constant stress and tight deadlines, and meeting deadlines requires team bonding and effective team management.