Learn how to maximize tax return in Canada for 2024. Discover key deductions, credits, and tax breaks that can boost your refund and lower your bill.

Continue readingCanada Carbon Rebate Guide for Small Businesses in 2025

The canada carbon rebate for small businesses in 2025 returns a portion of federal fuel charges to eligible employers. See if your business qualifies.

Continue readingUnderstanding the USA Estate Tax for Canadians in 2025

US estate tax for Canadians applies to U.S. situs assets over $60,000. Know 2025 limits, exemption, credits, and how to file under the Canada U.S. tax treaty.

Continue readingBare Trusts in Canada For 2025: Agreement & Tax Implications

Understand bare trusts in Canada for 2025, including agreement essentials and tax implications under CRA’s updated T3 reporting and exemption rules.

Continue readingWhen Is Canada Business Tax Filing Deadline in 2025? T2 Filing

Wondering about Canada business tax filing deadline 2025? T2 filing is due June 30 for most corporations, but exceptions apply! Find out more with NCS Canada.

Continue readingCanada Inheritance Tax and Cross Border Tax Rules in 2025

Navigate Canada inheritance tax and cross border rules for 2025. NCS Canada explains inheritance, capital gains, foreign property, & tax-saving strategies

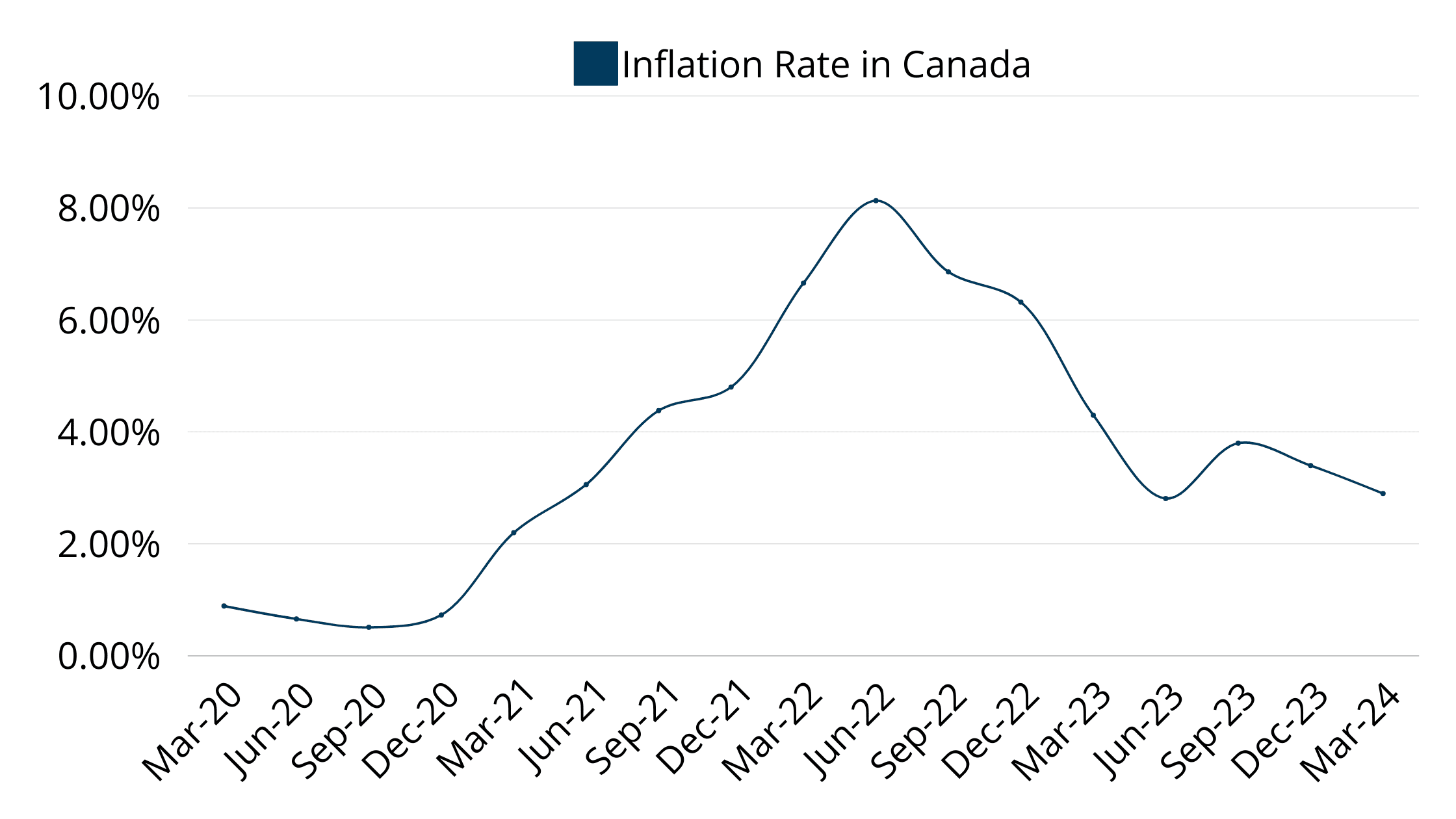

Continue readingNavigating Inflation: A Guide for Canadian CPAs

Thank you for your support and enthusiasm for the previous article on what’s new and different in the t1 income tax return. Now we’re back with another hot topic: what new changes have been made to a corporation’s tax return.

Continue readingFive Cyber Security issues that private Businesses should address now

Everybody is striving to stay up with the times in this digital age, and as we go into the new internet era, huge MNCs have their own firewalls and security measures that small and medium-sized business owners cannot afford.

Continue reading5 Ways to Keep Your Team Motivated

Maintaining the smooth and efficient operation of your finance and accounting departments, even during peak seasons, is a common challenge for businesses.

Accounting departments are often lean units in many companies, with members subjected to constant stress and tight deadlines, and meeting deadlines requires team bonding and effective team management.

How To Start Accounting Firm In Ontario?

To start any business, you need a license or registration from an authorized department. Starting and maintaining a business can be difficult. Here we get acquainted with 3 types of company registries, the process of its registration, and how to obtain a license.

Continue reading