Whether you’re running a small business or overseeing a growing enterprise, one thing remains constant: the need for accurate bookkeeping. Bookkeeping is a critical business function, ensuring that financial records are kept up to date, tax filings are accurate, and strategic decisions are based on reliable data. But when it comes to managing bookkeeping, there’s a common dilemma: should you handle it in-house, or should you outsource bookkeeping services to a specialised firm?

In this blog, we’ll explore the pros and cons of both options—in-house bookkeeping vs outsourcing—and help you decide which one is the best fit for your company.

Bookkeeping Basics: Why It’s Crucial for Your Business

Bookkeeping is the backbone of a business’s financial health. It involves recording, classifying, and interpreting financial transactions such as sales, expenses, and taxes. Without accurate records, businesses are vulnerable to financial errors that could lead to legal issues, tax penalties, and missed opportunities. While it might seem tedious or even unnecessary at times, bookkeeping is far from a “necessary evil”—it’s an indispensable part of running a successful business.

How Accurate Financial Data Drives Business Success

Accurate financial data is vital for making informed decisions. Whether you’re analysing profitability, assessing cash flow, or preparing for investment opportunities, precise records allow for insights that can drive your business forward. Inconsistent or inaccurate bookkeeping could cause significant issues, from lost tax deductions to poor business strategy. It’s critical to understand the value of accurate financial records in building a sustainable business.

In-House Bookkeeping: Pros and Considerations

When you opt for in-house bookkeeping, you hire a dedicated team or individual to manage all the bookkeeping tasks within your company. One major advantage is that your bookkeeping team is directly involved with your business operations. They can build a deeper understanding of your specific needs and maintain close communication with other departments.

However, there are some considerations to weigh:

- Increased overhead costs:

Hiring and maintaining an in-house team can be expensive, especially when factoring in salaries, benefits, office space, and training costs. - Time commitment:

Managing an in-house team requires oversight and training, diverting your focus from core business activities. - Risk of inexperience:

Unless you hire experienced professionals, you might find that in-house teams are not equipped to handle complex financial tasks, leading to errors.

Outsourcing Bookkeeping: The Advantages of a Professional Approach

Outsourcing bookkeeping services brings a host of advantages, especially for small businesses and startups that might not have the resources to maintain an in-house team. Among the advantages of outsourcing bookkeeping services is access to expert financial insights and reduced financial risks while ensuring compliance with industry standards.

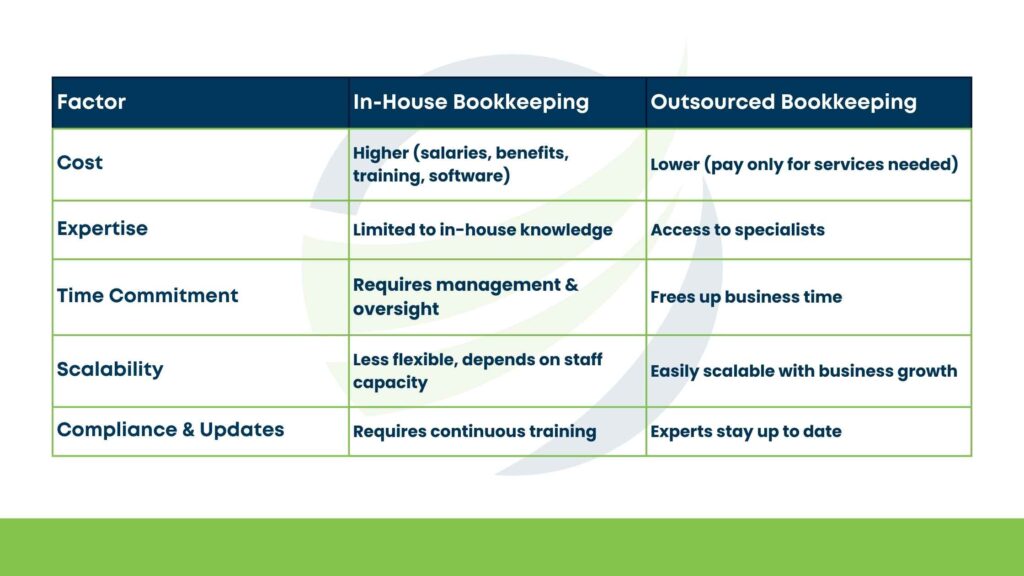

Cost Savings: Is Outsourcing More Affordable?

Outsourcing bookkeeping can provide substantial cost savings. With in-house teams, you have to cover salaries, benefits, training, and software costs. On the other hand, outsourcing bookkeeping services typically charge only for the services you need, making it easier to control your budget. This is especially beneficial for small businesses looking to reduce overhead without compromising on quality.

Expertise and Specialisation: Tapping Into a Wealth of Knowledge

When you outsource bookkeeping, you gain access to a team of professionals with specialised expertise. Outsourcing bookkeeping services allows you to tap into a pool of experts who stay updated on tax laws, regulatory requirements, and financial best practices. This is especially important for businesses that need advanced support but don’t have the resources for an in-house team of specialists.

Focusing on Core Business Activities: Efficiency Through Outsourcing

By outsourcing bookkeeping, you free up valuable time and resources that can be redirected toward growing your business. Instead of spending time managing finances, you can focus on product development, customer service, and other core activities that drive revenue. Outsourcing bookkeeping services allows you to scale more efficiently without getting bogged down by administrative tasks.

Selecting the Right Outsourcing Partner: Key Considerations

Choosing the right outsourcing partner is crucial. Whether you are looking for an outsource bookkeeper or a team that specialises in outsourcing bookkeeping services, it’s important to do your research. Consider factors such as the provider’s experience, reputation, and service offerings. Ensure that they understand your industry’s specific needs and regulatory environment. A strong partnership with a reliable outsourcing provider can help streamline your financial operations.

Cost Analysis: Comparing In-House vs Outsourced Bookkeeping

While outsourcing offers many benefits, it’s important to consider the disadvantages of outsourcing financial record keeping as well. Businesses may face challenges such as reduced control over financial data, potential miscommunications, and concerns over data security. Evaluating both the benefits and risks will help in making an informed decision.

A detailed cost analysis can help you compare in-house vs outsourced bookkeeping options. While it’s tempting to assume that outsourcing is always cheaper, the real savings come from understanding how much time, effort, and expertise goes into each option. With in-house bookkeeping, you must account for hiring costs, software, and training. By contrast, outsourcing provides predictable costs, often with less risk of financial mismanagement.

Company Size and Complexity: What’s Right for Your Business?

The choice between in-house bookkeeping vs outsourcing also depends on the size and complexity of your business. Smaller companies with straightforward financial needs may benefit from outsourcing bookkeeping services, while larger companies with complex accounting demands may require an in-house team. Assess the complexity of your finances to determine which option best fits your business.

Ensuring Regulatory Compliance: Outsourcing as a Compliance Solution

Regulatory compliance is a crucial factor to consider when choosing between in-house and outsourced bookkeeping. Outsourced bookkeeping services are well-versed in local tax regulations and compliance requirements. They can help ensure that your company remains compliant with tax laws, financial reporting standards, and other legal requirements. This is particularly important for businesses that operate in multiple states or countries, where tax regulations can vary widely.

Making the Right Decision: In-House vs Outsourcing for Your Business

Deciding whether to outsource bookkeeping for small business or maintain an in-house team is not a one-size-fits-all decision. It’s essential to consider your company’s financial situation, growth stage, and long-term goals. If your business is still in its infancy, outsourcing bookkeeping may offer the flexibility and cost-effectiveness you need. However, as your company grows and your financial needs become more complex, an in-house team may be a better fit.

Ultimately, the decision comes down to finding the right balance between cost, expertise, and operational efficiency. In-house bookkeeping vs outsourcing is not a simple comparison—both options have their strengths and challenges. By carefully evaluating your needs, budget, and future goals, you can make an informed choice that sets your business up for success.

FAQs

1. What is the difference between in-house bookkeeping and outsourcing?

In-house bookkeeping involves hiring an internal team to manage financial records, while outsourcing means hiring external professionals to handle bookkeeping tasks remotely. Each option has pros and cons, depending on your business size, budget, and complexity.

2. What are the advantages of outsourcing bookkeeping services?

Outsourcing bookkeeping services offers cost savings, access to financial experts, and improved efficiency. It reduces administrative burdens, ensures compliance with regulations, and allows businesses to focus on growth without the hassle of managing an internal bookkeeping team.

3. What are the disadvantages of outsourcing financial record keeping?

Some disadvantages of outsourcing financial record keeping include reduced control over financial processes, potential communication barriers, and data security concerns. Choosing a reliable service provider with strong security measures can help mitigate these risks.

4. How do I decide if my business needs in-house bookkeeping vs outsourcing?

Consider factors such as your budget, business complexity, and financial reporting needs. Small businesses often benefit from outsourcing due to lower costs and expert support, while larger companies with complex financial needs may require an in-house team for better control.

5. Is outsourcing bookkeeping more cost-effective than hiring an in-house team?

In most cases, outsourcing bookkeeping is more cost-effective because you avoid expenses related to salaries, benefits, office space, and software. With outsourcing, you only pay for the services you need, making it a flexible and budget-friendly option.

6. How can I ensure data security when outsourcing bookkeeping?

Choose an outsourcing provider with strict security protocols, such as encrypted data storage, access controls, and compliance with financial regulations. Signing a confidentiality agreement and reviewing their security policies can help protect your financial information.