Canada’s income splitting rules saw a major shift with the expanded Tax on Split Income (TOSI) regime that took effect on January 1, 2019. These reforms significantly impacted small business owners and their families by tightening the ability to use income splitting as a tax minimisation tool.

Once-flexible strategies have now become limited, requiring business owners to adapt both their financial plans and corporate structures to remain compliant. For those navigating these changes, working with experienced Canadian tax professionals can provide valuable clarity and guidance tailored to your unique circumstances.

Navigating the current income splitting rules in Canada demands a deeper understanding of both the TOSI framework and the Canada Revenue Agency income splitting rules. In this article, we’ll explore what has changed, who is affected, and what practical strategies still exist.

For Canadian families and business owners revisiting their tax planning approach, this guide offers the clarity you need to make informed decisions and stay ahead of evolving CRA requirements.

What Is Income Splitting in Canada?

Income splitting is a tax planning strategy in Canada that allows higher-income individuals to shift certain types of income to lower-income family members. This approach helps reduce the overall family tax burden by taking advantage of the country’s progressive tax system, where lower income levels are taxed at lower rates.

There are several methods allowed under the Canada Revenue Agency income splitting rules, though some are restricted by the Tax on Split Income (TOSI) rules. Common income splitting strategies include:

- Pension income splitting (for retirees aged 65+)

- Spousal loans at CRA’s prescribed interest rate

- Hiring family members at fair market wages

- Dividend splitting through private corporations (subject to TOSI rules)

Understanding what is income splitting in Canada and who is eligible for income splitting in Canada is key to ensuring compliance and minimising your tax liability.

Income Splitting Strategy in Canada

When implemented properly, income splitting rules in Canada offer several tax-efficient strategies for families. Two of the most common methods are:

- Spousal Loans: A higher-income spouse lends funds to a lower-income spouse at the CRA’s prescribed interest rate. The borrowed funds are invested, and any net investment income is taxed in the hands of the lower-income spouse at their applicable marginal tax rate. To comply with revenue Canada income splitting rules, interest must be paid annually by January 30.

- Family Trusts: A family trust allows income from investments or business operations to be distributed to various family members. This enables income to be taxed in the hands of lower-income beneficiaries, reducing the household’s overall tax liability.

To use income splitting effectively, strategies must comply with Canada Revenue Agency income splitting rules and avoid triggering the tax on split income (TOSI).

The CRA monitors for abusive arrangements, and non-compliance may lead to penalties or reassessments. While income splitting is a smart way to reduce taxes, it must be carefully structured to stay within legal limits.

How Do Income Splitting Rules in Canada Work Now?

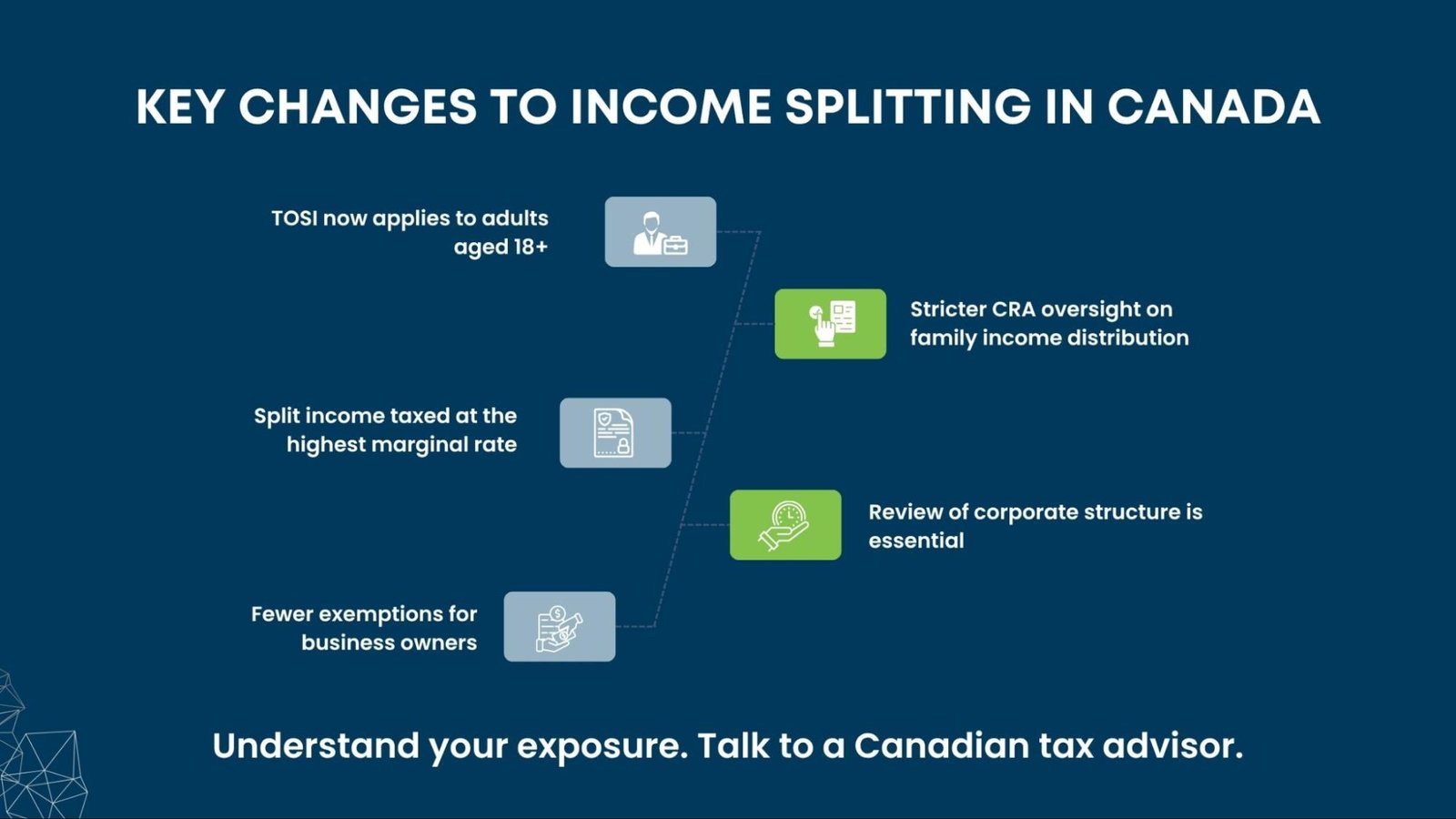

Since the expansion of the Tax on Split Income (TOSI) regime in 2018, income splitting rules in Canada have become much stricter. Previously, TOSI only applied to minors under 18. Today, anyone aged 18 or older may also be affected, especially if they receive split income from a related business.

Under current Canada Revenue Agency income splitting rules, the tax on split income TOSI now applies to adults who don’t meet specific exemption criteria, taxing their income at the highest marginal tax rate.

This eliminates the benefit of assigning income to lower-income family members. However, certain exceptions remain for business owners.

In most cases, the income recipient must be an immediate family member, such as a spouse, parent, child, or sibling, not extended relatives like uncles, aunts, nieces, or nephews.

What’s Exempt from TOSI Under Income Splitting Rules in Canada?

While the tax on split income (TOSI) rules significantly limit who can benefit from income splitting, the Canada Revenue Agency income splitting rules outline several important exemptions:

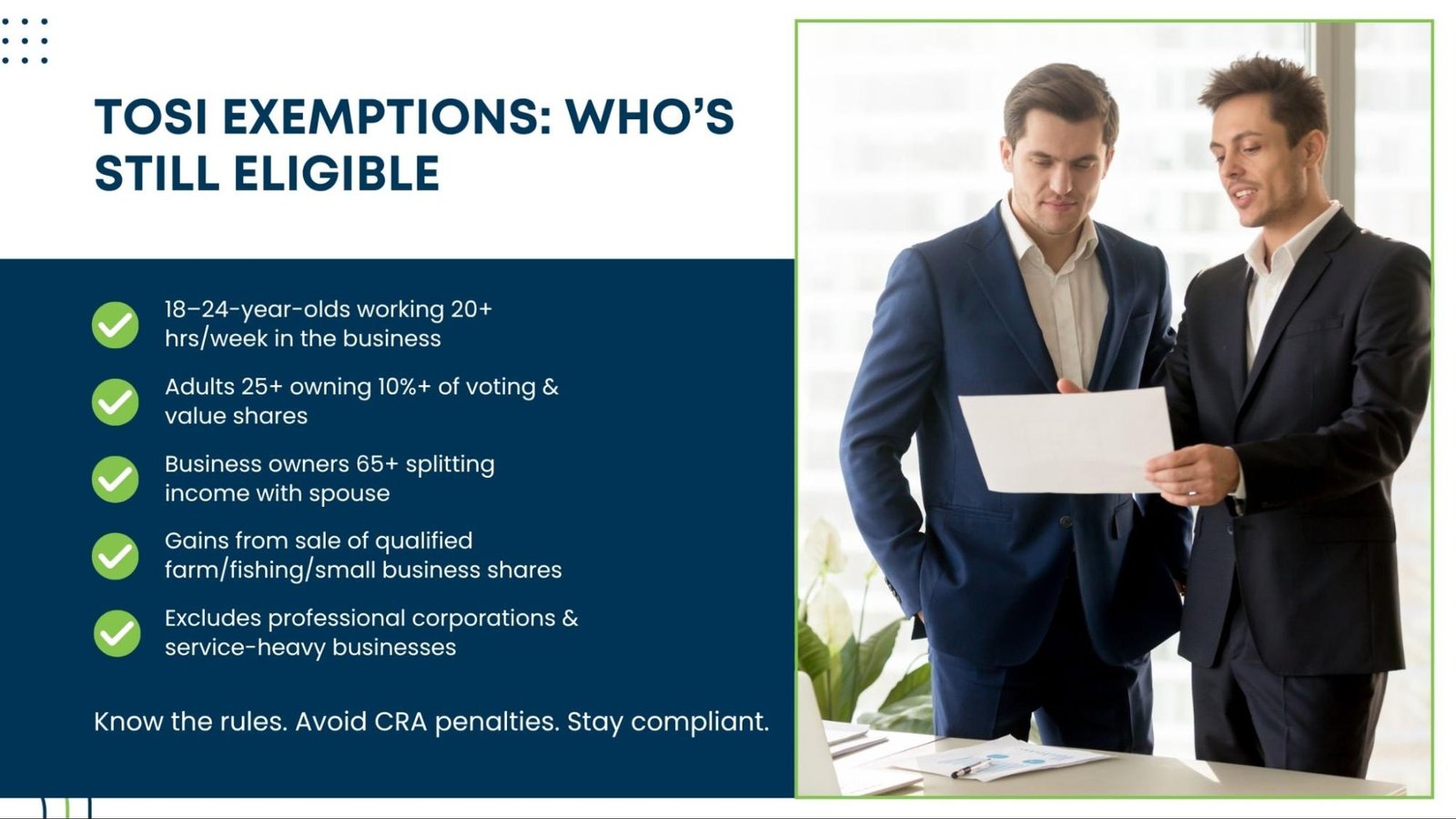

1. Excluded Business Gains (Ages 18–24)

If a family member aged 18–24 works an average of 20+ hours per week in the business either during the current year or in any five previous taxation years (not necessarily consecutive), their income may be exempt from TOSI.

- Even if the business is seasonal, the 20-hour test applies only to the months of operation.

- Dividends earned after active involvement may still be exempt, provided they are considered reasonable compensation.

2. Excluded Shares (Age 25+)

Dividends paid to a family member aged 25 or older are exempt from TOSI if they own at least 10% of the corporation’s votes and value.

Note: This exemption does not apply to professional corporations (such as those operated by lawyers, accountants, doctors, dentists, etc.) or to service-based businesses that earn 90% or more of their income from the provision of services.

3. Other Exemptions

- Business Owners Aged 65+: Income splitting with a spouse is generally permitted for those 65+ who contributed to the business.

- Capital Gains on Qualified Property: Gains from selling qualified small business shares, family farm, or fishing property are typically exempt from TOSI under specific CRA guidelines.

Navigating the Complexity of Canada’s Income Splitting Rules

The income splitting rules in Canada, particularly the TOSI exemptions, remain highly complex and continue to evolve with ongoing guidance from the Canada Revenue Agency (CRA) and tax court rulings.

From defining what qualifies as a “reasonable return” to properly documenting a family member’s contribution to the business, these areas are full of technicalities. Making assumptions without proper guidance can expose you to compliance risks.

For many small business owners, realigning with the expanded TOSI rules requires a detailed review of corporate structures, dividend policies, and recordkeeping practices.

Final Thoughts: Income Splitting Still Has a Place with Caution

While the income splitting rules in Canada have become more restrictive under the expanded Tax on Split Income (TOSI) framework, strategic opportunities still exist, particularly for business owners who understand the details.

With the right guidance, you can still reduce your family’s overall tax burden while staying fully compliant with Canada Revenue Agency income splitting rules.

If you’re asking, “Who is eligible for income splitting in Canada?”, the answer lies in understanding both the exceptions and the documentation required to support your claim. As we move through 2025, proactive planning, not guesswork, is essential.

With increasing CRA oversight and potential penalties for non-compliance, this is the ideal time to reassess your income-splitting strategy.

To navigate this evolving landscape with confidence, consult a qualified offshore tax professional who can help customise strategies to your family’s situation. Done right, income splitting can still be a powerful tool to optimise your tax position and preserve generational wealth.