As you enter retirement, one of the key financial services available to Canadian seniors is the Old Age Security (OAS) pension, a monthly benefit designed to assist with day-to-day living expenses. However, for higher-income earners, a portion of this benefit may be reduced through what is formally known as the OAS pension recovery tax, commonly referred to as the OAS clawback.

With updated income thresholds and revised recovery rules, understanding the OAS clawback 2025 is crucial for making informed and strategic retirement planning decisions.In this blog, we’ll explore how the OAS clawback works, the latest changes for 2025, and practical steps you can take to minimize its impact.

What Is the OAS Clawback?

The Old Age Security (OAS) clawback officially known as the OAS recovery tax, is a mechanism used by the Canadian government to reduce OAS pension payments for individuals whose net annual income exceeds a defined threshold.

Once this limit is crossed, monthly OAS payments are gradually reduced based on the excess income. The more you earn over the threshold, the greater the portion of your OAS you are required to repay.

For instance, if a retiree in 2024 earned $100,000 in net income, they would be subject to a partial clawback. Since this amount is well above the 2024 threshold, they could see hundreds of dollars deducted from their annual OAS payments.

This system ensures that public benefits are more targeted toward lower and middle-income seniors, but it also means that higher-income retirees need to plan carefully to avoid unexpected reductions in their benefits. Leveraging professional accounting or outsourced bookkeeping services can provide retirees with accurate financial tracking and planning to manage income effectively against clawback thresholds.

According to the Government of Canada, the OAS clawback threshold 2025 will be indexed to inflation, continuing the annual adjustment trend.

The Impact of Delaying OAS Payments Until Age 70

While you’re eligible to begin receiving Old Age Security benefits at age 65, many Canadians opt to defer their OAS payments until age 70. Why? Because for each month you delay, your benefit amount increases by 0.6%, resulting in a total boost of up to 36% if you wait the full five years.

This incentive is designed to reward those who choose to delay their pension and can significantly enhance your long-term retirement income.

However, it’s important to consider how this strategy intersects with the OAS clawback. Even with larger monthly payments, if your total annual income surpasses the clawback threshold, you may still be required to repay a portion or even all of your OAS benefits.

Understanding what is the OAS clawback threshold for 2025 is therefore critical when planning whether to defer your OAS. Higher payments won’t protect you from the recovery tax if your income crosses the designated limit.

How Will the OAS Clawback Change in 2025?

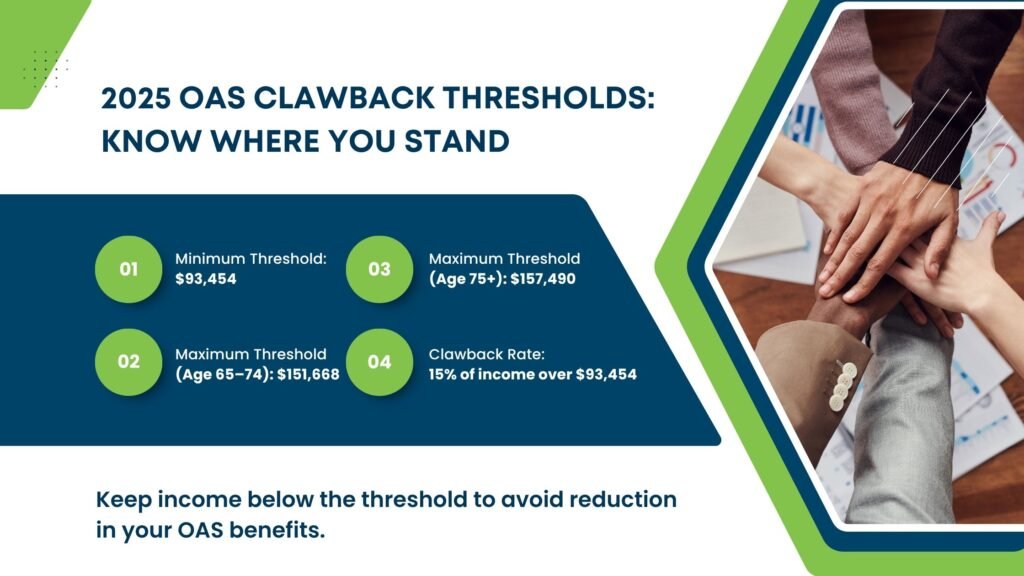

- For the OAS clawback 2025, the income threshold has risen to $93,454 up from $90,997 in 2024, providing seniors with a modest increase in allowable income before the clawback begins to apply.

- Once your net income exceeds this threshold, your OAS payments are reduced at a rate of 15 cents for every dollar above the limit.

- The oas clawback 2025 Canada calculation is based on your 2024 net income, including earnings from investments, pensions, or RRIF withdrawals.

- Careful income planning can help you stay below the threshold and preserve your full OAS entitlement.

How Does the OAS Clawback Work?

- The OAS clawback 2025 is applied as a monthly recovery tax, meaning your OAS pension payments are reduced incrementally rather than through a lump-sum repayment.

- The reduction begins once your net income exceeds the annual threshold $93,454 for 2025.

- The further your income goes beyond the threshold, the larger the reduction in your monthly OAS benefit.

- If your income is significantly higher around $150,000 or more you could see your entire OAS pension eliminated for that year.

What Is the Old Age Security Recovery Tax?

The OAS clawback, formally known as the Old Age Security pension recovery tax, is a repayment mechanism triggered when your income exceeds a certain threshold. In 2023, if your net annual income is more than $86,912, you are required to repay part or all of your OAS benefits. This repayment is assessed annually by the government based on your total income.

Importantly, if you live outside of Canada in a country where Canadian pensions are taxed at 25% or more, you may still be subject to this recovery tax even if your income is below the typical threshold.

The government considers your net world income, which includes all income earned both in Canada and abroad. If your income surpasses the limit, your OAS payments are reduced accordingly.

Maximum Income Recovery Threshold (Income Year 2025)

| Age Group | Minimum Threshold | Maximum Recovery Threshold | Clawback Rate |

|---|---|---|---|

| All Seniors | $93,454 | — | 15 ¢ per dollar above threshold |

| Age 65–74 | — | $151,668 | Up to 100% clawback |

| Age 75 and over | — | $157,490 | Up to 100% clawback |

- Minimum Threshold: Income above $93,454 triggers the OAS clawback.

- Maximum Recovery Threshold: Once income exceeds the age-specific limit ($151,668 or $157,490), the full OAS benefit may be clawed back.

- Clawback Rate: 15% of every dollar earned above the minimum threshold is deducted from your OAS benefits.

How the Clawback Is Calculated

| Net Income (2024) | Excess Over Threshold ($93,454) | Clawback Rate | OAS Clawback Amount | Remaining OAS (Assuming $8,000/year) |

|---|---|---|---|---|

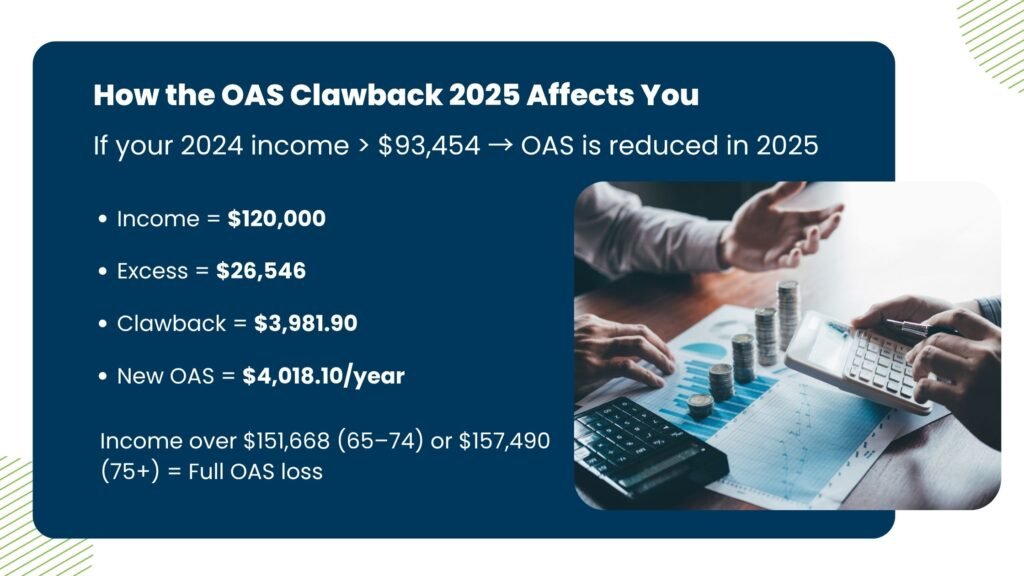

| $95,000 | $1,546 | 15% | $231.90 | $7,768.10 |

| $105,000 | $11,546 | 15% | $1,731.90 | $6,268.10 |

| $120,000 | $26,546 | 15% | $3,981.90 | $4,018.10 |

| $135,000 | $41,546 | 15% | $6,231.90 | $1,768.10 |

| $151,668 (Age 65–74) | $58,214 | 15% | $8,732.10 | $0.00 |

| $157,490 (Age 75+) | $64,036 | 15% | $9,605.40 | $0.00 |

How Can You Avoid the OAS Clawback?

Avoiding the OAS clawback 2025 may seem challenging, but with proactive planning, it’s possible to reduce its impact or even eliminate it altogether. Here are several effective strategies to help you preserve more of your Old Age Security benefits:

- Manage your income strategically:

Spread income over multiple years by delaying capital gains, RRSP withdrawals, or bonuses to stay below the 2025 clawback threshold of $93,454. - Consider income splitting:

Income splitting with a lower-earning spouse can help you stay below the OAS clawback 2025 threshold. - Delay your OAS pension:

Deferring OAS until age 70 increases your monthly benefit by up to 36%, which can help offset any clawback reduction. - Seek professional guidance:

A financial advisor can help structure your retirement income to minimise the clawback and maximise your long-term benefits.

Conclusion

The OAS clawback 2025 is more than just a tax, it’s a key factor in retirement income planning for higher-earning Canadian seniors. With the OAS clawback threshold 2025 set at $93,454 and maximum limits reaching over $150,000, understanding how your income affects your OAS entitlement is essential.

By staying informed, making strategic financial decisions, and seeking expert advice, you can manage your income to preserve more of your OAS benefits. Whether you’re planning withdrawals, splitting income, or considering when to begin your pension, proactive steps today can help you avoid unnecessary reductions tomorrow.

“Curious about the OAS clawback threshold for 2025?” or looking to navigate the Canada OAS clawback 2025 confidently, now is the time to review your financial strategy and align it with your retirement goals.