Running a small business means wearing many hats, owner, marketer, HR manager, customer service rep, and yes, accountant. At some point, juggling all these roles begins to feel less like multitasking and more like a bottleneck. That’s when many business owners pause and ask themselves, “Is this really the best use of my time?”

It’s a question more and more entrepreneurs are answering with a resounding no, especially when it comes to financial management. That’s why we’re seeing a steady rise in the number of small businesses outsourcing accounting services to trusted partners. According to global team’s recent industry research, 54% of small businesses are projected to outsource at least one core business function, with accounting and financial management leading the list.

This shift isn’t just about reducing stress; it’s about making smart, scalable decisions that support growth, profitability, and sustainability.

In this blog, we’ll dive into why this trend is gaining momentum, what’s included in these services, and how outsourcing your accounting could be one of the most strategic moves your small business makes.

The Financial Tightrope Small Businesses Walk

Small businesses often operate in lean environments. Resources are limited, every dollar counts, and the margin for error is thin. Add in evolving tax laws, regulatory requirements, and the ever-looming deadlines, and accounting can quickly become a source of anxiety.

You might be using spreadsheets or basic software to track income and expenses, but as your business grows, complexity rises. That’s when tax preparation services step in—helping with tax filings, compliance, and reporting, so small businesses can avoid costly mistakes.

That’s where online accounting services outsourced to experienced professionals can step in, not just to keep your books clean, but to provide insights and foresight that help you make better business decisions.

What Does Outsourced Accounting Actually Cover?

When you hear “outsourcing accounting,” it’s not just handing off your receipts to someone in another city or country. It’s a comprehensive service that can include:

- Bookkeeping

- Tax preparation and filing

- Payroll processing

- Accounts payable and receivable

- Financial reporting and forecasting

- Virtual CFO services

In essence, outsourcing gives you access to a full-fledged finance team, without the cost of hiring them in-house.

Why More Small Businesses Are Outsourcing Accounting Services

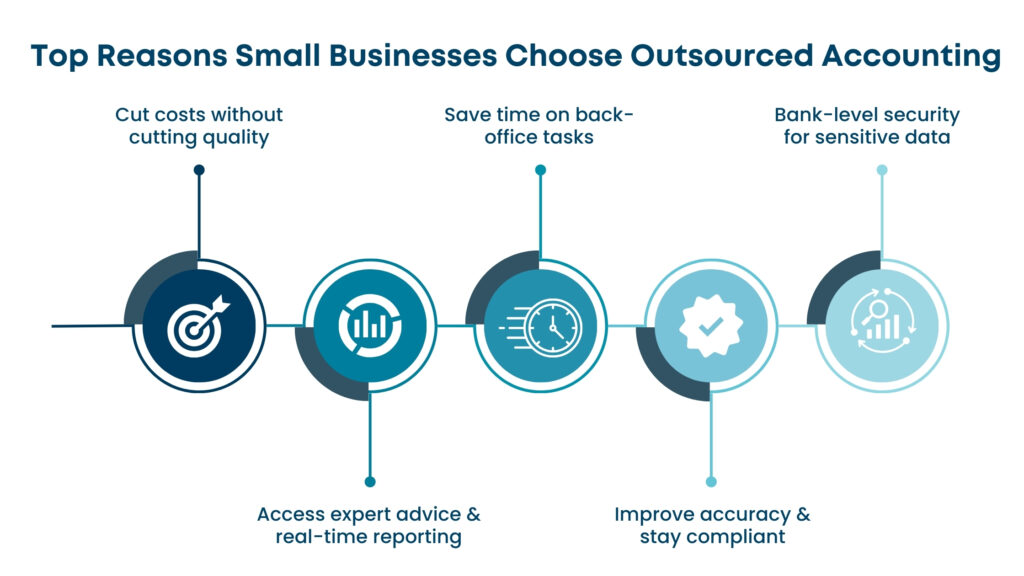

Let’s explore the real drivers behind this shift toward outsourcing financial services, especially among small business owners who are prioritising cost-efficiency without compromising quality.

1. Cost Efficiency Without Compromise

Hiring a full-time accountant or finance team isn’t feasible for most small businesses. Salaries, benefits, training, software, these costs add up quickly.

On the other hand, bookkeeping outsourcing for small business allows you to pay for only what you need, when you need it. Whether it’s weekly bookkeeping or end-of-year tax support, you can scale the service up or down depending on your budget and business cycle.

2. Access to Expertise and Technology

When you outsource bookkeeping and accounting small business needs, you’re not just buying time, you’re buying expertise. Outsourced providers live and breathe accounting. They stay on top of tax law changes, industry-specific regulations, and software updates.

You also benefit from the latest accounting tools and automation platforms, cloud-based, secure, and designed to reduce errors. Without the need to invest in expensive systems, you’re still getting best-in-class solutions.

3. Focus on Growth, Not Just Survival

Many entrepreneurs start out managing their own books to save money. But soon, that time spent in spreadsheets eats into hours that could’ve been used to acquire clients, innovate products, or build partnerships.

By handing over financial management to a qualified professional, like small business outsourced bookkeeper, you free up hours every week. And those hours can go directly into moving the needle on your business goals.

4. Accuracy and Compliance

Mistakes in tax filing or payroll can lead to fines, audits, or worse, lost credibility. That’s why many businesses turn to professional outsourced payroll services help prevent errors, maintain compliance, and deliver timely reporting. Outsourced teams are trained to avoid errors and catch red flags before they become liabilities.

With regular reconciliations, up-to-date reporting, and a sharp eye on compliance, they help keep your business on the right side of the law.

A Growing Global Trend: Online Accounting Services Outsourced

This isn’t just a local trend, it’s global. The finance and accounting BPO market was valued at $60.31 billion in 2023 and is projected to reach $110.74 billion by 2030, growing at a CAGR of 9.1% as per Fortune Business Insights

That kind of growth tells us one thing: small businesses outsource accounting services not just for convenience, but because the market recognises its strategic value.This rapid expansion reflects how businesses of all sizes, especially small and medium enterprises, are shifting priorities.

They’re no longer content with just “getting by” on basic financial tools or internal resources. Instead, they’re seeking agile, expert-backed solutions that help reduce risk, ensure compliance, and deliver data-driven insights.

Common Myths About Outsourcing Accounting Services

Let’s debunk a few misconceptions that hold business owners back.

“We’ll lose control over our finances.”

This is a valid concern, but in reality, outsourcing often increases transparency. With regular updates, dashboards, and direct access to reports, you get a clearer picture of your financial health than ever before.

“Outsourcing is only for large companies.”

There’s a common belief that outsourcing is only for large enterprises, but the truth is, small businesses are increasingly adopting outsourcing to stay lean, competitive, and compliant.

“It’s not secure.”

Reputable providers use bank-level encryption, secure client portals, and multi-factor authentication to protect your data. In many cases, outsourced accounting is more secure than storing documents on a laptop or filing cabinet in your office.

Signs You’re Ready to Outsource

Still on the fence? Here are a few signs that it’s time to consider outsourcing:

- You’re consistently behind on bookkeeping or tax filings.

- You spend more time in QuickBooks than with customers.

- Your financial reports are confusing or incomplete.

- Your in-house team lacks the expertise you now need.

- Growth has plateaued because you’re stuck in back-office tasks.

If any of these sound familiar, it’s time to ask whether the status quo is serving your business, or holding it back.

The Long-Term Impact of Smart Outsourcing

Making the decision to outsource bookkeeping and accounting small business tasks isn’t just about solving today’s problems. It’s an investment in long-term sustainability.

Here’s what small businesses typically experience after outsourcing:

- Cleaner books and better decision-making

- Stress-free tax seasons

- Faster access to financing or investment

- More time for vision and leadership

- Peace of mind

Final Thoughts

As the business world moves faster and gets more complex, one thing is clear, small businesses need time, accuracy, and flexibility to grow. That’s why outsourcing accounting services isn’t just a nice-to-have anymore, it’s a smart move that helps you stay focused on what matters most: running and growing your business.

Instead of stressing over tax deadlines, payroll, or compliance, outsourcing lets you hand those tasks over to experts. You get clean books, helpful reports, and peace of mind, without the cost of building an in-house team.

And the best part? It’s never been more accessible. Whether you’re running a café, growing a startup, or managing an online store, outsourcing gives you the support of a professional finance team, minus the overhead.

So the real question isn’t why outsource, it’s why wait?