Students pay fees to educational institutions for the entire year, and they receive a benefit at the time of tax payment, which is known as a tution tax credit.

Continue readingAre You Updated With Changes In T2- Corporate Income Tax Return?

Thank you for your support and enthusiasm for the previous article on what’s new and different in the T1 income tax return. Now we’re back with another hot topic: what new changes have been made to a corporation’s tax return.

Continue readingWhat’s New for 2021 T1 Tax returns?

As practicing CPAs, we need to be updated with the changes made by either government or CRA towards businesses. We have to be very active as our one mistake can make millions of dollars loss for the client. Let’s understand what CRA changes in 2021’s T1 return filling program.

Here we mention some changes to keep in mind for the busy tax season.

Advantages of Hiring Virtual Accountants/Assistants

Effective Time & Cost Management is one of the most important concerns for CPAs, Controllers and accountants. In this digital age, the best way to resolve this conflict is by creating a Virtual Team that can handle your day-to-day operational work. Though there are numerous reasons why professionals prefer Virtual Assistants (VA) over hiring employees, below are the benefits that will evoke you to take this step:-

Continue readingHow to protect yourself from Online scam in this Digital Era?

The world is now a global village, quite literally. It is very easy now to process any transaction on

online platforms. But here’s the twist – it is now very simple for fraudsters to execute perfect thefts online.

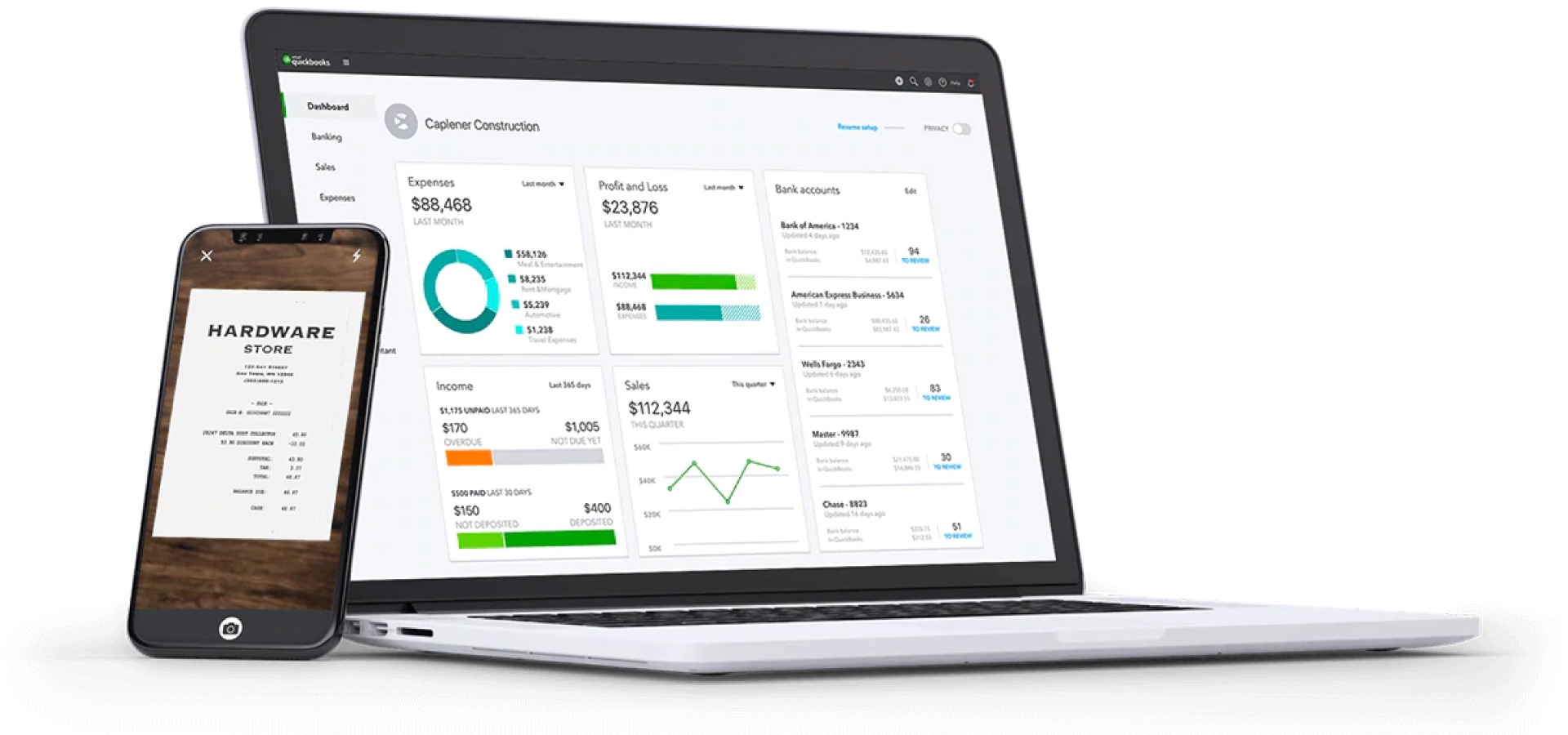

8 Hacks/Features of QuickBooks Every Accountant Must Know

QuickBooks Online enables us to manage the books of clients in a very accurate & systematic manner. Dive into these unexplored hacks that could possibly change your game & boast in front of your clients!

Continue reading