Mastering Tax Season 2025 with Confidence

Tax season 2025 is upon us, and for Canadian accountants, CPAs, and financial advisors, that means one thing: long hours, tight deadlines, and heavy workloads. It’s the time of year when the pressure is on to ensure clients file on time, avoid penalties, and meet the ever-growing demands of compliance. But with increasing complexity in tax regulations, the need for quick turnaround times, and a shortage of professionals to meet these demands, the question arises—how are accountants preparing to handle it all?

For many, outsourcing accounting services has become the key strategy to effectively manage the tax season workload while maintaining quality. This blog delves into how Canadian accountants can prepare for the busy tax season, address frustrations, and leverage outsourcing solutions like NCS Global to stay ahead of the curve.

1. The Frustrations of Tax Season: A Strain on Resources

Tax season in Canada is often associated with stress, frustration, and long hours. For many accountants, this time of year means an overwhelming surge of work. Key pain points include:

Increased Client Demands: More clients mean more tax returns, more paperwork, and an increase in complex cases. Meeting these needs while ensuring accuracy is a significant challenge.

Tight Deadlines: With the tax filing deadline looming, accountants are under constant pressure to meet deadlines. One missed deadline could mean penalties for both the client and the firm.

Staffing Shortages: Finding qualified tax professionals during peak season can be difficult, especially given the ongoing accountant shortage in Canada.

Complex Regulations: Tax regulations are constantly evolving. Keeping up with these changes while managing a full caseload is an additional burden on in-house teams.

These frustrations leave many accounting firms feeling stretched thin and looking for solutions.

2. Outsourcing: The Smart Solution for Managing Tax Season Workloads

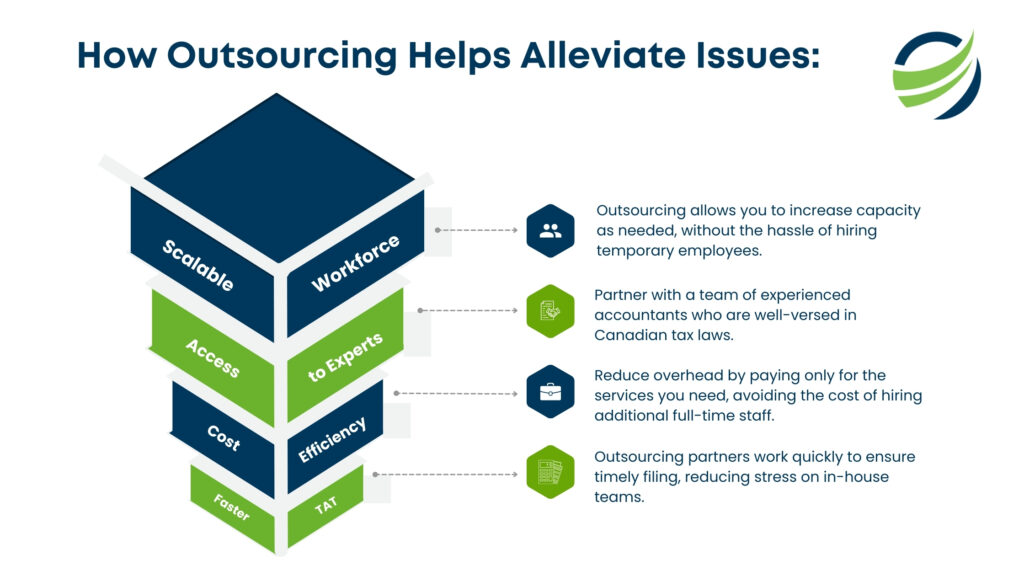

One of the most effective ways Canadian accountants are preparing for the busy tax season 2025 is by outsourcing their accounting services. Here’s why:

Scalability: Outsourcing allows firms to scale up their resources quickly. Whether you need extra hands for tax preparation, bookkeeping, or compliance checks, outsourcing partners like NCS Global can provide the support you need to handle the workload surge.

Expertise on Demand: Outsourced accounting services allow you to tap into a pool of highly experienced tax professionals who are well-versed in Canadian tax regulations. With NCS Global’s team of skilled accountants, you gain access to industry-leading experts who ensure the highest standards of compliance and accuracy.

Cost Efficiency: Hiring temporary in-house staff during tax season is costly and time-consuming. Instead, firms are turning to payroll outsourcing services to cut overhead while ensuring accuracy and compliance. Outsourcing eliminates the need for recruitment, training, and overhead costs associated with expanding your team. You only pay for the services you need, which frees up funds for strategic investments elsewhere. Many firms also leverage outsourced bookkeeping services to streamline financial management beyond tax season.

Reduced Stress for In-House Teams: By offloading routine tasks like tax return processing and document management, in-house accountants can focus on more complex and client-facing work. This reduces burnout and improves overall team morale during a stressful season.

3. How NCS Global Can Help Accountants Manage Their Workloads

At NCS Global, we understand the challenges that Canadian accountants face during tax season. Our outsourcing solutions are designed to help firms stay on track while maintaining quality and compliance. Here’s how NCS Global can make a difference:

24/7 Availability: Tax season doesn’t work on a 9-to-5 schedule, and neither do we. Our team is available round-the-clock, ensuring that all tasks are completed on time, even during the busiest periods.

Customised Solutions: We offer customisable services that align with your specific needs. Whether you require assistance with tax returns, bookkeeping, financial statement preparation, or payroll services, NCS Global has the expertise to handle it all.

Advanced Technology: We use the latest accounting tools and technologies to streamline the process, reduce errors, and ensure compliance. This enables faster turnarounds and minimises the risk of costly mistakes.

Dedicated Team: With NCS Global, you have a dedicated team of professionals who work as an extension of your own team. This collaborative approach ensures seamless integration and high-quality service.

4. The Benefits of Outsourcing for Canadian Accountants During Tax Season

Outsourcing has numerous benefits, especially during the intense tax season 2025. Here’s how it can elevate your firm’s operations:

Increased Efficiency: By outsourcing routine tasks, you can improve workflow efficiency and focus on high-priority tasks that require your expertise.

Improved Client Satisfaction: When you’re not bogged down by administrative work, you can provide quicker responses, better service, and more personalised support to your clients.

Focus on Growth: With outsourcing partners handling the peak season workload, you have more time to focus on client acquisition, business growth, and expanding your practice beyond tax season.

Flexibility: Outsourcing allows you to adjust resources as needed. If the workload increases, you can scale up your support quickly without worrying about hiring or training new staff.

5. How to Prepare for Tax Season 2025

To ensure a successful tax season 2025, Canadian accountants should begin preparation well in advance. Here are a few steps to consider:

1. Review Client Files Early: Start reviewing your clients’ tax files ahead of time to identify any potential issues or complexities.

2. Assess Your Team’s Capacity: Ensure that your team is adequately staffed for the busy season. If you anticipate high volumes, consider outsourcing to boost capacity.

3. Stay Updated on Tax Changes: Tax laws are constantly changing. Make sure you’re familiar with any new tax rules or regulations that could impact your clients.

4. Implement Efficient Processes: Streamline your internal processes to save time. Using tax preparation software, automating routine tasks, and outsourcing repetitive work can help increase efficiency.

Conclusion: Stay Ahead with Outsourcing

As tax season approaches, Canadian accountants need to be proactive in managing their workload. Outsourcing provides a scalable, efficient, and cost-effective solution to help accountants stay on top of their work while ensuring compliance and accuracy. NCS Global offers professional outsourcing services that can relieve the burden of tax season, allowing you to focus on delivering exceptional service to your clients.

By leveraging outsourcing to NCS Global, Canadian accountants can navigate the busy tax season 2025 with confidence, reduce stress, and set their firms up for continued success.