Navigating the complexities of the Canadian tax system can feel overwhelming, whether you’re filing as an individual or managing business finances. But with the right strategies, and professional support in areas like financial planning, outsourced accounting and bookkeeping understanding how to maximize tax return in Canada becomes not only possible but empowering.

In this 2025 guide, we’ll explore practical, CRA-compliant ways to unlock greater tax benefits. From leveraging key deductions and credits to planning smarter for the year ahead, these insights will help you take control of your tax return and potentially boost your refund while staying fully aligned with Canadian tax regulations.

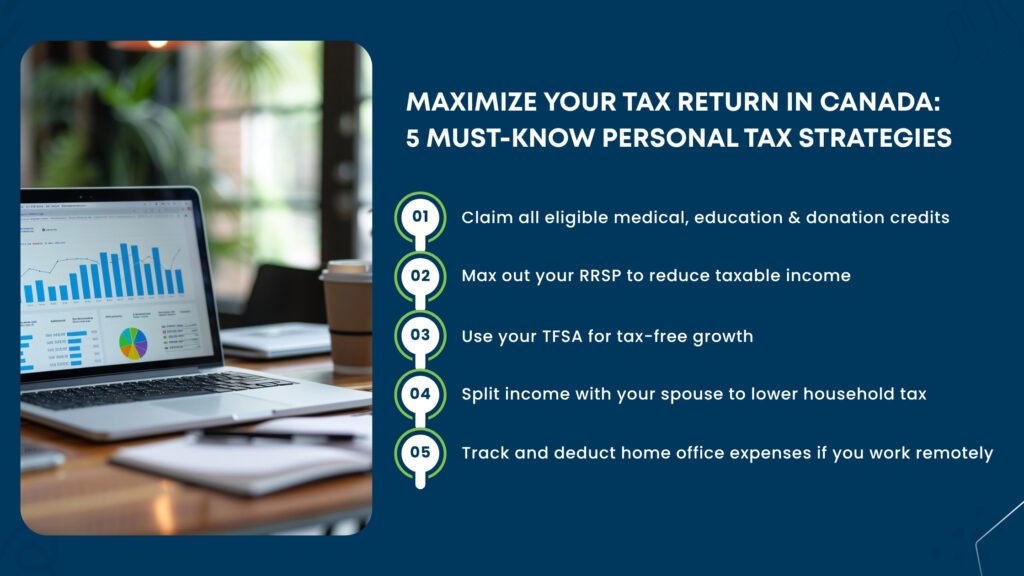

Personal Tax Tips to Maximise Your Tax Return in Canada

One of the most effective ways to boost your refund is to claim every deduction and credit you’re entitled to. If you’re wondering how to maximize tax return in Canada, these personal tax strategies for 2025 can help unlock savings you might otherwise overlook.

1. Claim All Eligible Deductions and Credits

To reduce your tax burden and potentially receive a larger refund, ensure you claim all available deductions and credits. Here are some of the most widely claimed and impactful tax deductions and credits available to Canadians:

- Medical Expenses: You may be able to deduct eligible medical expenses for yourself, your spouse, or dependents. Keep detailed receipts, CRA may request documentation.

- Charitable Donations: Contributions to registered Canadian charities can provide valuable non-refundable tax credits. When combined with carry-forward options, the savings can be significant.

- Education Costs: Claim eligible tuition, student loan interest, and textbook expenses to reduce your tax liability. These education credits can be transferred to a spouse or parent, making them even more valuable.

2. Maximise RRSP Contributions for Immediate Tax Relief

Contributing to your Registered Retirement Savings Plan (RRSP) remains one of the most powerful tools for tax savings. Not only do contributions reduce your taxable income, but your investments grow tax-deferred. In 2025, the RRSP contribution limit is 18% of your earned income from the previous year, up to a maximum set by the CRA. Check the latest RRSP limits on the CRA website.

3. Use Your TFSA for Tax-Free Investment Growth

While contributions to a Tax-Free Savings Account (TFSA) aren’t tax-deductible, the growth within the account, interest, dividends, and capital gains is entirely tax-free. In 2025, Canadians can contribute up to $7,000 to their TFSA, with all earnings sheltered from tax. Used strategically, the TFSA is a powerful tool for long-term, tax-efficient wealth accumulation.

4. Explore Income Splitting to Reduce Household Taxes

Income splitting can help reduce your household’s overall tax liability, especially when there is a large income gap between spouses or partners. Common methods include:

- Pension income splitting

- Spousal RRSPs

- Attribution of investment income

This strategy can create a more balanced tax outcome and often leads to thousands in annual savings.

5. Deduct Work-From-Home Expenses Where Eligible

With remote and hybrid work models continuing in 2025, the CRA allows eligible employees to claim home office expenses. This includes a portion of rent, utilities, internet, and supplies. You must meet specific conditions to qualify to review the CRA’s eligibility criteria to ensure compliance.

How Canadian Businesses Can Maximise Their Corporate Tax Return in 2025

Maximizing your corporate tax return in Canada requires more than just compliance, it demands foresight, structure, and smart financial strategy. Whether you’re a small business owner or managing a growing corporation, these 2025 tax strategies can help reduce your liabilities and improve cash flow, all while keeping your business on solid ground with the CRA.

1. Incorporate to Access Lower Tax Rates

Incorporating your business is one of the most effective ways to lower your overall tax liability. Corporations in Canada enjoy lower tax rates than individuals, and earnings retained within the business can be taxed at a deferred rate, freeing up capital for reinvestment. Incorporation also brings added benefits like limited liability and enhanced credibility.

2. Use the Small Business Deduction (SBD)

According to PWC, Canadian-controlled private corporations (CCPCs) can benefit from the Small Business Deduction, which reduces tax on the first $500,000 of active business income. To qualify, your business must meet CRA requirements for income type, structure, and ownership.

3. Claim Capital Cost Allowance (CCA)

CCA allows businesses to deduct the cost of depreciable assets like equipment and vehicles over time. Knowing your asset classes and applying the correct rates can lead to significant long-term tax savings.

4. Leverage SR&ED Tax Credits

If your business conducts R&D, explore the SR&ED program. It offers refundable and non-refundable credits for eligible innovation-related expenses. In 2023, over $3 billion in SR&ED credits were claimed across Canada (CRA SR&ED Program).

5. Maintain Accurate Financial Records

Clean, well-kept records are key to claiming full deductions and staying compliant during CRA audits. Invest in accounting software or professional bookkeeping to ensure clean, audit-ready books, because clarity today means confidence at tax time.

Why Professional Help Matters: Maximise Tax Returns with Expert Accounting Support

Understanding how to maximize tax return in Canada goes beyond knowing the rules, it’s about applying them strategically. That’s where professional tax and accounting services make all the difference. Whether you’re managing a small business, freelancing, or running an e-commerce venture, expert support helps you unlock savings, reduce risks, and make smarter financial decisions.

Maximise Your Refund with Expert Bookkeeping

Accurate bookkeeping is the backbone of effective tax planning. Professional bookkeepers in Ontario ensure your financial data is precise, organized, and optimized for deductions. By maintaining well-documented records, you not only meet CRA standards but also maximize your tax refund by identifying every eligible expense specific to your profession or industry. Inconsistent or outdated records often lead to missed claims and smaller refunds.

Virtual Tax Services: Convenience Meets Compliance

In today’s fast-moving, digital-first environment, virtual tax return services offer the perfect mix of convenience and accuracy. Whether you’re an individual or a business, you can access expert guidance on deductions, credits, and filing from anywhere in Canada.

Benefits include:

- Tailored advice based on your financial situation

- Flexible, no-appointment-needed scheduling

- Strategic review of what you can claim on your taxes to ensure nothing is missed

E-Commerce Accounting: Smart Tax Solutions for Digital Businesses

E-commerce comes with unique tax challenges foreign transactions, platform fees, digital ads. Specialized accounting services for online sellers provide critical support, especially in understanding the difference between tax deduction and tax credit.

E-commerce accountants help you:

- Track inventory and cost of goods sold (COGS) accurately

- Categorize income and expenses for maximum deductions

- File a compliant virtual personal tax return, tailored to your platform (Shopify, Amazon, Etsy)

With expert help, you’ll access every applicable tax break Canada 2025 list and ensure full compliance while boosting profitability.

Final Thoughts: How to Get the Biggest Tax Refund in 2025

In 2025, the key to how to get the biggest tax refund lies in preparation, precision, and planning. Whether you’re an individual aiming to claim every eligible expense, or a business leveraging advanced tax incentives, the path to a higher refund starts with understanding the system, and acting on that knowledge strategically.

From RRSP contributions and capital cost allowances to SR&ED claims and home office deductions, every financial decision can impact your bottom line. With the right tax consulting, compliance support, and expert financial advice. Canadians can do more than just stay compliant, they can maximize tax returns to build wealth, strengthen cash flow, and achieve long-term goals.