Canada Business Tax Filing Deadline 2025: Everything You Need to Know About T2 Filing

Understanding tax filing deadlines is essential for businesses operating in Canada. The Canada business tax filing deadline 2025 varies depending on the business structure and fiscal year-end. Filing on time is necessary to avoid penalties and interest charges. This guide outlines key deadlines, payment schedules, and compliance strategies.

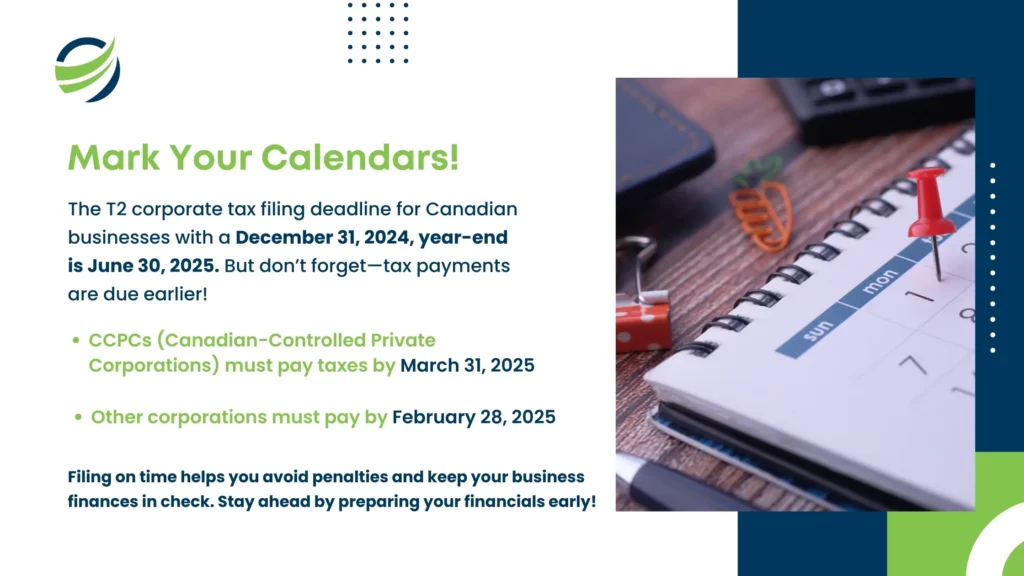

T2 Filing Deadline

All corporations in Canada must submit a T2 Corporation Income Tax Return. The t2 filing deadline is six months after the fiscal year-end. For businesses with a December 31, 2024, fiscal year-end, the return must be filed by June 30, 2025.

Although the cra business tax filing deadline for T2 returns is six months after year-end, tax payments are due earlier:

- Two months after the fiscal year-end for most corporations.

- Three months for Canadian-controlled private corporations (CCPCs) that qualify for the small business deduction and have taxable income below the threshold.

For example, a CCPC with a December 31, 2024, fiscal year-end must pay taxes by March 31, 2025, while other corporations must pay by February 28, 2025.

Deadlines for Self-Employed Individuals and Small Businesses

Self-employed individuals follow a different self employed tax return deadline. Their personal tax return is due by June 15, 2025, but any taxes owed must be paid by April 30, 2025 to avoid interest charges.

For small businesses, the small business tax return deadline depends on whether they are incorporated. Sole proprietorships follow personal tax deadlines, while incorporated businesses must adhere to the business income tax deadline, which is six months after their fiscal year-end.

Penalties for Late Filing and Missed Payments

Businesses that miss the Canada business tax filing deadline 2025 may incur penalties:

- Late filing penalty: 5% of the balance owed, plus 1% per month for up to 12 months.

- Repeated late filing: Additional penalties may apply for businesses with prior late filings.

- Interest charges: The CRA applies daily interest on overdue tax payments.

Failure to comply with tax deadlines can also impact a company’s financial standing, creditworthiness, and ability to secure loans or investments. Repeated late filings can result in increased scrutiny from the CRA, leading to audits and additional compliance costs.

Business Tax Extension Deadline 2025

Canada does not offer automatic tax extensions for corporations. Businesses needing additional time must request relief under taxpayer fairness provisions. However, the business tax extension deadline 2025 does not defer tax payments, which must be made by the original due date to prevent interest charges.

Self-employed individuals and sole proprietors can request extensions in certain cases, but taxes owed must still be paid by April 30, 2025.

Ensuring Compliance with CRA Business Tax Filing Deadlines

To avoid penalties, businesses should:

Maintain Accurate Records

- Track income, expenses, and deductions using accounting software.

- Keep all tax-related documents well-organised for easy access and review.

Plan for Tax Payments

- Set aside funds in advance to cover tax liabilities.

- Make quarterly installment payments if necessary.

Use Professional Tax Services

- Accountants or tax professionals ensure compliance with the cra business tax filing deadline. Many businesses also work with outsourced bookkeeping services to maintain accurate records year-round, helping optimise deductions and reduce filing errors.

- Professional services help optimise deductions and reduce filing errors.

File and Pay Early

- Filing ahead of the deadline minimises the risk of errors and last-minute complications.

- Early filing helps in managing cash flow better and reduces financial stress during tax season.

Stay Updated on Tax Regulations

- Tax laws and policies may change annually. Keeping up-to-date with CRA announcements ensures compliance and helps businesses take advantage of available tax credits and deductions.

Outsourcing Tax Preparation for Efficiency

Businesses may benefit from outsourcing tax preparation to outsource experts who can:

- Ensure accurate filing of T2 returns by the business income tax deadline.

- Identify tax-saving opportunities and deductions.

- Reduce administrative workload, allowing businesses to focus on core operations.

- Offer strategic tax planning to minimise liabilities and maximise financial efficiency.

Outsourcing tax preparation minimises errors and ensures compliance with CRA regulations. Additionally, businesses can benefit from expert advice on tax planning, financial forecasting, and risk mitigation strategies.

For a broader understanding of Canada’s tax landscape, including inheritance tax and cross-border tax rules, check out our detailed blog on Canada Inheritance Tax.

Common Mistakes to Avoid When Filing Business Taxes

Missing Deadlines

Late filing leads to penalties and interest charges that could have been avoided.

Incorrectly Calculating Tax Payments

Underpaying taxes can lead to additional fines, while overpaying may affect cash flow.

Failing to Keep Proper Records

Incomplete or missing documentation can lead to complications during audits.

Not Claiming Eligible Deductions

Many businesses miss out on tax savings due to a lack of awareness about deductions they qualify for.

Ignoring CRA Notices and Correspondence

Addressing tax issues promptly helps avoid further financial or legal repercussions.

Conclusion

Meeting the Canada business tax filing deadline 2025 is crucial for compliance and avoiding penalties. Whether a business is a corporation, CCPC, or sole proprietorship, understanding the t2 filing deadline, cra business tax filing deadline, and business income tax deadline is essential. Extensions may be available under certain circumstances, but taxes owed must still be paid on time to prevent interest charges.

Businesses can ensure compliance by maintaining accurate records, planning tax payments, and seeking professional tax assistance. Proactive tax management helps businesses meet the small business tax return deadline and minimise tax-related risks. By outsourcing tax preparation and staying informed about tax regulations, businesses can streamline the filing process and reduce the likelihood of errors and penalties.

With a strategic approach, businesses can confidently navigate tax season while maintaining financial stability and compliance with CRA requirements.

FAQs

1. What happens if I miss the Canada business tax filing deadline 2025?

Missing the deadline results in penalties, including a 5% late filing fee and 1% per month on the outstanding balance, plus daily interest charges.

2. Can I apply for an extension on my T2 return?

Canada does not provide automatic extensions for T2 filings, but businesses facing hardship can request relief through the taxpayer fairness provisions.

3. When is the small business tax return deadline?

The deadline depends on the business structure. Incorporated businesses must file within six months of their fiscal year-end, while sole proprietors must file by June 15, 2025.

4. What is the penalty for not paying business taxes on time?

Late payments incur interest charges from the first day after the deadline, and repeated non-compliance can result in increased penalties and CRA audits.

5. How can I reduce my tax liability as a small business owner?

Tax planning strategies include claiming all eligible deductions, making RRSP contributions, and structuring income efficiently. Consulting a tax professional can also help maximise savings.

6. Is outsourcing tax preparation beneficial for small businesses?

Yes, outsourcing ensures compliance, reduces administrative burdens, and helps optimise deductions while preventing costly filing errors.